753 words / 3.5 minute reading time

- Short term wheat stocks are limited.

- Trade is subsequently slow.

- The USDA’s monthly WASDE reiterates the 2020 production estimate discrepancies.

The Wheat Markets Last Week

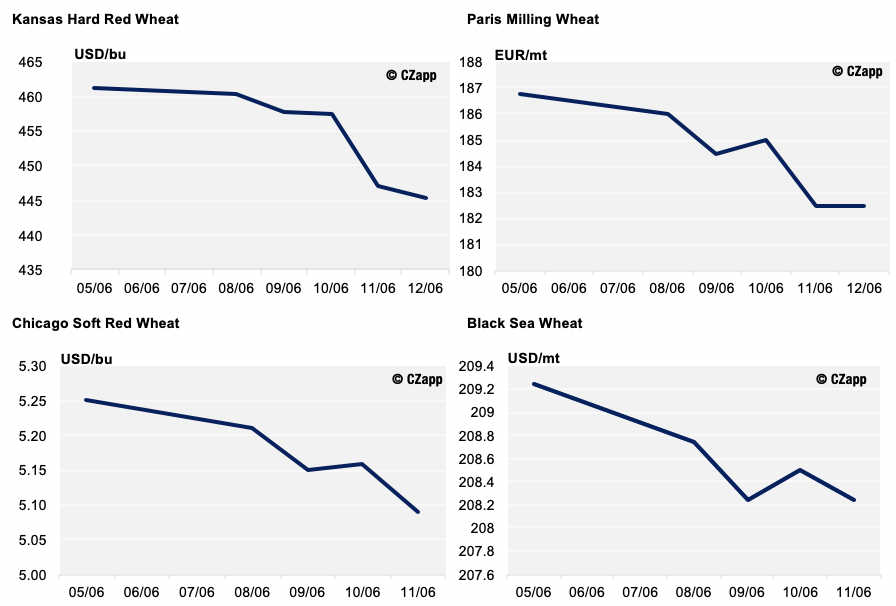

The wheat prices have been on the decline over the last week as buyers have held back on big purchases.

With combines starting to roll over the last couple of weeks in the Northern Hemisphere, one would expect more consistency in crop estimates, but that is not forthcoming, so trade is a little stunted.

Fewer offers in the global marketplace and large stocks predicted have kept the market defensive. Add in the global economic woes due to coronavirus fallout and demand is expected to be hit.

Low Old Crop Stocks and Limited Trade

With Black Sea wheat restrictions and the sizable EU wheat exports this year, there were never likely to be many offers for potential buyers.

Egypt was back for more this week, having bought 120k tonnes of wheat from the Ukraine last week. Russia was reported to be the only seller and there wasn’t much of that, so 120k tonnes of Russia was bought for July shipment. Priced at US$227/mt, it was US$7/mt more than last week’s purchase.

Thailand passed on a tender for feed wheat, buying Australian barley instead.

The Philippines came out and bought only 56k tonnes of their 168k tonne wheat tender.

With little on the sellers table until we see more harvest in the Northern Hemisphere, global trade looks like being slow.

2020 Production Estimates and the USDA Monthly WASDE

There have been a number of crop production estimates released recently and few seem to be in agreement with each other.

Yesterday saw the latest USDA monthly WASDE report. The main feature of the report was the raising of harvest prospects with weak demand and thus an enormous 316m tonnes of end stocks in 2021, up from 310m tonnes last month and 295m tonnes at the end of the 2019/20 marketing year.

In other reports, the Ukraine wheat crop is predicted to be anywhere from 23 to 28m tonnes. Russia’s wheat crop is expected somewhere between 76 and 82m tonnes.

In the US, the harvest has begun in the South, but reports are variable. Drought and freeze damage are unknown in the Hard Red Wheat and the wet season for the Soft Red Wheat may yet pose a problem. Despite this, the smaller crop on the lowest ever acreage does not look to be getting any smaller.

This week, some EU crop estimates have been slashing up to 5m tonnes or more off the wheat crop in the last month, together with suggestions of lower acres planted. Crop ratings in France remain at 56% good/excellent; the lowest in many years. We may well see 15m tonnes (or more) less wheat in the EU than 2019’s 154m tonnes.

India continues to look to be on course for a record wheat harvest in 2020, up to 107m tonnes from last year’s 103m tonnes. This is despite the swarms of locusts devastating crops all over East Africa, the Middle East, Pakistan (which has declared a state of emergency) and India.

Argentina is reported to have planted 40% of the wheat crop but dryness is becoming a problem. This could impact the expectations for a record 22m tonne harvest.

Australian ABARES have estimated a crop size of 26m tonnes, up from 21m tonnes last month and 15m tonnes in the same period of 2019. This may yet materialise, but it has only just been planted.

Conclusions

Tight old crop supplies will soon be a story of the past if expectations for a large 2020 world wheat harvest resulting in record end stocks in 2021 materialise.

Global economic woes as recessions bite may well dampen demand as the consumer has less to spend.

However, we are in unprecedented economic times as we hopefully move on from the coronavirus pandemic, so wheat demand is difficult to accurately assess going forward. With so many differences in production forecasts, will the 2021 stockpiles really be as large as the USDA predict?

There is still a long way to go before we get much certainty on either the supply or demand side of the wheat market. Stocks may look comfortable today, but I was once told “a market is never more bullish than when it looks to be at its most bearish.” We will have to wait and see!