Insight Focus

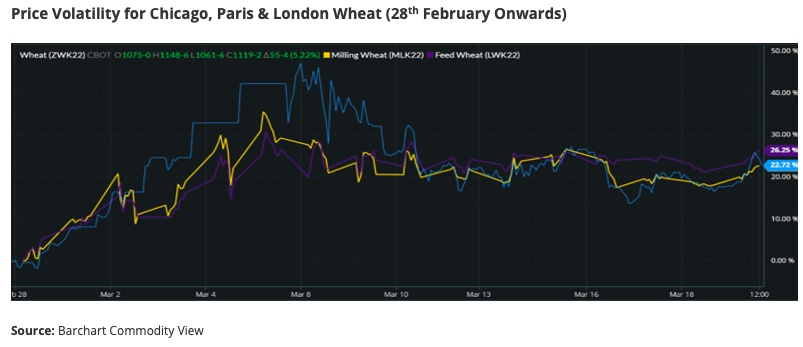

- Wheat market volatility is tracking geopolitics.

- Supply problems grow as Russian conflict lingers.

- North Africa hit hardest due to reliance on Black Sea wheat.

It’s been four weeks since Russia invaded Ukraine, and little has become clear on how or when the conflict will end.

As the Russian military advances grind to a near standstill and Ukrainian resistance maintains its resolve, there are many lingering questions about the world of wheat.

The wheat futures market remains extraordinarily volatile on a day-to-day basis. Stability, politically and for market prices, is set hand in hand for now.

The Challenges for Wheat in a Long War

Major wheat importing nations are attempting to reassure their populations and the market that there’s no need for panic. Nonetheless, the longer the conflict, the more complicated supply will become.

Algeria has suggested that domestic wheat reserves are adequate until August, by which time the Northern Hemisphere winter wheat harvest will be in its closing stages. Jordan has indicated sufficient reserves for one year. Egypt will look to further enhance domestic wheat purchases from the imminent wheat harvest.

As we’ve previously mentioned, political upheaval is a serious concern for the North African governments, with the 2010/11 Arab Spring uprisings so fresh in memories.

Feed costs for livestock are a widespread worry as prices are too high to maintain a margin. Sunflower availability is also proving a difficult issue in the feed sector, with a major ingredient being rationed.

Russia and Ukraine account for approximately 50% of global sunflower production and provide 80% of the world’s exports.

Russian Cause for Concern

Russian President, Vladimir Putin, is facing a multitude of issues as hostilities continue. However, as the largest exporter in the world’s wheat market, maintaining supply is imperative for Russia’s rapidly deteriorating global reputation.

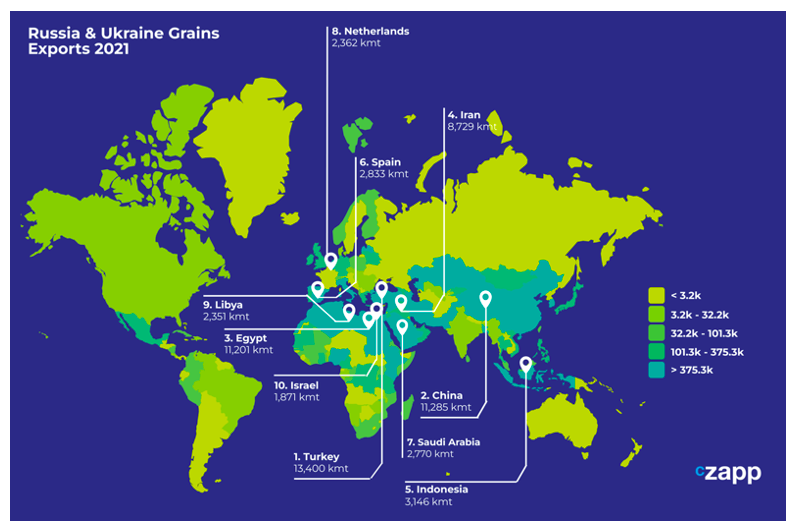

The Black Sea is the route for the majority of the 35m tonne pre-invasion estimate for Russian exports, together with the 24m tonne estimate for Ukraine.

Russia needs money and space for its summer wheat harvest. Re-establishing the shipping routes through the Black Sea is critical to this. With ship owners reluctant in the extreme to send vessels anywhere near a warzone, a more peaceful Ukrainian coast will be required.

The Next Few Months are Crucial to Food Security

If Vladimir Putin can bring this war to a peaceful end in the near future, markets will potentially see a justifiable slump in prices and trade will restore confidence in the currently upturned supply chain.

In the likely event that the conflict continues, trade flows may need to change. The US, Europe, Australia, and Argentina could endeavour to offset the short-term fall in Black Sea wheat exports. After a good harvest, India may think about exporting too. The result may well be continued crazy volatility.

As Northern Hemisphere harvests get into full swing in June, stocks should help cool supply worries in 2022, with credible solutions emerging thereafter.

Ukrainian suffering is the immediate priority, but we hope the months ahead don’t create added concern for peace in North Africa as people are unable to afford to feed their families.

Pressure on feed costs will linger on as long as the conflict does.

It seems clear to me that Russia and Putin need a resolution soon. Russia needs to export through the Black Sea, while Putin needs to restore some international acceptance.

Other Insights That May Be of Interest…

Making Sense of a War-Torn Wheat Market

What the Conflict Between Russia & Ukraine Means for Wheat

Russian Invasion Could Make India a Major Global Wheat Player

Explainers That May Be of Interest…