Insight Focus

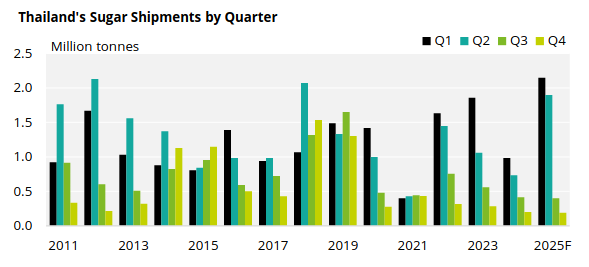

We are reducing our Thai 2024/25 cane crop forecast to 105 million tonnes, from 111 million tonnes. At the same time, we expect Q1 sugar supply from Thailand to be one of the strongest on record due to issues in Brazil. This means Thailand could export a record amount of raw sugar next season.

Thailand to Export Record Raw Sugar in 2025

Despite sugarcane supply issues in Thailand due to weather and disease, we expect the country to achieve a record Q1 export volume of raw sugar next year, at 2.15 million tonnes. However, for this to happen we need almost a perfect logistics program with no upsets or delays in the crop start up.

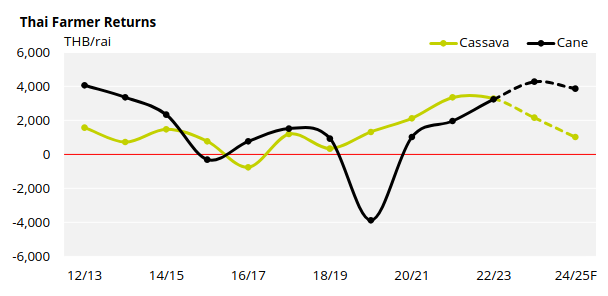

We expect the provisional cane price for 2024/25 to be around THB 1,100/tonne, which is lower than the previous season at THB 1,430/tonne. However, sugarcane still pays more due to the cassava price collapse.

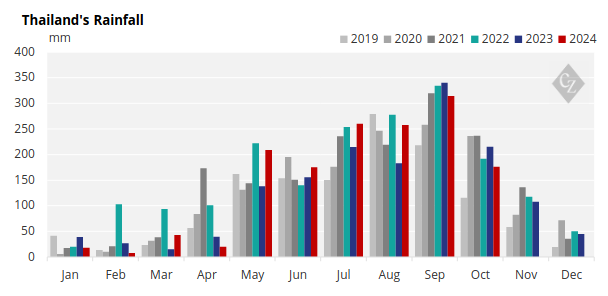

So far, there is no news about a shift in weather patterns, so we expect La Nina to remain for the foreseeable future.

All in all, we expect the 2025/26 season will be another golden year for the farmers. It is possible to see Thailand rebound back to 120 million tonnes to 130 million tonnes in 2025/26 due to the weather and the high cane price.

Decline in Sugarcane Production for 2024/25 Crop Year

However, in the meantime, we are likely to see a decline in Thai production. Agricultural yields for the 2024/25 Thai sugarcane crop have not developed as well as hoped, which has led to us reducing our average yield forecast for this upcoming season to 10.3 tonnes/rai (64.375 tonnes/ha) from our previous estimate at 10.8 tonnes/rai (67.5 tonnes/ha).

Slightly poorer rains for September and October have led to this drop but also in some regions we have seen the re-emergence of white leaf disease.

White leaf disease is caused by a tiny organism called phytoplasma, spread by leafhoppers, which turn sugar cane leaves yellow and white.

It is quite a common problem, but it is likely that due to the drought from January to April this year, where the sugar cane became weak, that it is was more vulnerable to the disease.

Not only is there less supply from Brazil due to a lack of rain, but the timing of Indonesia’s Raw Sugar Import Permits for 2025 has allowed Indonesia to import more sugar, means that shipment needs to be after January 1. This means that there is a lot of pressure for Thailand to meet global sugar demand for 1H’25.