665 words / 3 minute reading time

- There is no party without the big buyers.

- Old crop or new crop? That is the question.

- It is raining everywhere! Well, nearly everywhere…

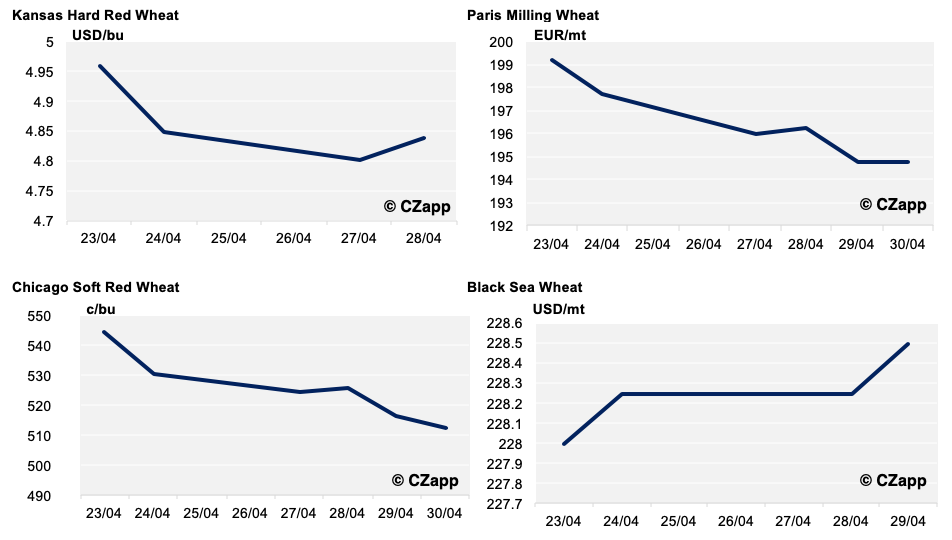

The Key Wheat Markets Last Week

The wheat market has certainly taken a breather and a restock over the last week.

Buyers have been there, as always, but the big players have been quiet. The stockpiling talk and apparent panic buying has disappeared just as the Black Sea governments restrict exports and the old crop looks tight.

The weather has put a dampener on the market and the focus is definitely turning towards the new crop in the Northern hemisphere with the 2020 harvest only weeks away.

There is No Party Without the Big Buyers

The last week has seen an unexpected absence from some of the biggest wheat importers. In our previous Weekly Wheat Wonders, we mentioned buying by Egypt and Saudi Arabia, with the former having purchased 240k tonnes of an anticipated 800k tonnes to be procured over the coming weeks. We await the next round; surely this is not too far away?

Despite the lack of headline buyers, Japan had its usual weekly tender buying 115k tonnes, while Taiwan purchased 220k tonnes of US Hard Wheat for milling. So, trade continues with a need to feed the world’s population.

It is interesting that some buyers stay away for now, with the old crop looking tight in Europe and the Black Sea.

- Russia have announced that their 7m tonne grain export quota for April-June has already been sold.

- Ukraine has exported 18.8m tonnes of its 20.2m tonne limit for the season.

- EU soft wheat exports are so far at 27.97m tonnes, up from 17.16m tonnes last year.

Old Crop or New Crop?

With the harvest kicking off in North Africa, we know that the main Northern Hemisphere winter wheat harvest will be ramping up in the next six weeks.

Prices tend to be cheaper at harvest than in the April to June months, as farmers need both storage and cash flow, which pushes wheat onto the market.

We have seen a good rally with some panic buying since the Coronavirus plummeted prices towards contract lows earlier in the year. Now is perhaps time for reflection and to buy what is needed awaiting cheaper new crop supplies.

The Rain

There has been a lot of focus recently on rain, or the lack of it.

Three years of drought in Australia is maybe signed to the history books as the last few months have seen good rain. This should lead, as previously mentioned, to a resurgence in the 2020 wheat crop.

Although Northern Europe faced a horribly wet autumn for the planting season, with acres of winter wheat down significantly, this has been followed by a concerning dry spell, adding stress to an already struggling 2020 wheat crop. The rain has arrived and it may be just in time.

The Black Sea region has seen wheat production estimates falling for the last few weeks as a prolonged warm and dry winter has seriously dented the upcoming harvest. It has finally started to rain and this may yet save the harvest. Although it may be raining, in the important southern regions of Russia, the forecast rain may not be enough.

What’s Next?

With the big buyers sitting it out looking at prices drop, maybe we will see a quieter time. Although at some point, with the exporters stocks to use ratios looking tighter than previous years, the buyers will be back.

The rains helping the 2020 harvest will encourage patience, especially with the Black Sea export restrictions and the new crop being cheaper than the old crop. But can they wait that long? Food security is everything in the coronavirus era!

To sustain a bull market, the bull needs feeding and the big buyers would help that.