784 words / 3.5 minute reading time

The most important things for an emerging market are:

1. Being able to buy product.

- This is impacted by their ability to access major currencies.

2. Buying the ‘right’ product.

- i.e. using this fixed pool of available FX to buy the best combination of ‘staples’ for that market, taking into account products that can substitute each other.

3. Buying that ‘right’ product as cheaply as possible in local terms.

Pakistan’s currency has been one of the worst affected this year. We will, therefore, use them an example as we explore purchasing behaviour of emerging markets.

Pakistan: An Exemplary Emerging Market

- As a food item, dairy is second only to cereals in the level of per capita consumption in Pakistan.

- Like many other emerging markets, the Pakistani dairy industry is not large enough to meet increasing demand, so is an important importer of dairy.

- The major dairy product imported by Pakistan is SMP.

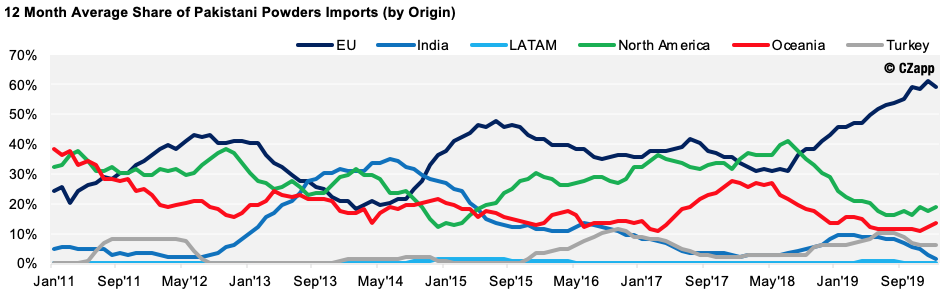

Key Import Origins

- Pakistan is a major SMP importer from all major origins (EU, India, LATAM, North America, Oceania and Turkey).

- Since August 2018, the EU has become the supplier of choice (supplying over 50% of all powders).

- Due to its close proximity, Pakistan is a key outlet for India when it has surplus dairy product to export.

Currency

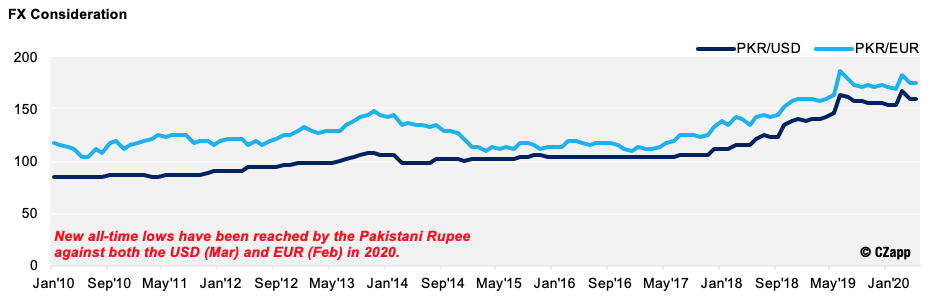

- Unlike many other emerging markets, Pakistan is less reliant on oil for its economy; its strongest industry is actually agriculture.

- Pakistan employs a ‘soft-peg’ FX regime, but the International Monetary Fund (IMF) have recommended a move to a more market-based FX rate.

- The combination of this loosening FX and COVID-19 has seen Pakistan’s currency severely devalue.

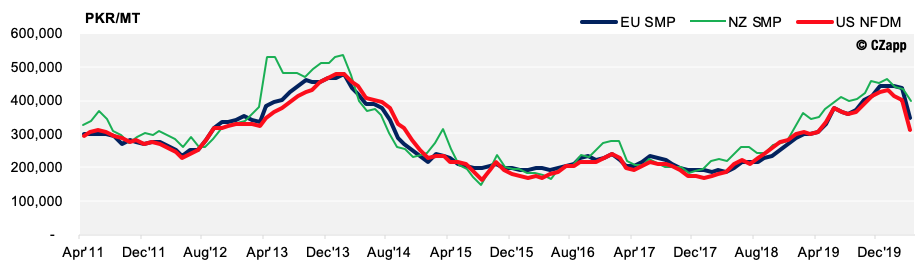

Dairy in Local Terms

- Given the high consumption of dairy in Pakistan, it is a relative staple. Thus dairy imports tend to be less affected than other products (Pakistani per capita consumption is similar to Canada at 185/kg/person/year).

- A key driver of the origin split appears to be the outright local price:

- Historically, the US has gained market share when the US origin prices have been cheaper for a sustained period in local terms.

- The US product must be cheaper than the EU product to account for more expensive freight, given greater distance from the US.

- US origin looks to be becoming cheaper in local terms now. It will be interesting to observe how the origin split of imports develops. I expect EU to lose share to the US if US pricing remains discounted.

- Other emerging economies who import dairy have also had severe currency devaluations lately.

- As noted in prior reports, those with economies very dependent on oil may have issues accessing major currencies and thus buying products for imports such as dairy.

- For those markets similar to Pakistan with less reliance on oil, the important driver of imports is likely to be the elasticity of demand (e.g. Pakistan has relatively inelastic demand for dairy given it is a staple).

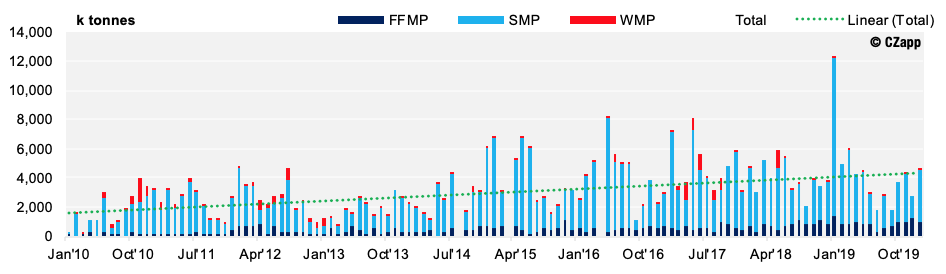

Pakistani Dairy Powder Imports

- Pakistani dairy powder imports for 2019 totalled over 51,000mt.

- Trend imports are ~4,200mt/month and grow on average by roughly 25mt/month (approximately one 40ft container), but there is substantial volatility around this trend.

- SMP is ~80% of powders imported. It is typically preferred by emerging markets as it is usually the cheapest source of dairy nutrition.

Note: There is no statistical seasonality in Pakistan’s imports.

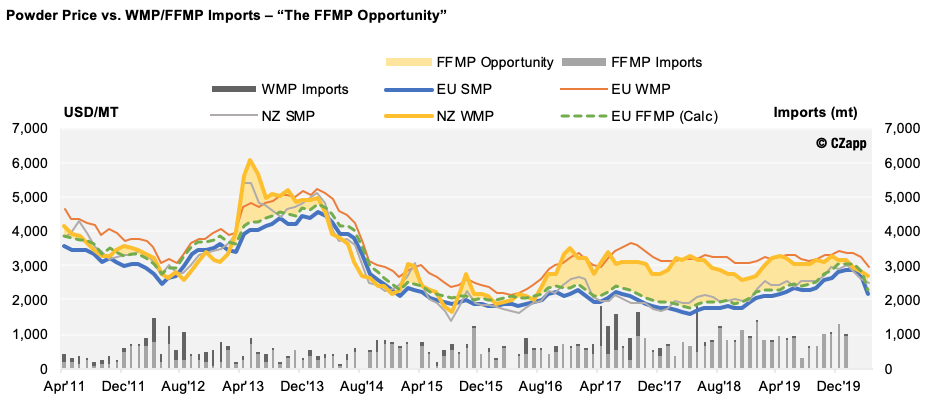

The Growing Volume of FFMP Imports

- FFMP is a relatively new product in global dairy trade.

- FFMP is a combination of skim milk and vegetable oil that has been dried; it is a substitute for WMP.

- From Jul’16 to Feb’20, FFMP was priced at a substantial discount to WMP, which allowed its place in dairy trade to grow quickly; this growth has been almost entirely in emerging markets.

- This opportunity has closed for the first time in years so it will be interesting to see if the ~11kMT/year of FFMP for Pakistan, and volumes into other emerging markets, swing back to WMP.

- If aggregated over all emerging markets, this swing volume could become material. Given different supply origins dominate each, it could also loosen large volumes of SMP in Europe and tighten the WMP picture in NZ. This is certainly something to monitor closely!