Insight Focus

EU sugar production set to recover in the 2024/25 season. Sugar beet area has expanded following higher prices. But UK beet prices will decline in the 2025/26 season and beet acreage may fall.

EU Sugar Production Recovers

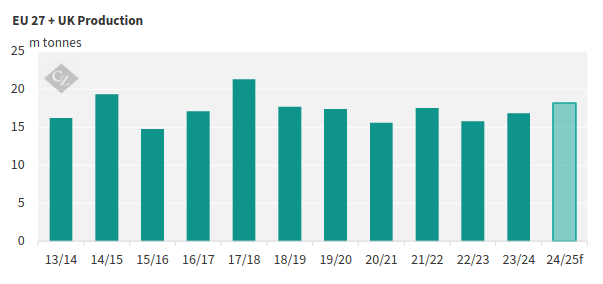

We believe that the EU and the UK (EU-28) will produce 18.2m tonnes of sugar in the upcoming 2024/25 season, up by 1.4m tonnes from the 2023/24 season.

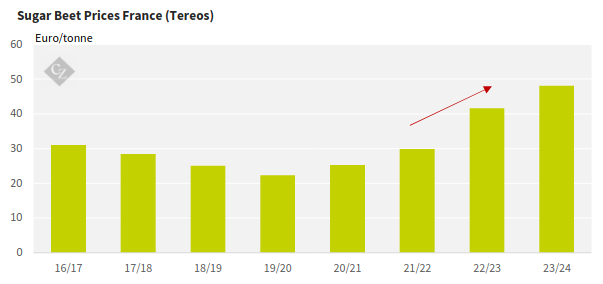

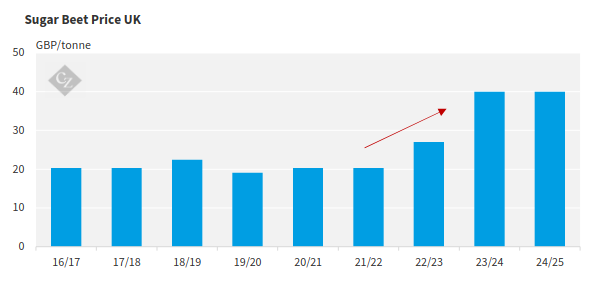

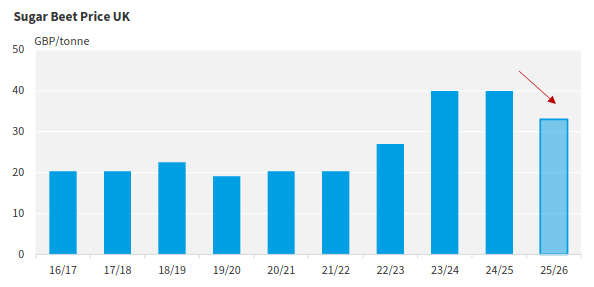

This is thanks to two consecutive seasons of high beet prices paid to farmers both in countries in the EU, like France, and the UK.

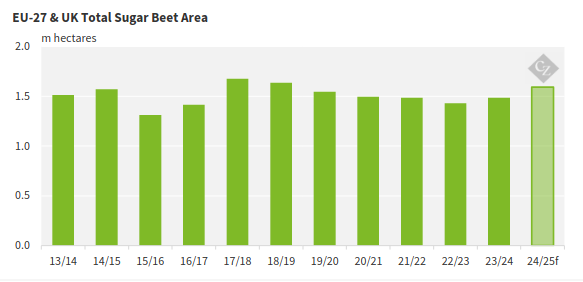

Higher beet prices have further incentivised an increase in sugar beet area across the EU and the UK.

In Germany, farmers increased plantings by 5.7% from the 2023/24 season leading to higher sugar production of around 4.7m tonnes in the 2024/25 season. Although beet plantings were delayed due to rainfall earlier in the year, test cuttings have confirmed an average sugar content and a good crop yield for the upcoming 2024/25 season.

Weather Favourable for Beet Growth

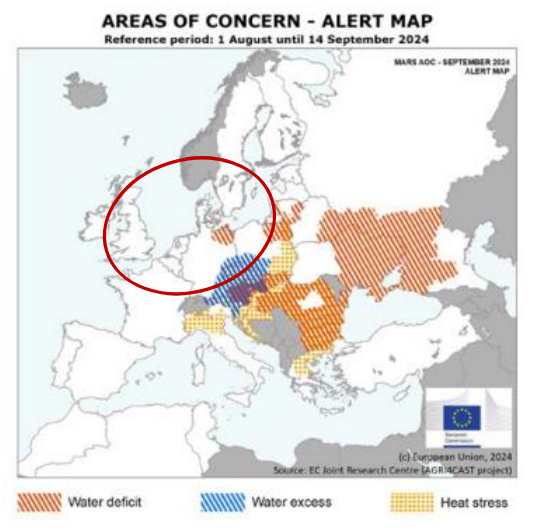

Weather across majority of the beet belt has been favourable for beet growth in general. Sugar beet yields in Poland are also expected to be good as rainfall and average temperatures returned after higher temperatures in July and August, allowing the beet to develop well.

Source: EC Joint Research Centre

In other countries such as Spain the sugar beet harvest has almost been completed in Andalucia, and regional authorities have reported positive yield estimates. The European Commission has further revised their estimates up since August by 2% for sugar beet yields in their latest crop monitoring report.

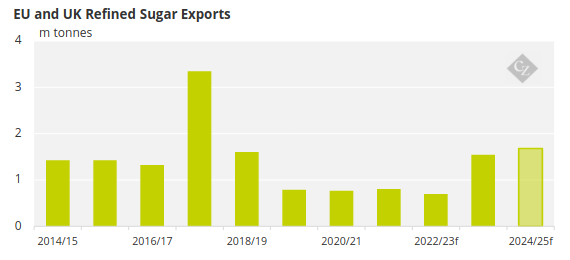

Exports Set to Increase

We estimate that exports will also increase from the last season in the upcoming 2024/25 season following the increase in sugar production across the EU and UK.

Beet Prices Down in the 2025/26 Season

However, the gains in sugar production may be short-lived – beet prices have plateaued for both the 2023/24 season and the upcoming 2024/25 season, but UK beet prices are set to decline by 17.5% in the 2025/26 season as reported by the NFU. Acreage could decline following the lower beet prices.

Acreage may also decline across the EU as there have been reports of reduced beet volume contracts for the 2025/26 season due to declining demand in the EU sugar market.

Beet prices are generally negotiated once a year for the next crop and are slow to react to prices. We will have to wait to see if EU beet prices follow a similar trajectory to UK beet prices and the effect this will have on acreage. Even if beet prices do fall, farmers may still choose not to switch from growing sugar beet unless growing other crops offers a better return than sugar beet.