This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

Cash refined sugar prices were mixed for the week ending October 11. Recent hurricanes Helene and Milton mostly missed major Southeast sugar cane growing areas and refineries in Florida and Georgia, though transportation was disrupted, leading to significant destruction.

High Temperatures Cause Concern

Bulk refined cane sugar prices for 2025 were lowered by 1c/lb this week. Spot prices through December 31, 2024, remained steady. Beet sugar prices for 2024-25 were firmer, with the low end of the Midwest price range increasing by 1c/lb from a week earlier and the high end rising by 2c/lb in the latest week.

Beet processors have adopted a firmer stance due to concerns about late-season dry weather affecting sugar beet crops, coupled with above-normal temperatures that have delayed the full harvest in key regions.

Michigan remained extremely dry and too warm to pile beets outdoors, with full harvest postponed until late October. Little to no rain has fallen in recent weeks, exacerbating disease problems. While sugar content in Michigan’s harvested beets has held up well, beet tonnage has declined.

In the four major beet-growing states, an aggregate of 23% of sugar beets had been harvested as of October 6, up from 19% the previous year but behind the 2019-23 average of 28%, according to the USDA in its Crop Progress report.

By mid-October, full beet harvest is expected to be underway in all areas except Michigan, as growers rush to get the large crop out of the ground before freezing temperatures threaten plants still in the fields.

Following a brush with Hurricane Francine a few weeks ago, Louisiana sugar cane was 11% harvested as of October 6, up from 4% the previous year and the five-year average of 8%, the USDA reported. The harvest had just begun in Florida but is likely to stall due to rain from Hurricane Milton.

2025 Sales and Delivery Trends

Sales for 2025 continued at a slow pace, with mostly small and mid-sized users still needing to cover their needs. All beet processors remained in the market, though one was not aggressively pursuing new sales. Some noted difficulties in finding buyers for the remaining sugar they have available.

Sugar deliveries contracted for 2024 continued at a mixed pace. One processor reported its best September on record, while others noted that shipments to certain sectors fell short of expectations. The fourth quarter typically sees strong delivery volumes for both retail and bulk sugar.

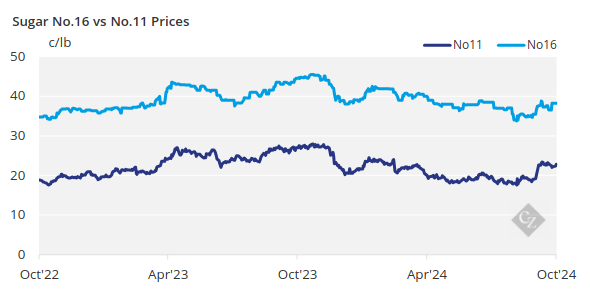

New York world raw sugar futures (No. 11 contract) prices fell to three-week lows, driven by rain in previously parched Brazil and weaker crude oil prices following recent spikes caused by tensions in the Middle East.

The USDA’s October 11 WASDE report forecast 2024-25 US sugar ending stocks at 1.78 million tonnes, up 11,000 tonnes from September, as higher domestic production and imports offset lower beginning stocks. Projected deliveries remained unchanged from the previous report.

Corn sweetener markets were quiet as 2025 negotiations got off to a slow start, amid lower corn prices and indications of weaker demand for certain products.