This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- As the sugar beet harvest winds down, the cane harvest advances, and sugar prices are unchanged.

- The USDA adjusted projections in its November WASDE report but left some unanswered questions about Mexico’s quota.

- Corn sweetener contracting for 2024 is moving ahead.

Higher Production Partially Offset

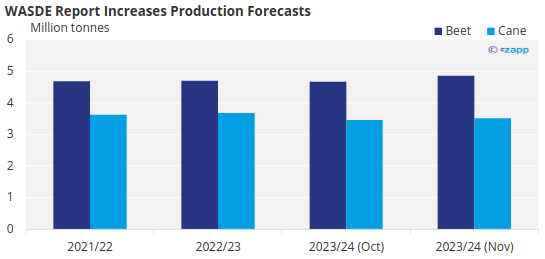

Sugar beets in the four largest producing states were 95% harvested as of November 5, ahead of 91% as the 2018-22 average for the date, with other states quickly moving toward completion, the USDA said. The harvest was complete in the Red River Valley states of Minnesota and North Dakota with two grower cooperatives leaving a total of about 45,000 acres (18,210 hectares) of excess beets in the fields because high yields would surpass processing capacity for the season. The cane harvest in drought-stressed Louisiana was progressing about a week behind the average pace. The USDA in its November 9 World Agricultural Supply and Demand Estimate (WASDE) report forecast 2023-24 beet sugar production at 4.9 million tonnes, up 4.1% from October and a record high.

Note: figures converted from short tons to metric tonnes

Cane sugar outturn in Louisiana was raised (though down from 2022-23) despite 100% of the crop in exceptional drought conditions. But with forecast use unchanged, the higher total production was nearly offset by lower beginning stocks and lower imports for 2023-24, boosting 2024 carryover just

11,200 tonnes and raising the ending stocks-to-use ratio to 12.4% from 12.3% in October. This compares with 14.6% in 2022-23.

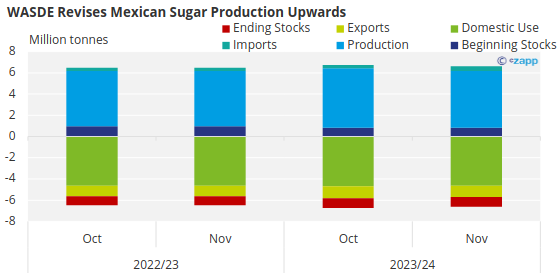

As expected, the USDA lowered its forecast for Mexico’s 2023-24 sugar production, but with drought persisting in that country, the 5.33-million-tonne actual weight production number still may be too high.

That raised questions about whether Mexico will be able to fill its US export limit, especially with sugar prices in Mexico record high at an average of USD 1.14/lb (refined) in October, 68% above US refined cane sugar.

Sugar Deliveries Lose Pace

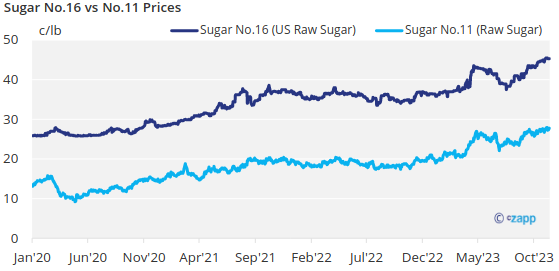

US bulk refined beet sugar offers for spot delivery were USD 0.59 to USD 0.62/lb FOB and for 2023-24 were USD 0.57 to USD 0.59/lb FOB Midwest, all unchanged. Spot refined cane sugar was offered at USD 0.68/lb nationwide through December 31. It was offered for calendar 2024 at USD 0.63/lb FOB Northeast and West Coast and at USD 0.59/lb to USD 0.61/lb FOB Gulf and Southeast, all unchanged.

Sellers continued to report a mixed pace of contracted sugar deliveries. Some said deliveries had picked up from the slow summer months and were at an expected pace for the season. Others said shipments remained slower than expected. The slowness mostly was in bulk shipments to food manufacturers as retail shipments were as expected or even stronger. With 2022-23 sugar deliveries for human consumption nearly flat compared with 2021-22, some see the USDA’s 2023-24 delivery forecast up 47,173 tonnes from last year as too high.

Inquiries about pricing of sugar for 2024-25 continued with a few sales of beet sugar reported in the low- to mid-USD 0.50/lb range FOB Midwest, which is flat to modestly below current 2024 price levels. Contracting for 2024-25 is expected to move slower than it did for 2023-24 when sales mostly were wrapped up in March 2023.

High Mexican Sugar Prices to Support HFCS

Corn sweetener contracting for 2024 advanced as buyers and sellers were intent on wrapping up business ahead of Thanksgiving to avoid dragging negotiations into the year-end holiday period. After a slow start with buyers balking at refiners’ offers, most trade appeared to be completed at levels about flat with last year, when prices were up sharply from 2022.

The USDA’s November 9 forecast of record-high 2023 corn production and lower average corn prices may encourage buyers to “dig in” as they seek lower corn sweetener prices for 2024. At the same time, higher sugar prices in Mexico are expected to drive increased demand for imports of US high-fructose corn syrup in 2023-24, while high US sugar prices also were seen as supportive to corn sweeteners.