559 words / 3 minute reading time

- Short term trade uncertainty with both buyers and sellers; who moves next?

- The weather is too dry in parts of Europe, but healthy rains in Australia bode well.

- With exports possibly banned and stockpiling still happening, what happens next?

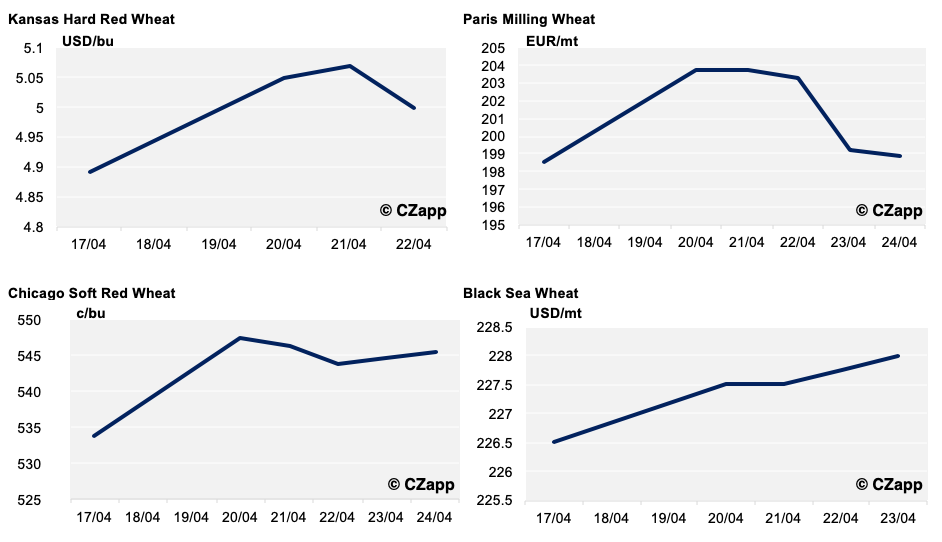

The Key Wheat Markets Last Week

The main wheat markets had a bit of rally at the end of last and early this week, but have spent the last few days up and down, struggling a little for direction. Uncertainty with various fundamentals has held back major price movements.

Short-Term Trade Uncertainty

As previously mentioned, Russia implemented a maximum export restriction of 7m tonnes of grains for April to June, which should equate to 5.5-6mmt of wheat. There is much discussion as to when this limit will be reached and reports suggest that wheat exports will be banned by mid-May until we see new crop emerge out of Russia onto the world market.

Ukraine have similarly put export restrictions on for wheat, at 20.2mmt. To date they have exported at least 18.5mmt, so there is a real possibility of an export ban there before new crop emerges onto the market in the latter stages of June.

Egypt, having made a statement to increase state reserves of wheat due to uncertainty surrounding the Coronavirus and logistics, purchased 240,000mt at the end of

last week. Interestingly this was made up of 180,000mt of French and 60,000mt of Russian wheat. If Egypt returns to the market soon, which is probable despite the start of their domestic harvest, it is unclear as to who will supply their needs.

Fewer offers coming out of the Black Sea and EU soft wheat exports running at 68% more than last year, at 26.71mmt there may be US Hard Red Winter wheat offered as it was in the mix last week. Despite being a few dollars too expensive the drastic collapse in oil prices should make the freight costs and hence the wheat more competitive.

Saudi Arabia has also issued a tender for 655,000mt wheat, which again could come from various origins considering the reduced freight rates from further afield.

Weather Opposites

We have seen significantly better rains in Australia this year, as farmers head into their wheat planting season. This is hugely welcome after three years of drought. Estimates suggest that the 2020 crop could well be in the region of 23m tonnes, up from circa 15m tonnes in 2019.

In contrast, the Russian 2020 wheat crop previously estimated to be circa 83-84m tonnes is currently looking to be more like 77-80m tonnes, with dry weather in many of the important growing regions.

Having had an extremely wet autumn for planting, Northern Europe is now experiencing a concerning dry spell which, if rains do not relieve, could see a drop of more than the currently estimated 10m tonnes in the UK and France.

What’s Next?

The market looks to be on the very edge with trade disruptions, due to export restrictions and potentially higher purchases as Governments look for increased food security.

Add weather into the mix for the 2020 crop and, until more certainty is widely seen with regards the importers and the exporters, we could have a very spicy next few months ahead.