- La Niña phenomenon should extend until June 2022.

- However, new developments have emerged for the CS region.

- What are the expected impacts for cane and the 2022/23 season?

Better than expected

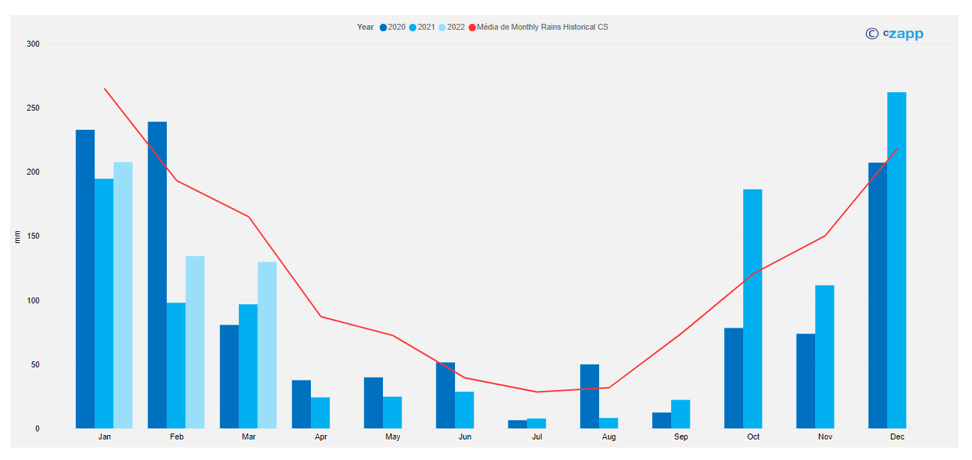

- Contrary to initial reports, December should end with rains 20% above average in Centre South (CS) region.

- This brings relief for cane fields and is positive for cane agricultural yields.

- Nonetheless, soil moisture monitoring shows areas still with levels below ideal.

- This means that, even with good December rains, more is needed in the upcoming quarter to allow cane to properly develop for next season.

CS Monthly Rains – have a look at our Interactive Reports for CS Weather Forecast and Hist Data

- Brazil is now under La Niña influence, and its impacts varies depending on the region – you can read more about it here.

- Previous forecasts were pointing to rains below average across CS during Q1’22, but new developments have emerged.

- While some CS states should experience lower precipitation than normal, like Minas Gerais (MG), Goiás (GO) and Mato Grosso do Sul (MS), others like São Paulo (SP) and Paraná (PR) could actually see volumes above average.

- Why does it matter?

Why it Matters Where Deficit Rains Should Occur

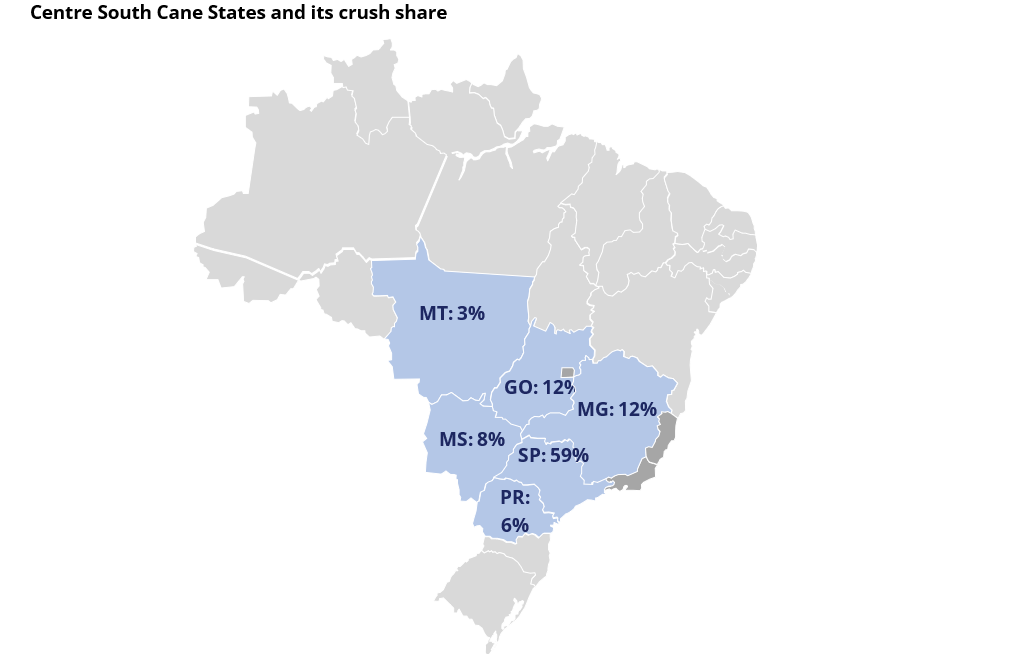

- Assuming that SP and PR states do actually register rains above or even just on average, the risk of downside for cane crush estimates is reduced.

- Seeing as they together represent 65% of total cane crushed in CS, this new weather development is important.

- Back in October, our alternative scenarios were considering just downside , since all meteorological models were pointing to lower precipitation.

Just how much upside?

- Rains are essential for cane development, especially in Q1.

- However, it is not the only factor to be considered…

- Crop care and ratoon maintenance also play a big part in agricultural yields improvement, as does the age of the cane fields.

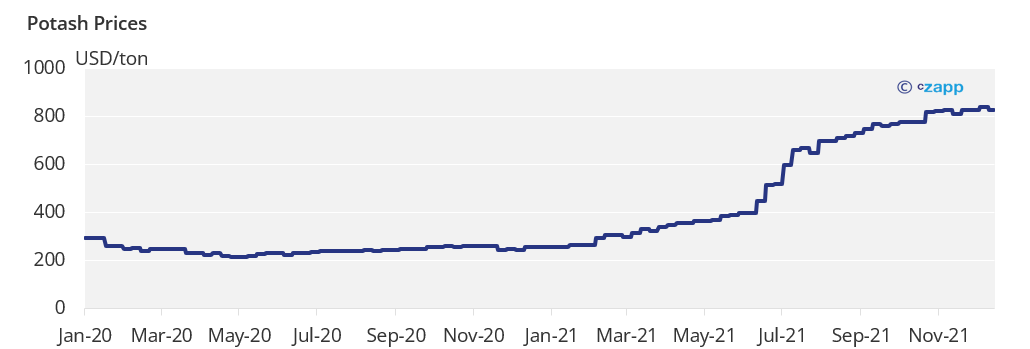

- This means application of fertilizers, herbicides, cane field renovation, etc..

- The spike in fertilizer prices , and even worst the product shortage, means crop care will be impacted.

- We have heard reports of herbicide shortage as well, which can lead to cane competing for nutrients with weeds.

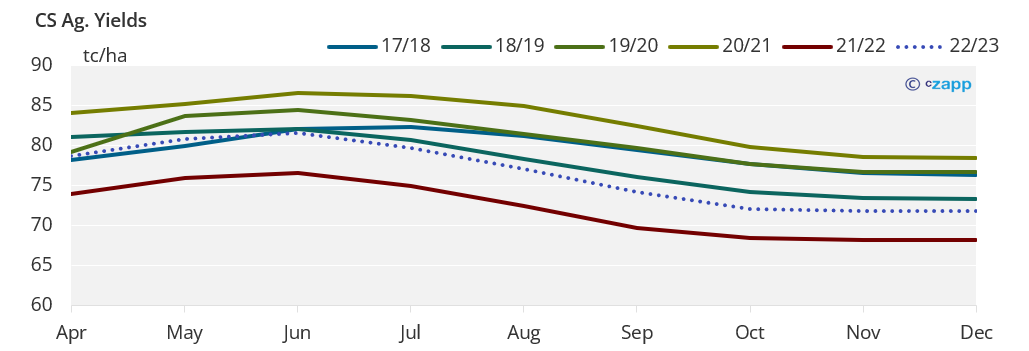

- Additionally, cane fields are older since the dry weather last year prevented mills from carrying on with cane renovation plans – older cane field, negative impact on agricultural yields (TCH, ton of cane per ha).

- These factors can limit the upside for cane next season, even with excellent rains.

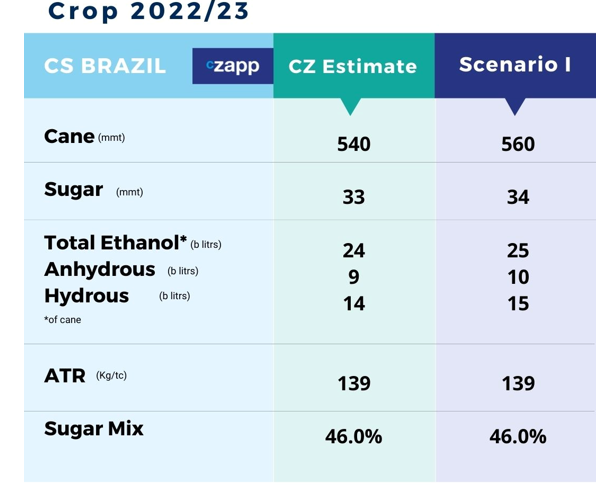

- In order to reach 540mmt for next season, we reckon TCH (ton cane per ha) would need to recover by around 6.5%.

- In order to reach 560mmt crush, TCH would need to recover around 10% – which is quite a leap considering the risks and factors listed above.

- We are not saying it is impossible, but further upside seems limited.

- As for sugar mix, another season of max sugar is expected given the risky outlook for ethanol prices and expected parity should continue to favour sugar.

Other Insights that may be of interest

- How the Fertilizer Crisis Impacts CS Brazil’s Sugarcane Sector

- CS Brazilian Cane in 2022/23: Another Awful Harvest?

Explainers that may be of interest

Interactive Data Reports that may be of interest…