596 words / 3 minute reading time

- The wheat market has rallied sharply over the last 10 ten days.

- This was in response to concerns of food shortages leading to global stockpiling.

- China being back on their feet from a trading perspective was also a key motive.

Price Rally in the Wheat Markets

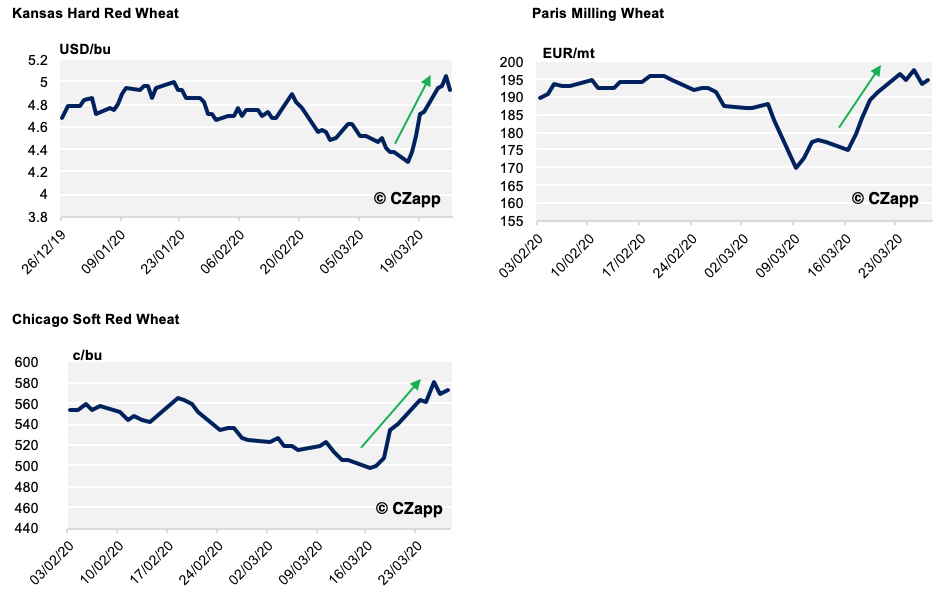

- The wheat markets around the world have risen even more sharply over the last ten days than they declined after the coronavirus fears spread.

- As you can see on the graphs below, from the end of January 2020, the wheat markets crashed as fears grew with concerns that a global economic slowdown/recession may be on the horizon, potentially eroding world wheat demand.

- That has changed over the last ten days, with the wheat market rallying on an extraordinary scale…will it stick or is it short lived?

Why Did the Rally Happen?

1. Stockpiling is Panicking Food and Supply Processors

- Everywhere you look there are reports from Australia to the UK, from Asia to the US of people stockpiling food and basic supplies.

- This creates strain on the supply chain, especially on the logistics and distribution industries.

- Short term stockpiling, if only for a matter of days, empties the shelves, but not the processors or warehouses.

- Over the last 10 days, we have seen processors, such as bakers and food companies start to panic purchase, pushing up prices as they scramble to buy the wheat available in the system. Once the buyers buy, the funds jump in on the herd mentality and they each fuel yet more buying…until one of them stops?!

2. China are Trading Again

- There has previously been much talk about agricultural purchases by the Chinese from the US in order to live up to the ‘Phase One’ Trade Agreement signed in mid-January.

- The coronavirus put paid to that plan and President Xi has been preoccupied with the start of a global pandemic.

- With several days of no new domestic cases of coronavirus in China, things are turning a corner and the purchases have finally started. 340k tonnes of Hard Wheat purchased in the last week has kept the bulls in charge.

3. Concerns of Food Inflation and Shortages

- Last week, we mentioned a currency crash for the Russian Ruble. This makes Russian wheat cheaper on the international export market and conversely more expensive on the domestic market.

- With a desire to prevent high food inflation or more importantly long term, any food shortages, there has been talk of export restrictions. These rumours have covered mainly Russia, Ukraine and Kazakhstan.

- Russia announced a 10 day ban on exports, which they subsequently clarified and then scrapped within a couple of days. Today, they have proposed a grain export of 7m tonnes for April to June 2020.

- Rumours continue to circulate from Ukraine, while Kazakhstan has issued an order to halt the export of flour, buckwheat and various other products. As a major flour exporter this will impact supplies to some buyers. These three countries combined account for approximately 60m tonnes of the 183m tonnes of global wheat exports.

- Talk of disruption here inevitably gets the market bulls excited…

Extraordinary Times Produce Extraordinary Market Movements…

- Panic buyers, the usual buyers, plus new trade agreement buyers and a helping hand from the funds have spurred the market to an unthinkable rise from two weeks ago. Add in logistical restrictions with staff homebound and potentially large logistical restrictions imposed by governments and things can get very exciting on the price front.

- The bull run may or may not be short lived, but calm in the world must prevail to allow the true longer-term fundamentals to control the market place.

- Extraordinary times produce extraordinary market movements. Never say never….the market is always right!