Insight Focus

Key PET and packaging legislations show no sign of slowing down in 2025. New changes are likely to impact on polyethylene terephthalate (PET) producers across the EU and the US.

Legislation Continues into 2025

In Europe, the mandatory recycled content legislation for PET bottles to contain at least 25% recycled content will come into force in 2025 (rising to 30% in 2030), with separate collection rates for single use PET bottles obliged to reach 77% by 2025 (90% by 2029).

The Extended Producer Responsibility (EPR) legislation is also set for a 2025 rule, with the continuation of fees levied on the producers depending on the type and recyclability of their materials, with producers responsible for the waste management of their packaging.

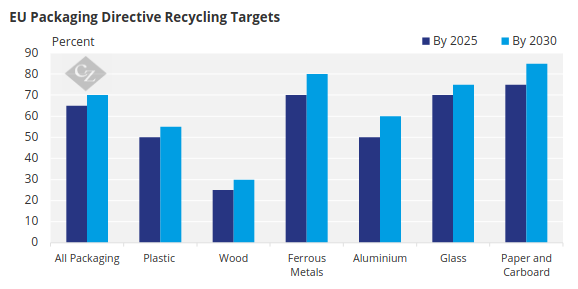

Source: European Commission

The widely publicised Packaging & Packaging Waste (PPWR) Directive will not rest in 2025 either, with the PPWR milestones this year representing a pivotal shift towards sustainable packaging, promoting greater collaboration across industries to meet these new standards.

We will likely see the introduction of packaging digital product passports to be able to track and trace the materials used, specifically regarding the sustainability of the product.

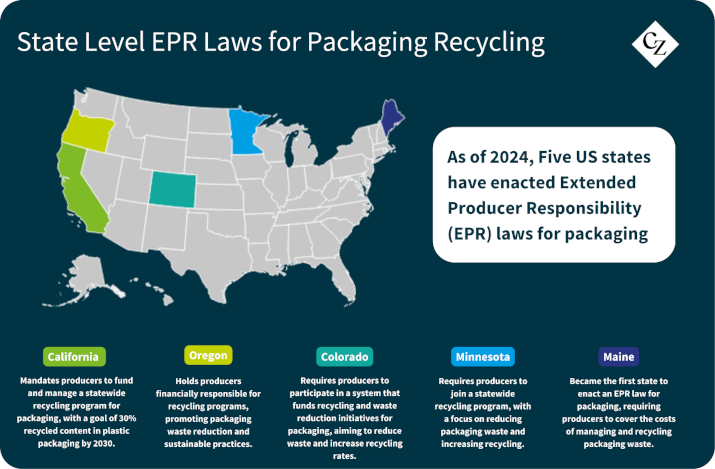

In the US, state-level EPR laws will continue in 2025, with progressive states including California, Maine, Colorado and Oregon requiring producers to fund recycling programs and to meet recycled content levels.

California, for example, has already mandated that 30% recycled content must be used in plastic containers by 2030, with similar legislation likely in other states.

Impact on Producers

For PET producers, the impact of these developments will be largely connected to supply chain issues and cost implications. With everyone wanting – and needing – to use more recycled content, the challenge will be getting their hands on a reliable supply of quality rPET.

With this increased demand for rPET, the price will likely increase compared to virgin PET, knocking on to a price increase for converters and producers. Meeting these recycled content levels is also complicated by the insufficient collection and sorting infrastructures in many territories.

These issues mean that the converters and PET producers that invest in recycling facilities and other relevant technologies are destined to enjoy a competitive advantage, particularly those who are investing in innovative solutions that support a circular economy.