Insight Focus

Across Latin America we expect sugar production to increase. With higher crops and a decrease in exports to Mexico we expect to see higher volumes of sugar available from Latin America to the world market.

What can we expect from Mexico and Central America?

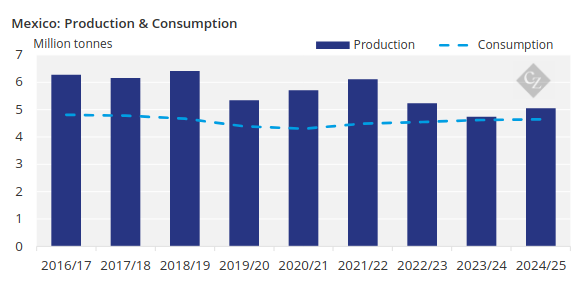

We expect Mexico to produce up to 5 million tonnes of sugar for this upcoming season. However, there are concerns about the crop being closer to 4.7 million tonnes due to the lingering effects of the two-year drought. There haven’t been many changes to improve irrigation in the cane producing regions to help cane growth and yields. Now that the crop has kicked off, farmers are still waiting to see how cane will perform this season.

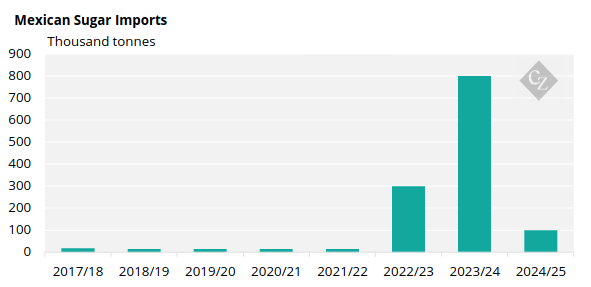

With higher production, we expect exports to the US and the world market to increase. We expect Mexico will export 800,000 tonnes to the US and 200,000 tonnes to the world market. This season, Mexico imported a record amount of sugar due to the decrease in production. For 2024/25 Mexico will import around 100,000 tonnes, down 700,000 tonnes compared to 2023/24.

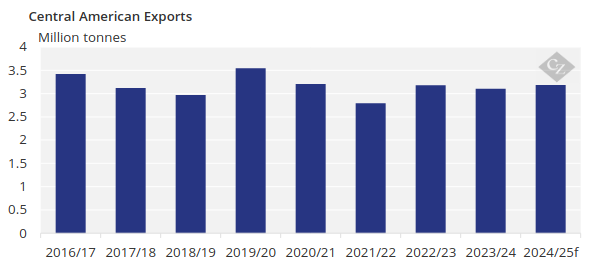

With a decrease in Mexican imports, there will be more availability from Centrals for the world market. We expect to see around 300,000 tonnes available to the world market compared to season.

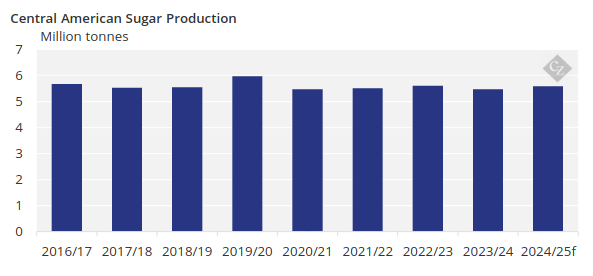

We think Central American sugar production will increase by 100,000 tonnes this upcoming season. The Central American crop usually begins within the first two weeks of November. This month there has been unexpected precipitation in both Guatemala and El Salvador, which has led to delays in the start of the season.

These delays are not expected to last long and should not affect overall production or the health of the cane. However, if it continues to rain, this could be an issue for producers in this region.

What can we expect from countries in South America?

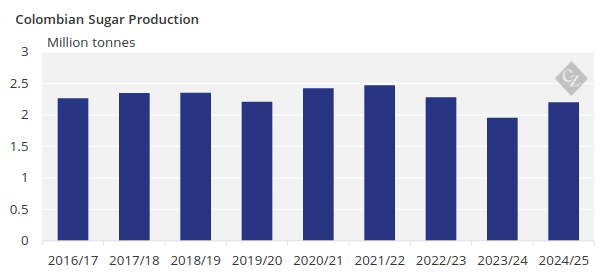

We expect Colombian sugar production to recover to 2.2 million tonnes this upcoming season due to better weather that will allow yields to recover after two consecutive years of la Niña.

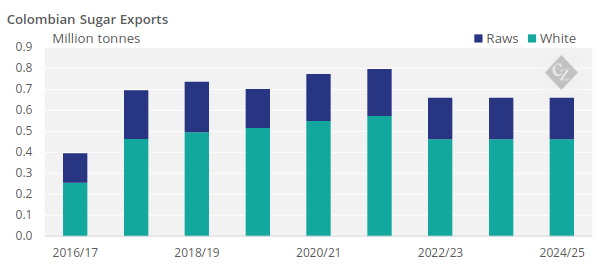

This will allow for an export increase of 30,000 tonnes compared to last season. If this weather continues, we could see even more sugar available from Colombia to go into the world market.

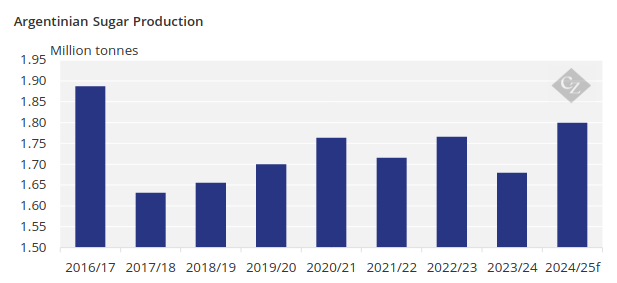

Like Colombia, we expect Argentinian sugar production to increase this upcoming season. Argentina has been producing around 1.7 million tonnes of sugar each year. However, we think production could increase to 2.2 million tonnes this upcoming season due to favourable weather, and an increase in yields and area planted.

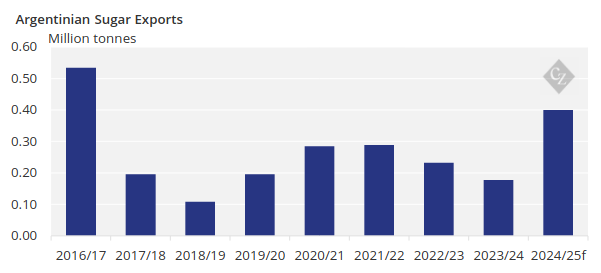

With an increase in production, we expect to see an increase in total exports. We expect to see around 400,000 tonnes of exports from Argentina. Most of these exports will go to Chile, Uruguay and the US. Even though we don’t expect many of these volumes to go into the world market, Chile will need less sugar from other origins which could liberate additional sugar into the world market.

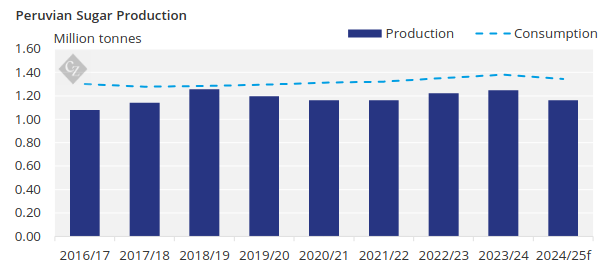

Looking at other countries in South America, we are also expecting a small increase in production in Peru. We expect Peru to produce 1.3 million tonnes of sugar. The increase in production is due to an increase in production capacity. There are weather concerns in the northern sugar producing region with increasing precipitation which could negatively impact production.

With higher production, we expect export to increase to 120,000 tonnes and imports to decrease to 200,000 tonnes. Overall, we expect to see an increase in export availability from Latin America for the upcoming season. The increase in exports will lead to higher sugar availability for the world market.