Some Useful Acronyms: SMP (Skimmed Milk Powder), FFMP (Full Fat Milk Powder), WMP (Whole Milk Powder), EEX (European Energy Exchange), MSCI (Morgan Stanley Capital International), EM (Emerging Markets).

- Back in June, we showed you with five dairy charts that we thought it’d be worth keeping an eye on over the course of the year.

- These included SMP spreads during COVID-19, the production/sales opportunity of FFMP, the emerging market FX, the correlation between the price of Brent Crude Oil and SMP, and the relationship between India’s reservoir levels and its SMP sales eights month on.

- Six months down the line, we’re to show you what’s happened with these charts and put our predictions to the test.

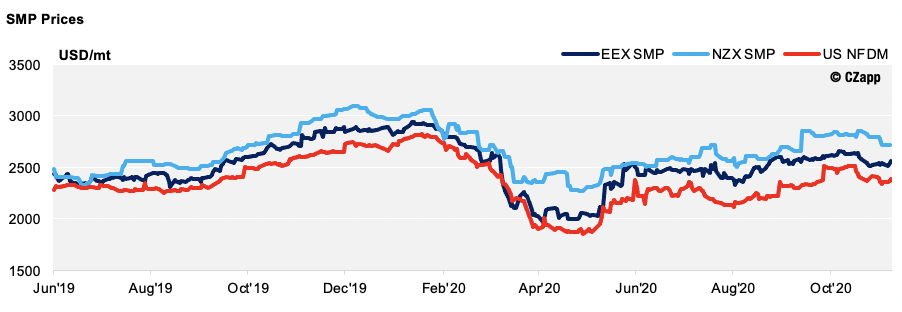

Cross Market Spreads

In June, we said that US inventories were high and growing and that this could lead to spreads widening again in the near term. This played out as expected, with the spread reaching its widest level since early 2017 in both September and November.

The spread has been substantial for some time now and we have seen buyers in battleground markets such as South-East Asia switch to importing US product to take advantage of this. Even though Mexican imports are down 18% from the US YTD, total SMP exports are still up 25% YTD driven by strength from the Philippines, Malaysia, Vietnam, Indonesia and China.

It is now clear that a substantial amount of longer tenor contracts for dairy powders were done after prices softened in April and May. This has kept product availability from NZ and EU tight and enabled these origins to defend their premium over the US over this time.

These contracts are ending now and, with Chinese seasonal demand also having finished, we saw the first signs of correction of NZ SMP pricing on the first GDT Event of November. We expect this dynamic to continue and for spreads to continue to close unless soil conditions dry out significantly in NZ, as they are seasonally at risk of doing in the coming months.

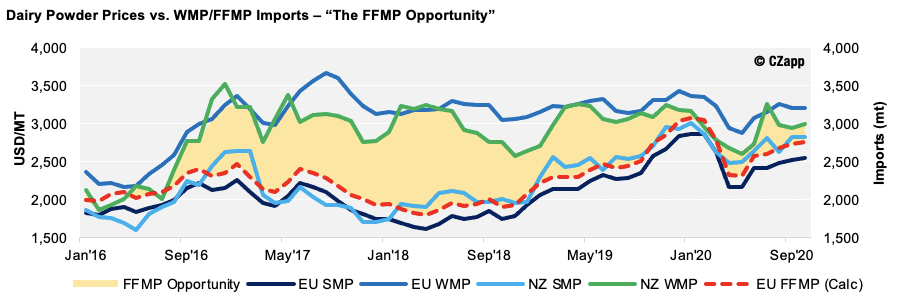

FFMP vs. WMP

From a supply perspective, SMP and FFMP are substitutes. But from the demand side, some buyers use FFMP as a substitute for WMP. Thus, the pricing interplay between EU FFMP and NZ WMP also drives the FFMP production decisions.

In June, ‘the FFMP opportunity” had just reopened. We thought this might support the SMP/Butter stream in Europe, as it provides a valuable outlet for any excess SMP there. Unusually, SMP production has been unchanged year-to-date, while exports are down 15% year-to-date as the US has stolen share. FFMP exports have remained unchanged year-to-date, but it does not seem like the outlet valve was fully utilised and EU SMP stocks should be growing.

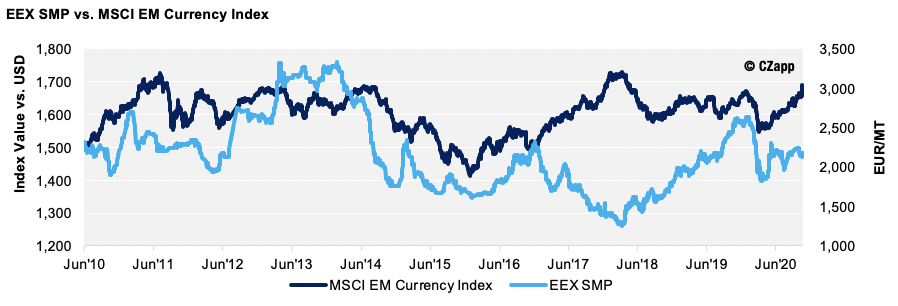

Emerging Market FX

Emerging Markets (EM) make up a large proportion of dairy powder demand.

Given that most major commodities trade in USD or EUR, access to these currencies and relative strength against them plays a key role in whether EM’s can purchase and the magnitude of their buying.

We suggested that if strength in EM currencies continued after June, it would drive convergence of the pricing spreads across the three main origins. EM currencies have continued to recover strongly since falling sharply in February. This strength has shown in the strong imports of US origin product given its relative cheapness; however, spreads have not yet closed for reasons mentioned in the Spreads section above.

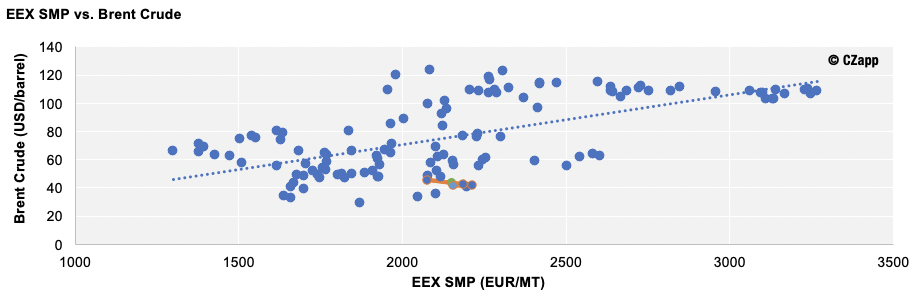

Oil Prices

In June, we suggested that, though oil prices have been on the rise, further gains would be required to justify SMP pricing at those levels.

The red mark below represents June, the green mark is today, and the navy line represents the path over the past five months. As you can see, some move toward the average line was made, but European SMP prices are still relatively “expensive” compared to oil prices.

Though the recovery in the oil price may be expected to continue as progress is made on COVID vaccines, given SMP stock levels, it seems more likely that SMP will be the leg to do the bulk of the work.

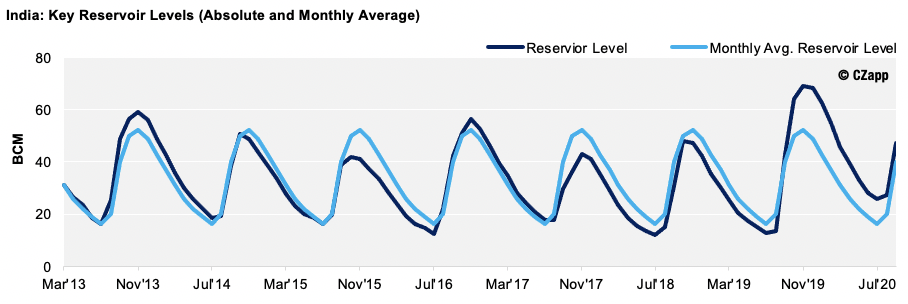

Key Indian Reservoir Levels

As discussed in this article, there’s a relationship between water reservoir levels in India and Indian SMP trade eight months later.

Rainfall was strong in India in March and April of this year; reservoir levels have now been above average since September 2019.

This has led to material stock growth in India with commentators mentioning stocks over 200k tonnes.

When Indian stocks get to extreme levels, the Government often comes under pressure to subsidise exports. These typically go to nearby neighbours but can be disruptive in key markets such as Egypt, the UAE (both of which are key SMP markets for the EU) and Malaysia.

Other Opinions You Might Be Interested In…

- Czapp Explains: Skimmed Milk Powder vs. Whole Milk Powder

- Five Dairy Charts You Should Be Watching Right Now

- What Drives Emerging Markets to Buy Dairy Powders?

- An Introduction to Dairy – Skimmed Milk Powder (SMP)

- An Introduction to Dairy – Whole Milk Powder (WMP)