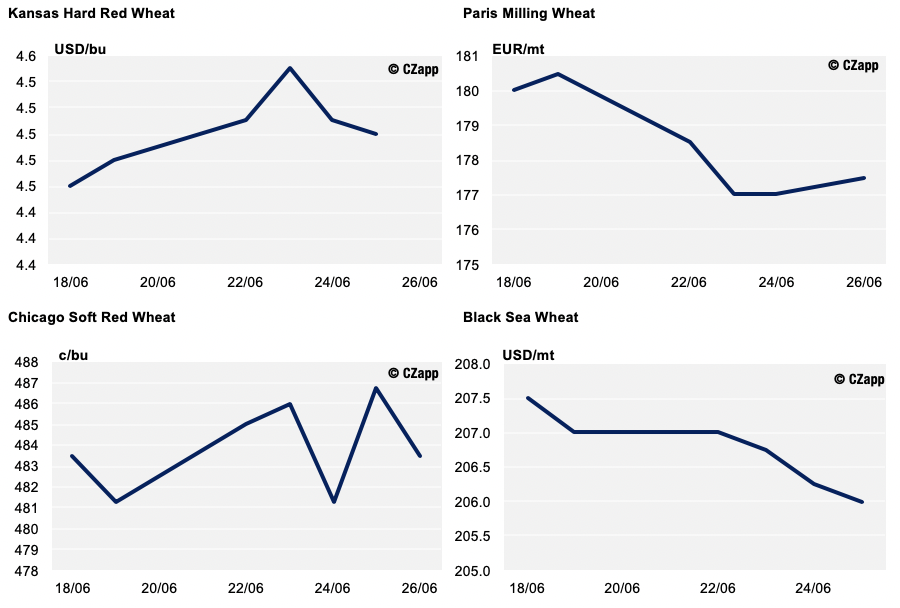

- The world’s wheat markets have been more stable again this week.

- The harvest is underway in parts of the Northern Hemisphere.

- Buyers and sellers are relatively quiet as the crop sizes are difficult to determine.

The Wheat Markets Last Week

World wheat prices have seen a greater level of stability over the last week, especially in the US as the harvest progresses.

The Black Sea and Europe have seen more downward price movement during this period due to the sentiment of potentially better crop outlooks, after many of the dry parts of Europe received rain.

Harvest

North Africa, a large wheat importer, has seen some poor domestic harvests in recent weeks.

The region has suffered one of the worst droughts in decades, with poor wheat crops appearing across the likes of Morocco, Algeria and Tunisia. We have seen Egypt, the world’s largest wheat importer, suggest over recent months that they have a desire to increase the nation’s stocks in order to ensure food security.

The most recent USDA WASDE report in June estimated that North African States will import 29.7m tonnes during the 2020/21 marketing year, up from 26.95m tonnes in the 2018/19 season and 27.95m tonnes in the 2019/20 season.

In the US, the wheat harvest is progressing with mixed reports. In the Hard Red Wheat (HRW) States, the harvest got off to a bad start, with reports of poor yields in Texas. However, as the combines rolled into Oklahoma, yields started to improve a little, albeit with lower protein. Moving into Kansas, a big HRW State, there are concerns that the dry spell and late frosts caused damage, which is now beginning to show, with low yields and possibly more of the same as the harvest heads north in the State. The Soft Red Wheat States were anticipating better yields than have so far been reported after having a wetter season, but most of the wheat is yet to be cut.

Southern Europe has seen the beginnings of harvest, but more for barley than wheat, so we will see more here over the coming weeks.

Buyers and Sellers

It has been a relatively quiet week with regards to trade news. Inevitably, trades, such as the regular Japanese weekly tenders, are being filled as we saw the purchase of 101.2k tonnes from the US, Canada and Australia.

Yesterday, the USDA’s US weekly export report showed sales of 518.7k tonnes last week. This shows that trade is ticking along reasonably well, but there are no exceptional purchases by the importers.

The uncertainty surrounding the world wheat crop estimates, from the Northern Hemisphere harvest just beginning to the Southern Hemisphere harvests at the end of 2020, means buyers and sellers appear reluctant to commit in large volumes.

The ongoing issues relating to coronavirus are an additional consideration for the trade. Until we achieve worldwide progress and have the pandemic under control, allowing economic return to normality, there will be apprehension throughout the global market.

What Comes Next?

The coming few weeks will certainly start to give a more solid indication of the 2020 wheat supply.

This same period may begin to allow more assessment of the coronavirus pandemic. This will impact economic activity and the demand side of the 2020/21 wheat market.

For now, we will have to remain patient. Perhaps, price wise, we are in the lull before the storm?