Insight Focus

- December NZ milk production surpassed expectations at 225.2 million kgMS.

- Fonterra’s South Island farmers and non-Fonterra farmers each set a December production record.

- We anticipate 207 million kgMS in January, with butter market volatility to be watched.

NZ Milk Collections Exceed Expectations

The latest milk collection figures for the month of December have been reported by all dairy processors. After being spot on for October and November, our call of just under 220 million kgMS for December was very light, with the actual DCANZ print for December New Zealand milk production coming in at a surprisingly strong 225.2 million kgMS.

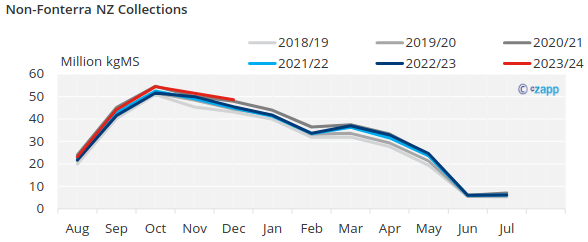

Our prediction for the non-Fonterra share of 21.7% was exactly right, but all processors materially outperformed our expectations. This was especially true of Fonterra’s South Island farmers at a record 78.8m kgMS for this group. The non-Fonterra group came in at 48.6 million kgMS, which was also a record December for this group.

Rainy December Boost Production

New Zealand weather in December was warm and wet in most key dairying regions. We had underestimated the impact of the wet second half of the month and this clearly had a very positive impact on milk production.

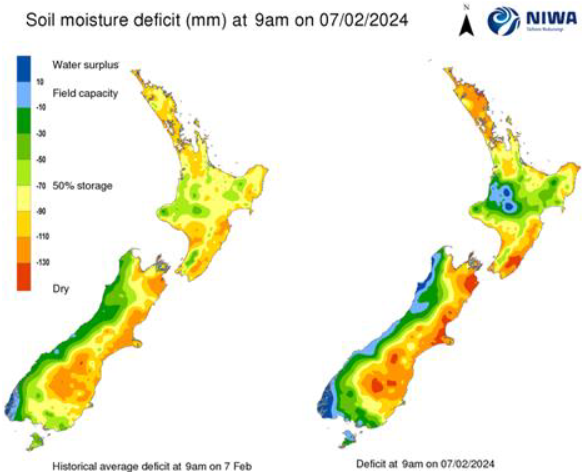

Temperatures in January were well above average for New Zealand, at 1.3 degrees Celsius higher than normal across the country. It has been significantly drier (and sunnier) in most regions, except for the Central North Island and West Coast of the South.

This has reflected in the soil moisture, which shows sharp contrast in different parts of New Zealand. Given that the Waikato is the top dairying region, this could mean mixed production signals for the month.

Source: NIWA

January Production Expectations Positive

We expect a DCANZ print of a little over 207 million kgMS for New Zealand Milk Production in January. The expectation is for up to 163 million kgMS from Fonterra. The non-Fonterra group should come in at around 44 million kgMS for their third “best ever production for that month” in a row.

Other Market Intel

Butter is the product in focus, with extreme volatility being observed. NZ is reportedly well sold so all eyes will be on EU cream use as we approach the northern hemisphere peak. The flip side of this, which may fall under the radar to begin with, will be additional SMP production, especially if demand wanes. A sustained butter rally always makes me nervous for SMP and WMP (via fat-filled milk powder).

There was a surprisingly strong GDT this week before a string of major holidays, including Lunar New Year in many countries across Asia and Tet in Vietnam. Ramadan begins early March and Easter later in the month. Granted buying will have been done for these important periods weeks ago, but will we see market activity dip as participants are away from their desks?