Insight Focus

2024 monsoon rains have been favourable. This could potentially lead to better cane yields this season. What can we expect from India in 2024/25?

India is unlikely to ease restrictions on sugar exports until at least early next year. In this report, we will delve into the factors influencing this decision, starting with production.

Production Outlook

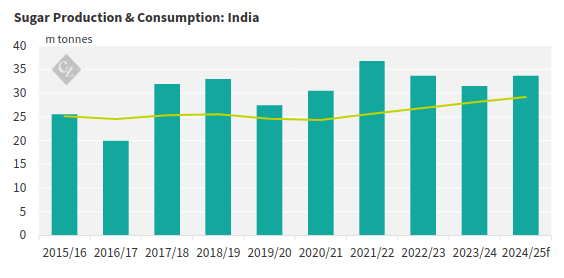

For the 2024/25 season, we anticipate India’s sucrose production will be 37m tonnes. Sugar production will reach 33.7m tonnes.

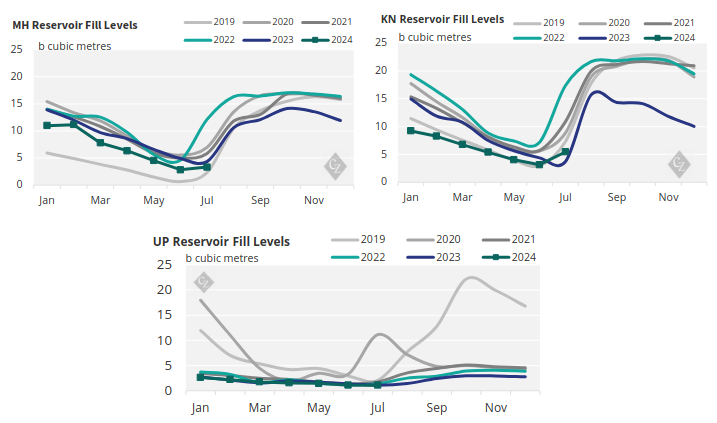

Reservoir levels have improved in major cane-growing regions like Maharashtra and Karnataka thanks to favourable rainfall in July. Good rainfall is vital for sugarcane because it replenishes groundwater used for irrigation and limits any negative impact on yields.

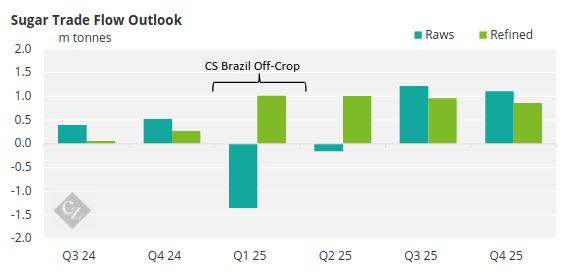

After accounting for ethanol diversion and domestic consumption, India will have about 5.5m tonnes of excess sugar available. Mills are pushing the government to allow for 2m tonnes of sugar exports, especially in Q1 and Q2 of next year, taking advantage of Brazil’s off season.

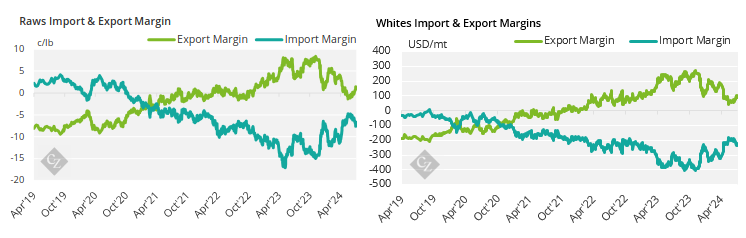

With the recent price strength, export margins are no longer negative, meaning that at today’s price mills could earn 0.9c/lb over the domestic price if they were able to export to the world market.

Similarly, for refined sugar, if mills were to export today, they would theoretically earn 48USD/mt over the domestic market.

Food security remains the top priority for the government, so there will be challenges in balancing ethanol production with domestic sugar consumption, making sugar exports unlikely until early next year when the government will have a better view on crop performance.

Feedstock Diversification and Challenges

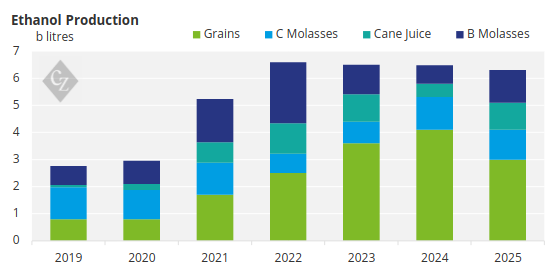

India uses a variety of feedstocks to produce ethanol with the sugarcane industry being the largest contributor. Other feedstock sources include broken rice, grains, and maize. The chart below shows the feedstock composition for ethanol production:

Grains played a significant role in ethanol production during the 2023/24 season, as sugar diversion to ethanol was limited to 2.37m tonnes. C-heavy molasses was preferred over B-heavy molasses as Oil Marketing Companies (OMCs) offered higher prices for ethanol derived from C-heavy molasses.

For the 2024/25 season, we expect more sucrose to be diverted to ethanol, but a significant amount will need to come from other industries, particularly the grain sector, if the government is to meet their E20 mandate.

The government has imposed export bans on rice, including broken rice, due to depleted domestic stocks exacerbated by the pandemic. As a result, maize is poised to play a crucial role in helping India achieve its E20 mandate next year.

OMCs have rolled out provisional prices for maize, offering higher prices for ethanol produced from maize. Many distilleries have been upgraded to handle dual feedstocks, including grains. However, this shift presents a challenge as grains also serve the poultry industry, which consumes 60% of available grains for animal feed.