Opinion Focus

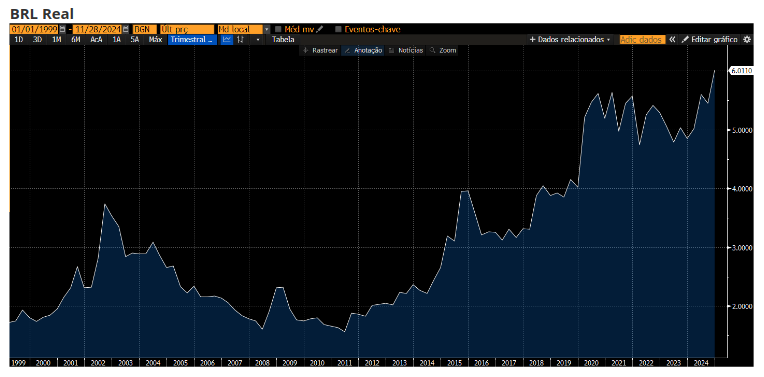

The BRL has weakened to record lows against the US Dollar. Let’s look at what this means for the sugar industry.

On Wednesday, the Brazilian Real weakened to a historical mark surpassing BRL 6/dollar. The fiscal package presented by the current government failed to ease worries of growing debt.

Source: Bloomberg

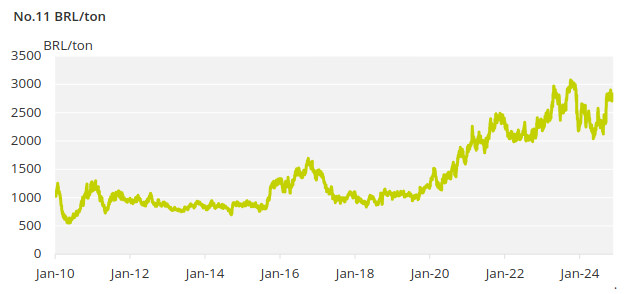

However, what is bad for some can be good for others. Sugar prices in BRL/tonne are close to levels last seen in October 2023, when the raw sugar futures were higher than 27c/lb.

You might be thinking that Brazilian sugar mills are therefore hedging aggressively into this price strength. However, this isn’t the case.

Don’t be Fooled by The Spot

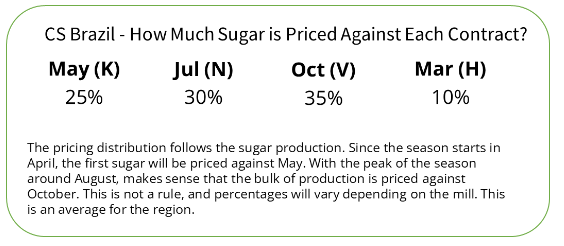

The previous chart shows spot BRL against spot raw sugar futures. At this time of year the spot sugar contract is the March futures contract. While the March contract might be important for Northern Hemisphere sugar producers, it is the less important for Brazilian ones. We are entering the Centre-South Brazilian off-crop and virtually all of this season’s sugar has been made and sold. Very little Brazilian sugar is hedged against March.

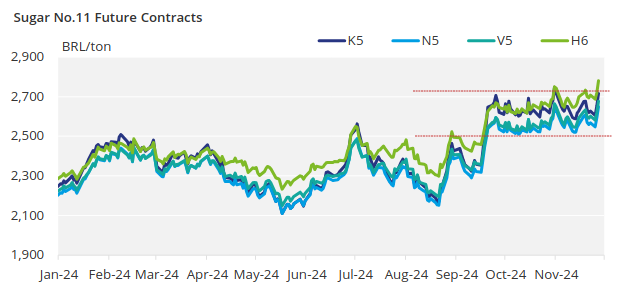

So, it’s best to look at each contract against the forward currency and see how the overall returns throughout the season are for Brazilian sugar producers.

Even though BRL weakened to historical levels and the currency carry improved a bit, sugar returns for next season have not yet broken the range we have been seeing since late September.

This just might explain why we are yet to see more hedging from Brazilian producers.

The second reason has to do with budget. As one miller said, it’s one thing to have an average return of around BRL 2500/tonne when you are certain your revenue and margins will not be affected by crop failure. It’s another thing if you are still uncertain on how much sugar will be produced in 2025. This depends on rains over the next 4 months… there are still many uncertainties for 2025/26 crop in CS Brazil.