Insight Focus

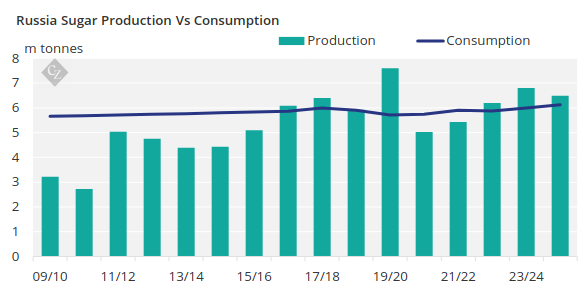

Russian Sugar production will fall in 2024/25 to 6.5m tonnes. This still leaves about 500k tonnes excess sugar that can be exported into the region.

A Production Surplus 3 Years In A Row

We think that Russia will produce 6.5m tonnes of sugar in the upcoming 2024/25 harvest. This would make it one of the better campaigns in recent years whilst falling somewhat short of the previous 23/24 season.

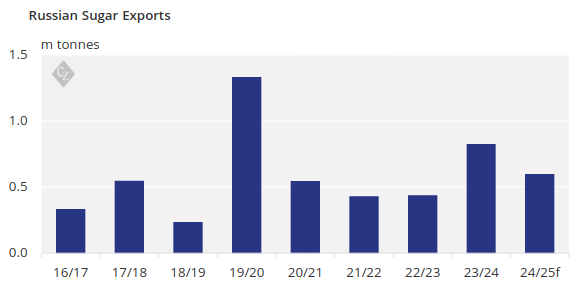

There will once again be a production surplus, this time about 500k tonnes, which should be exported within the region. Almost all of this sugar should be exported to Eurasian Economic Union (EAEU) countries as Russia has banned exports until the end of August to all but EAEU countries with specific volumes allowed (Armenia, Kazakhstan and Kyrgyzstan and Belarus).

Once the export limitations end, Russia’s export markets remain limited as container exports for sugar from Black Sea ports are still prohibitively expensive. Last year, Russia found new export routes into Afghanistan (whilst India and Pakistan weren’t exporting) and Serbia; the route into Afghanistan appears less attractive now as Pakistan has opened up 150k tonnes of export quota and we’ve heard that demand in Afghanistan is poor.

2024/25 Production – The Finer Details

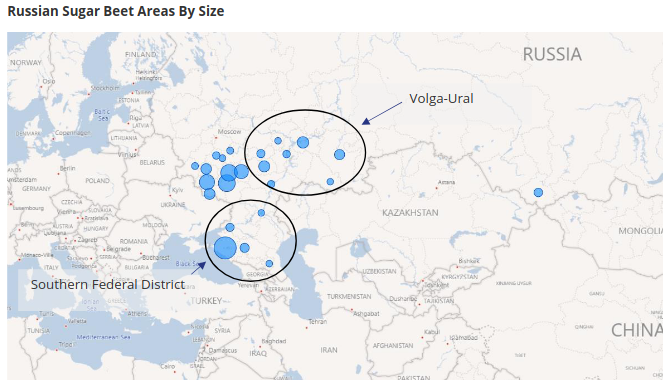

It’s been very hot and dry across much of Russia so far this year, particularly in the beet growing Southern district and Volga Ural, which account for about 25% and 15% of Russia’s beet area respectively. Ironically, in these areas, beets were also late to be sown because of frost.

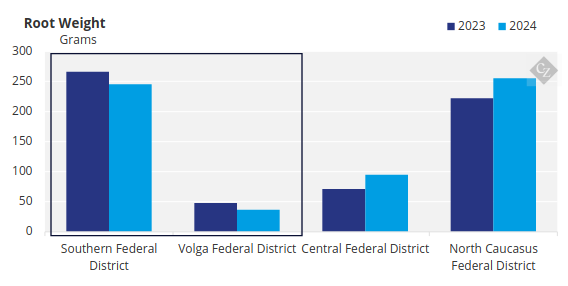

Unsurprisingly, beet development has suffered, and harvesting will start in August, rather than July as usual. As a result, the root weight is slightly lower than last year here; in Russia’s other beet regions it’s the opposite. But in the central area which makes up almost 50% of area, the beet weight is better than last year.

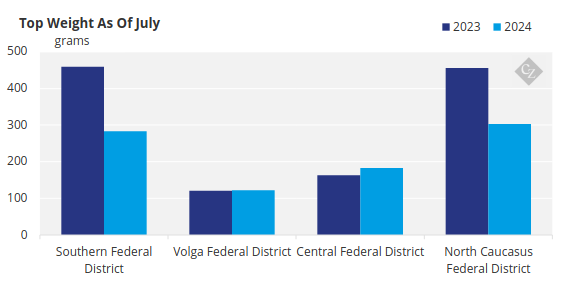

It’s the top or leaf weight that look more concerning in the South, with tests showing a 38% decrease on the previous year. Usually this is an indication that the plant is stressed and future growth is likely to limited.

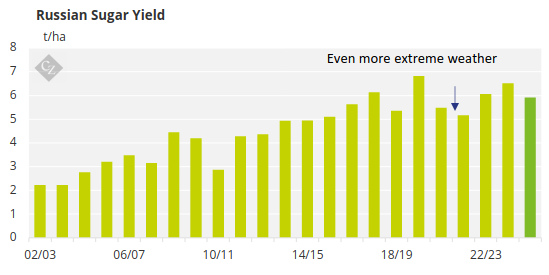

Taking all of this into account it’s likely that yields will be poorer than in the past 2 seasons. However, we are optimistic that yields could be a bit better than in 20/21 and 21/22, where the beet really suffered from extreme temperatures (over 42 degrees) and a lack of sunlight due to storms.

This puts yields a little below 6 tonnes per hectare.

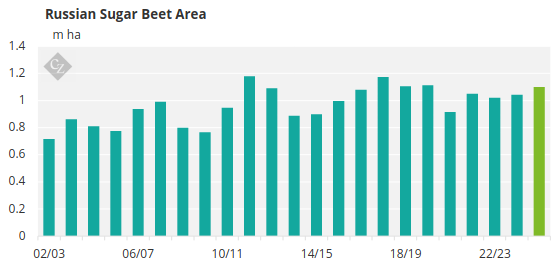

We believe that Russia’s beet area has increased about 5% to around 1.1m ha in 2024/25. This means production should reach 6.5m tonnes.