680 words / 3 minute reading time

Some Useful Acronyms: USDA (United States Department of Agriculture), WASDE (World Agricultural Supply and Demand Estimates), HRW (Hard Red Wheat).

- Have State restrictions given the global wheat trade a sting in the tail of the 19/20 season?

- Kansas; the ‘breadbasket of the breadbasket’ in the US. What does the freeze bring to the party?

- The USDA’s WASDE report suggests higher global wheat stocks. Can we take that at face value?

The Markets Last Week

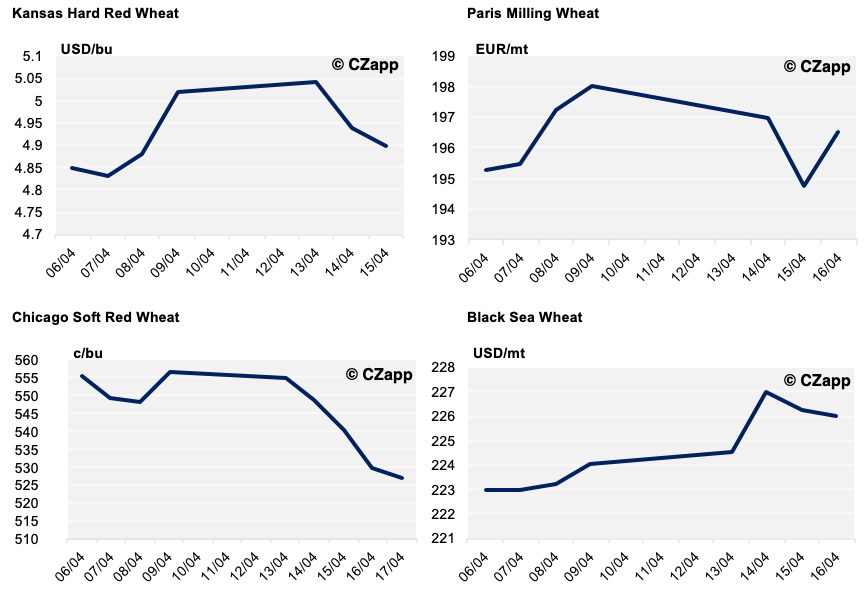

Over the last week, we have seen a reasonable amount of volatility in the wheat markets, with the end of one marketing season on the horizon, together with a new year only a few weeks away in June.

The most notable change is in the Black Sea wheat futures. Restrictions, as discussed below, have caused somewhat of a spike in prices relative to other EU and US markets as supplies get tighter.

The EU wheat market remains supported with continued good sales. Current EU soft wheat exports for the 2019/2020 season stand at 26.71m tonnes as of the 12th April, up 68% compared to the 7th April 2019.

Restrictions

- Russia has limited Apr-Jun grain exports to 7m tonnes, which should equate to 5.5-6m tonnes of wheat.

- Ukraine have exported 18.5m tonnes so far and the Government have stated that they will take action on banning exports if traders sell more than the agreed 20.2m tonnes.

- Kazakhstan have restricted wheat exports to 200k tonnes for April 2020.

The Unknown

Kansas State is the US’ biggest producer of the largest (by volume) wheat; Hard Red Wheat (HRW). One frost at this time of year should not present any problems. Consecutive night frosts, where the wheat crop freezes, thaws and then freezes again several times over is considerably more likely to damage a crop. We have seen this in the last week with temperatures well below freezing. A continuation will cause alarm, even if the real damage is difficult to assess until harvest.

In Russia, there are areas with dry soils. Although forecasts look slightly better than a few days ago, it is worth a mention.

The Southern and Eastern regions of the Ukraine are some of the most productive in the country. Spring rainfall since the 1st March has been the lowest in 30 years. There is not much in the forecast and it is needed. This is one to watch!

The USDA April WASDE Release

World ending wheat stocks are predicted to rise to 292.78m tonnes from March’s estimate of 287.14m tonnes. Do we, therefore, assume supplies are plentiful and all is well?

We have previously discussed importers stockpiling and that is where much of the extra stock is anticipated to be found. China on its own is expected to have 150.36m tonnes of stock, up from the March estimate of 148.26m tonnes.

We have said before, but a reminder that as a combined exporting force, Russia, Ukraine and Kazakhstan account for circa 60m tonnes of the 182.72m tonnes of global trade this marketing year.

Their marketing year-end combined stocks are put at 10.7m tonnes (down from 15.81m tonnes in 2018). This is the smallest total since the 2012/13 season and much has changed in the world wheat trade since then. At less than 10%, this is the tightest stocks-to-use ratio in some 20 years.

Any production issues in the Black Sea region will really put the cat among the pigeons!

Thoughts for the Future…

There appear to be a lot of fingers pointing in the direction of the Black Sea wheat region, with Governments trying to sure up domestic supplies by restricting exports.

Low rainfall, together with dwindling end of year stocks, leaves many unanswered questions for 2020. Add in the freezing temperatures in the US on the lowest acreage of wheat in over 100 years and the ‘plentiful’ global stocks may yet look inadequate.

If Governments, such as Egypt’s, are going to create coronavirus-inspired stockpiles, where will they come from?