Opinion Focus

The BRL has been one of the world’s worst-performing currencies in 2024. This follows concern over the PT government’s spending plans. BRL weakness could weight on agricultural commodities.

Brazil increasingly feeds the world.

It’s the world’s top exporter of sugar, corn, soybeans, orange juice, beef and coffee. It’s influential in peanuts and recently developed a strain of tropical wheat too.

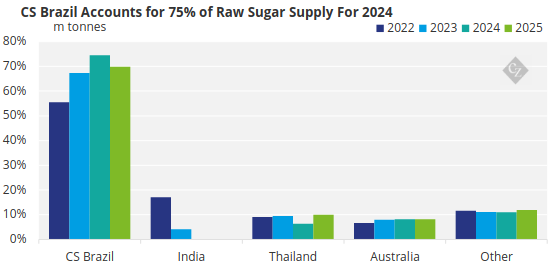

Brazil’s shipments of these foods travel far and wide around the world, with especially strong flows to East Asia. Brazil’s agricultural shipments mean that the Brazilian Real is an important factor when considering commodity futures prices. This is especially the case for sugar this year, where Brazil will supply 75% of the world’s raw sugar in 2024.

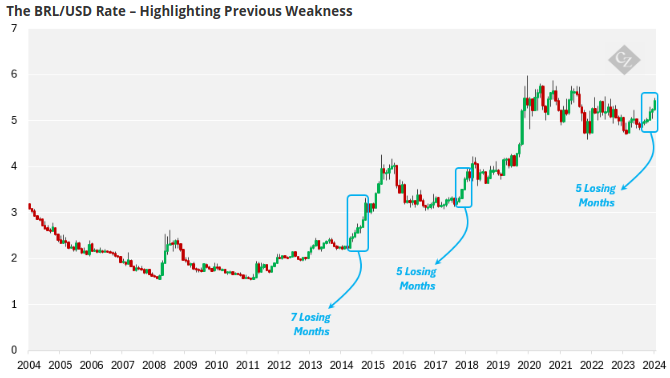

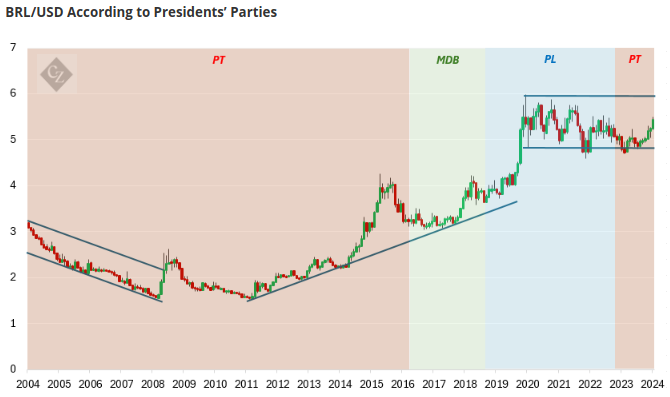

The BRL has been one of the world’s worst performing currencies in 2024. Starting the year at 4.85, it’s depreciated by 12% to reach 5.40 at the time of writing. It’s already strung together 5 consecutive months of weakness, the worst losing streak since 2018. If June is another weak month, that’ll be 6 in a row for the first time since 2014, when the PT were last in power.

This price weakness looks like a change in character for the BRL’s behaviour. After a decade of weakness in the 2010s, culminating in a devaluation from 1.5 vs the USD to 6, the BRL has spent the 2020s trading sideways near 5 to the USD, a period of relative calm and stability. But this looks like it may be changing, and it’s possible the BRL revisits 6 against the USD in the coming months.

Within Brazil, there’s increasing concern over the intention of the PT government to spend heavily. Economists point out that government spending remains at pandemic levels. Recent changes to the federal tax credits system, which hits the agricultural sector hard, have added to the unease, as has the upcoming departure of Roberto Campos Neto from the Central Bank in December. He is likely to be replaced by someone more amenable to the government’s tax and spend policies, rather than seeking to reduce debt. This may discourage inward investment into Brazil.

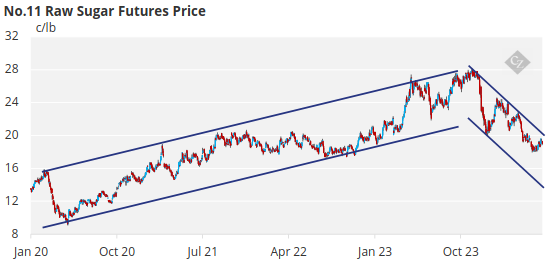

A weaker BRL would make Brazilian agricultural commodities cheaper in USD terms when they are sold to the rest of the world. This means that Brazilian producers can hedge their products at lower levels in USD terms; their cost of production in Dollars will also be lower. This has the potential to weigh on commodities in which Brazil is a major supplier, like sugar.