659 words / 3 minute reading time

- Lab tests in China suggest they have found an effective African Swine Fever vaccine.

- The UK’s wettest February ever sees lakes instead of fields of wheat.

- Argentina leave wheat export taxes at 12%, much to the relief of wheat farmers going forward.

African Swine Fever

The outbreak started in China in early 2018 and has decimated the country’s pig herd. The Chinese herd stood at over 50% of the global total and has seen culling of 40% or more, wiping out over 20% of the entire world pig population and pork production. China’s Harbin Veterinary Research Institute say that they have found an effective and safe vaccine. There was no confirmation as to when the vaccine may be made publicly available. This is vital progress following recent illegal and unofficial vaccines that have been used with completely unknown results. Separately, in the last few months, US researchers are confident that they have found a 100% proven vaccine but that it is still a long way from being ready for commercial release to farmers.

The UK Had their Wettest February on Record

In February, fields in the UK were submerged under water where green fields of wheat usually decorate the countryside. Reports are hugely varied as to the area of winter wheat sown, not to mention how much of that will be rotting underwater. France too is struggling with horribly wet conditions as they see the worst wheat conditions of 64% good/excellent (vs 85% at the end of February 2019) since at least 2011.

On a Positive Note…

ABARES in Australia are predicting a 40% increase from 15.1m tonnes in 2019/20 to 21.3m tonnes for the 2020/21 wheat crop. This is due to the rains currently being received allowing an anticipated increase of 20% in acres sown.

Argentinian Farmers Worried About Export Taxes

The new Argentinian government have had farmers concerned since December whether tax hikes on Soybeans, corn and wheat were going to scupper their export competitiveness and incomes. This week it

has been announced that the world’s biggest exporter of soy products around the globe has hiked the taxes on soy products but left corn and wheat export taxes unchanged at 12%. This will be a big relief to the wheat farmers and give more stability going forward.

Our Trade Thoughts…

Despite the headlines surrounding Coronavirus and potential demand destruction and logistical issues, the global wheat trade continues to trundle along.

US wheat export inspections were good last week at 654,000m tonnes. China has tentatively made enquiries about US wheat prices over recent days. There is no word of trade being done but are the Chinese looking to back up the US/China ‘Phase One Trade Agreement’ with some wheat purchases?

The European Commission has stuck to last month’s soft wheat export estimate of 28.0mmt for the 2019/20 marketing year, well up from the 2018/19 level of 21.5mmt.

Ethiopia’s public procurement service have tendered to buy 400,000mt of milling wheat, with tenders closing on 7th April.

Prices and the Futures

Russia, the largest wheat exporter, is seeing FOB prices lowering as the global market is generally showing lower new crop prices after the coming Northern Hemisphere summer harvest than the

current old crop prices. This is encouraging buyers to purchase what they need, but not necessarily look forward beyond old crop needs.

What Lies Ahead, With or Without Coronavirus?

Coronavirus fears continue and what that may or may not mean for global wheat demand is still a grey area. This has been the large weakness to markets over the last few weeks. The wheat markets do,

however, appear to have stabilised a little over the last few days.

Does the bizarre weather around the world paint a good, bad, optimistic or pessimistic view of the upcoming 2020 wheat crop?

As exporter’s stocks dwindle, might we see China buy US wheat and set the market on an upward trend towards the start of the new crop harvest in a few months?

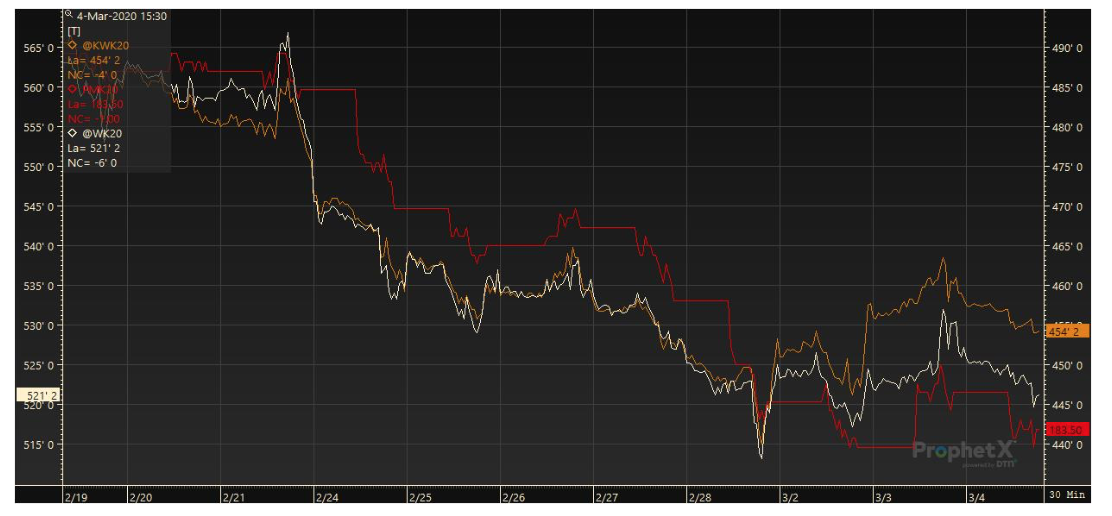

Biweekly Movement in Key Wheat Markets (Paris, Kansas, Chicago)

Source: Refinitiv Eikon