691 words / 3.5 minute reading time

- The USDA’s WASDE Release was a gloomy read.

- Is the coronavirus pandemic really impacting on long term wheat demand?

- How is the 2020 wheat crop shaping up?

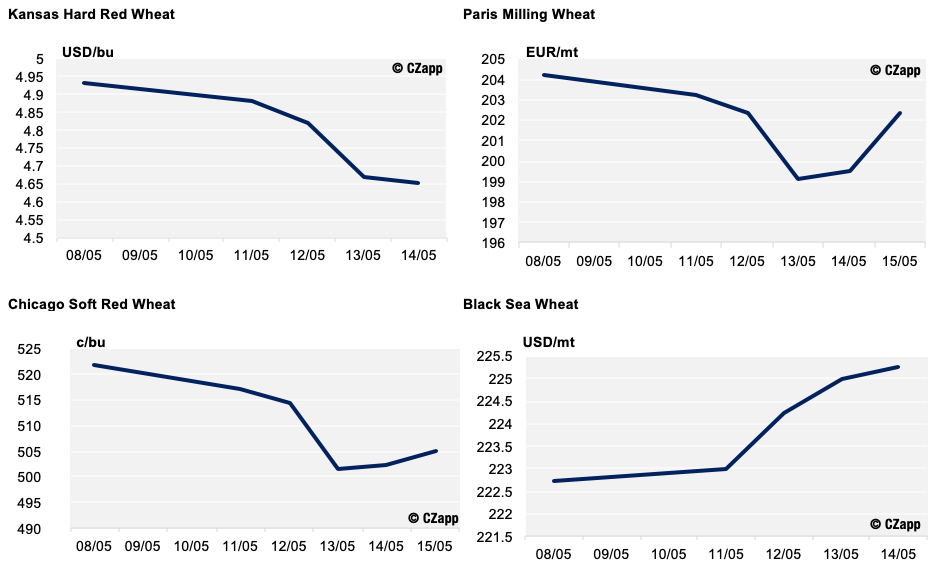

The Key Wheat Markets Last Week

Globally, the wheat markets have taken a hit over the last couple of weeks. The exception, to a degree, are the Paris Wheat Futures where exports remain good and weather for the 2020 crop is an ongoing concern with smaller acres in the ground.

The USDA’s May WASDE Release

We saw the first official estimates from the USDA this week for the global 2020 wheat crop, in terms of both production/supply and demand.

Global production for the 20/21 marketing year was estimated to be up from 764m tonnes in 2019 to 768m tonnes in 2020.

Ending stocks for 19/20 coming into the new crop marketing year were raised higher than expected to 295m tonnes from 292m tonnes last month.

Ending stocks for 20/21 are estimated at a huge 310m tonnes, well above any pre-report trade thoughts. Interestingly, just over 50% will, as with 19/20, be held in China.

Larger year-on-year wheat crops for major exporters Russia, Australia and Argentina will make for an interesting level of competition on the global stage with Europe, Ukraine and the US having significantly smaller 2020 crops than in 2019.

The Coronavirus Factor

President Trump stated that the hard-fought Phase 1 Trade Agreement with China is now of secondary importance to the Coronavirus. Having been criticised for calling it the “Chinese” or “Wuhan virus”, he has now suggested new tariffs on Beijing as a potential retaliation to the virus and the huge economic and social impact it has had on the US.

Despite these reports, the US and Chinese trade representatives have been involved in calls and agreed to create a beneficial environment for carrying out the Phase 1 Trade Agreement.

A renewed trade war between China and the US in these economic times would undoubtedly be destructive to all commodity markets.

In terms of pure demand for wheat as a result of the Coronavirus, there will be many unanswered questions for some time, as many companies throughout the food supply chain are experiencing. Coronavirus cases and the safety of their employees are a problem; will this change the ability for the smooth supply chain to function as in the past?

Any supply chain issues, coupled with possible changes to peoples’ diets due to reduced out-of-home food consumption, as well as wider financial implications are a big unknown. They could have an important part to play in the wheat prices over the coming months.

The 2020 Wheat Crop

As mentioned above, the WASDE highlighted production increases and reductions in various major exporters throughout the world. Although estimates point to a large crop, the weather is keeping the trade guessing.

The Black Sea has seen some rain following a very warm and dry winter.

Northern Europe has seen an extremely wet autumn. With fewer acres planted, followed by a worrying dry spell, rain has now arrived.

Australia has received good rains in advance of the planting season.

Conditions in Argentina are very favourable with planting to get into full swing in the next few weeks.

The US has the lowest number of winter wheat acres in well over 100 years, with freezing temperatures, dryness in parts and flooding in parts over the last months.

It is an ongoing weather story globally which has yet to play out, even with Northern hemisphere harvests in small parts just beginning. Conditions have been far from ideal where the crop is maturing, and in the Southern Hemisphere, where planting is far from done, there is a long way to go.

What Lies in Store?

The wheat markets have most definitely been under pressure over the last week or two. It will take buyers to return, or a less relaxed attitude towards the upcoming weather issues and the 2020 crop, to really turn things around.

The lockdown exits and the return to normality would help sure up demand, but if and when that will come is a significant unknown.

‘Stability’ is not a word for the 2020 wheat market!