640 words / 3 minute reading time

- How is the wheat market faring in these uncertain times?

- Does the increasing number of Coronavirus cases create a workforce challenge?

- It’s now make or break for the Northern Hemisphere’s 2020 wheat crop.

The Market Moves

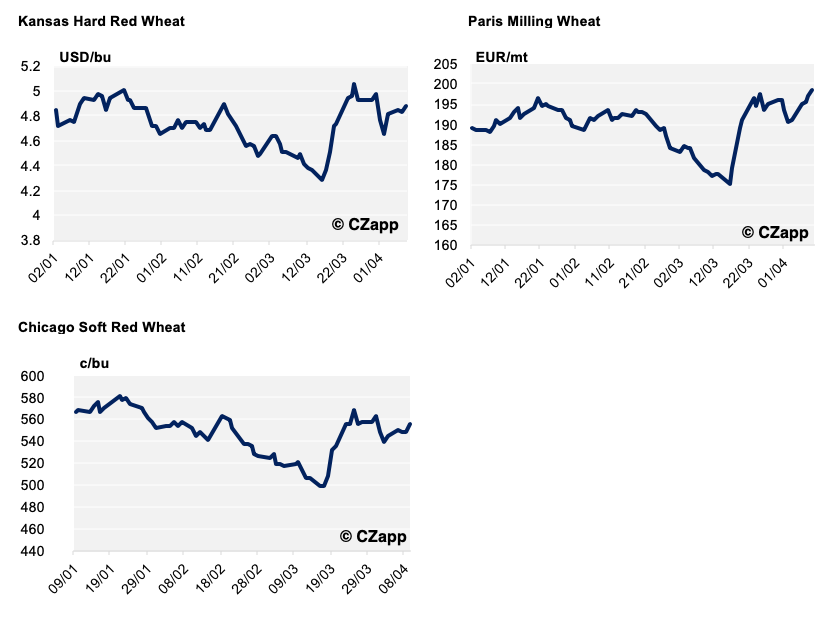

A quick recap reminds us that we have seen some big swings in the Global wheat market over the first few months of 2020.

- We had the Coronavirus hit in mid-January, crashing the market along with the financial and other commodity markets.

- Panic-buying and stockpiling from consumers, followed by processors and funds jumping in, pushed the market up in March to within a whisker of where it was before the crash. Talk and action of governments worried about food security added to the strength.

- More recently, we’ve had a bit of a breather. Are we going to return to the fundamentals, or more panic?

The last week has seen a more stable wheat market. The exception is the European market, which has seen more of an uplift as EU wheat exports so far for 19/20 reach 24.78m tonnes, up from 14.94m tonnes last year. The 2020 crop issues (see below) continue to be an ever-greater concern.

The Workforce

- We mentioned in our previous article that, around the world, governments importing wheat are concerned about food security related to potential logistical issues.

- Not only ‘lockdowns’, but what if workforce absenteeism from Coronavirus and other illnesses prevents the normal smooth, well-oiled supply chain from functioning as needed?

- An inability to produce, process or move wheat and its products to the consumer will without doubt create market turbulence and maybe more panic.

Make or Break for the Northern Hemisphere’s 2020 Wheat Harvest?

- We are beginning to see the first meaningful crop reports coming out for the 2020 wheat crop.

- The French Agriculture Ministry have estimated that soft wheat plantings are down 7.5% from last year; this is the lowest level in 17 years! At this point in 2019 the crop was rated 82% good/excellent. That number currently stands at 62% G/E.

- Rumours circulating suggest that the UK and France will produce at least 10m tonnes less than they did last year. This will have to come straight off the exports in due course. Who will make up the balance?

- Russia, currently expected to export 33-35m tonnes of wheat this year, as the World’s largest exporter, is scheduled to have a record crop. The suggested 83m tonnes, up from 73.5m tonnes this year could fill the EU shortfall; if it materialises. As the crop exists dormancy ahead of schedule, following a warm winter, forecasts suggest dry conditions are already likely to be reducing those crop estimates to below 80m tonnes.

- The US has had the first of its official crop rating reports this week. The crop looks good in the Soft Red Winter (SRW) states compared to last year, but more importantly the Hard Red Winter (HRW) states are looking somewhat less good. With the acres of SRW at 5.69 million acres vs HRW at an all-time low of 21.7m ac this is definitely a situation to watch.

What Lies Ahead?

- Coronavirus is on everyone’s mind. If it slows down soon it will allow the wheat market to return to fundamentals. That does not look likely over the coming weeks, so will governments be spooked in to buying sprees and/or will workforce and logistic issues upset the smooth supply chain? Either of these can send shockwaves through the market.

- The 2020 wheat crop is approaching the all-important growing stages across the Northern Hemisphere. Not everyone will have a big crop; watch this space…

- We have a USDA WASDE (World Agricultural Supply and Demand Estimates) report out later today, will this tell us anything we do not already know?