Insight Focus

- Demand for Chinese PET resin should drop with two of the key buyers at war.

- Prices will likely leap as Brent crude oil breaches 100 USD/bbl.

- European PET resin prices should also climb as energy and raw material costs rally.

War in Ukraine Hits International PET Flows

- Russia’s invasion has hit all commodity markets, with PET resin no exception.

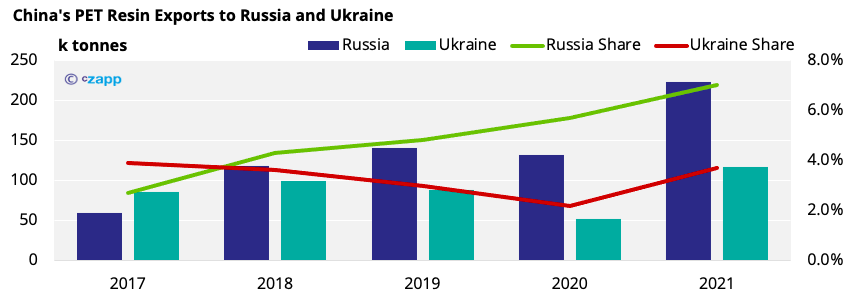

- Both Russia and Ukraine are key markets for China, with Russia the main buyer of Chinese PET resin.

- Over the last five years, Russia’s offtake has jumped from around 60k tonnes in 2017 to nearly 225k tonnes in 2021, representing over 7% of China’s total PET resin exports.

- However, the Rouble has hit a record low against the Dollar following last week’s attack on Ukraine, and it’ll likely come under sustained pressure as Europe and the US strengthen economic sanctions.

- Russia’s demand for USD-denominated Chinese PET exports should therefore be hit, causing a ripple effect across Asian markets.

- Although Russia’s PET market is largely self-sufficient, domestic PET contracts are typically formula linked to USD-denominated Chinese PET prices.

- As a result, Russian bottlers and converters will be hit by a substantial inflation shock, lowering future import requirements.

- As for Ukraine, it has traditionally been a key buyer of Chinese PET, although China’s lost market share to Lithuania in recent years.

- Having said that, Europe’s production constraints and outages saw China’s exports to Ukraine rebound to an all-time high (∼166kmt) in 2021.

- Whilst loss of Ukrainian demand in isolation would have a limited impact on China’s total export flows, further expansion of the conflict zone could weaken China’s access to the wider region.

- Shippers are already reporting disruption of flows into the Black Sea, but the situation remains fluid and is changing by the hour.

- According to Hellenic Shipping News, all Ukrainian commercial ports have reportedly stopped operations, including the main port of Odessa.

- The Russian Navy has also restricted access to the Kerch Strait and the north-western part of the Black Sea, impacting all Ukrainian ports east of Crimea, including Mariupol.

Petrochemical Prices Jump as Crude Breaches 100 USD/bbl

- Russia’s invasion has also sent Brent crude oil prices soaring, touching 105 USD/bbl last week for the first time since 2014.

- Russia is the second-largest exporter of crude oil, after Saudi Arabia, and is also the world’s largest natural gas exporter, accounting for 35% of Europe’s supply.

- Crude prices eased on Friday as Russia’s energy industry avoided sanctions.

- It then opened 5% higher on Sunday and looks set to remain above 100 USD/bbl in the near term.

- Given Europe’s integrated and deep-set reliance on Russian energy resources, any ban on crude or gas exports would have severe and mutually assured economic repercussions.

- Global commodities and petrochemical prices jumped following the surge in crude.

- Olefin and aromatics, key petrochemical feedstocks for plastic production, saw prices leap in major markets.

- PTA futures immediately reacted, tracking crude oil closely as we would expect.

- However, in the past few days, we’ve seen good selling pushing futures downward.

- Whilst, in Europe, PX and PTA spot prices also saw sharp increases, with PX spot prices up 45 USD/mt on the week.

European Energy Costs Increase

- Alongside increasing raw materials, the Dutch Natural Gas contract, a leading European gas benchmark, increased by as much as 62% on news of invasion last Thursday.

- German power for March increased by as much as 58%.

- Although European gas prices eased on Friday, they regained upward momentum on Monday and remain close to record levels.

- The impact of higher energy costs will result in increased production costs for European PET producers.

- However, unlike last year, most PET producers have structured new 2022 contracts to include a range of variable components.

- A new wave of surcharges is therefore not expected at this stage.

Market Implications & Concluding Thoughts

- The situation is fluid and highly volatile.

- However, fallout from the conflict looks set to weaken China’s PET export demand and producer margins, making it difficult to sustain current levels into H2’22.

- Further freight disruption may also stimulate rate increases, leading to higher landed costs in key markets, compounding European supply constraints.

- Within Europe, increased energy costs and increases in raw material prices will result in higher PET resin contract prices.

- European spot PET prices should rise into March following higher import parity levels and increased pre-peak season buying.

Other Insights That May Be of Interest…

Ukraine & Grains: Who is Most at Risk?

China’s Record PET Orders Threatened by Logistical Chaos