- Rumours suggest Petrobras may soon adjust gasoline prices higher.

- Prices were last raised in mid-January when crude oil was USD 85/bbl.

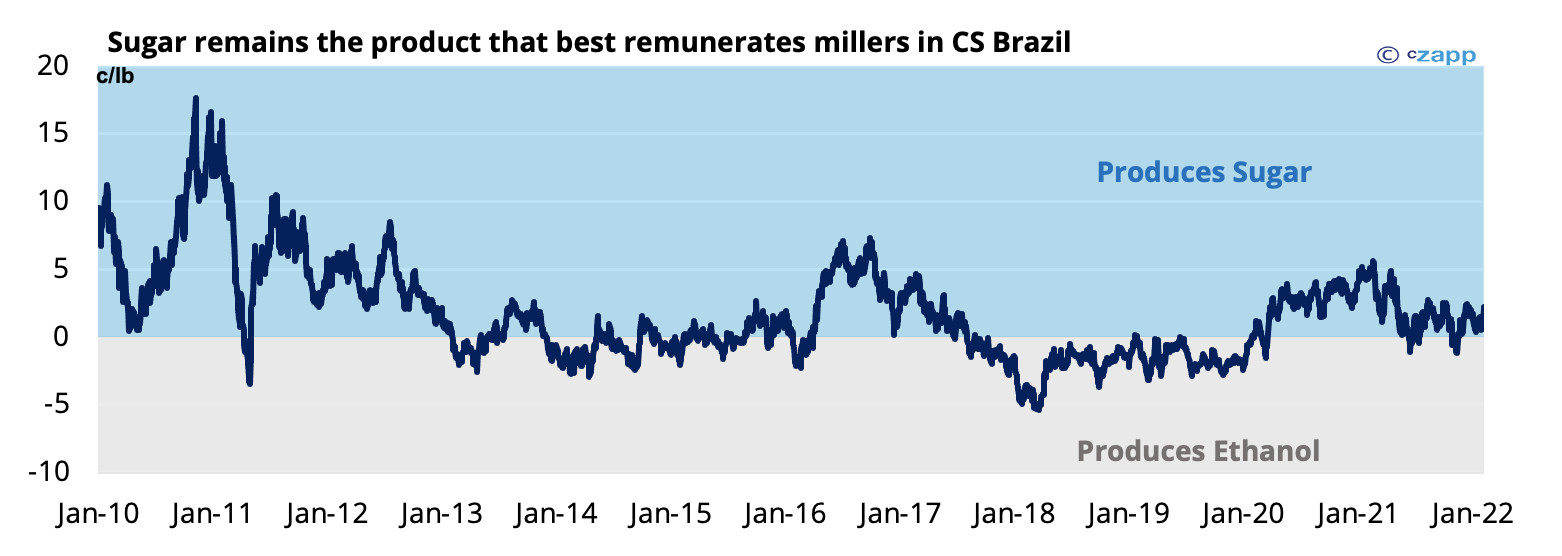

- A higher gasoline price could incentivize mills to make more ethanol, not sugar.

The cost of war

- Crude oil prices have been strengthening for months, but Russia’s invasion of Ukraine has pushed them far above USD 100/bbl.

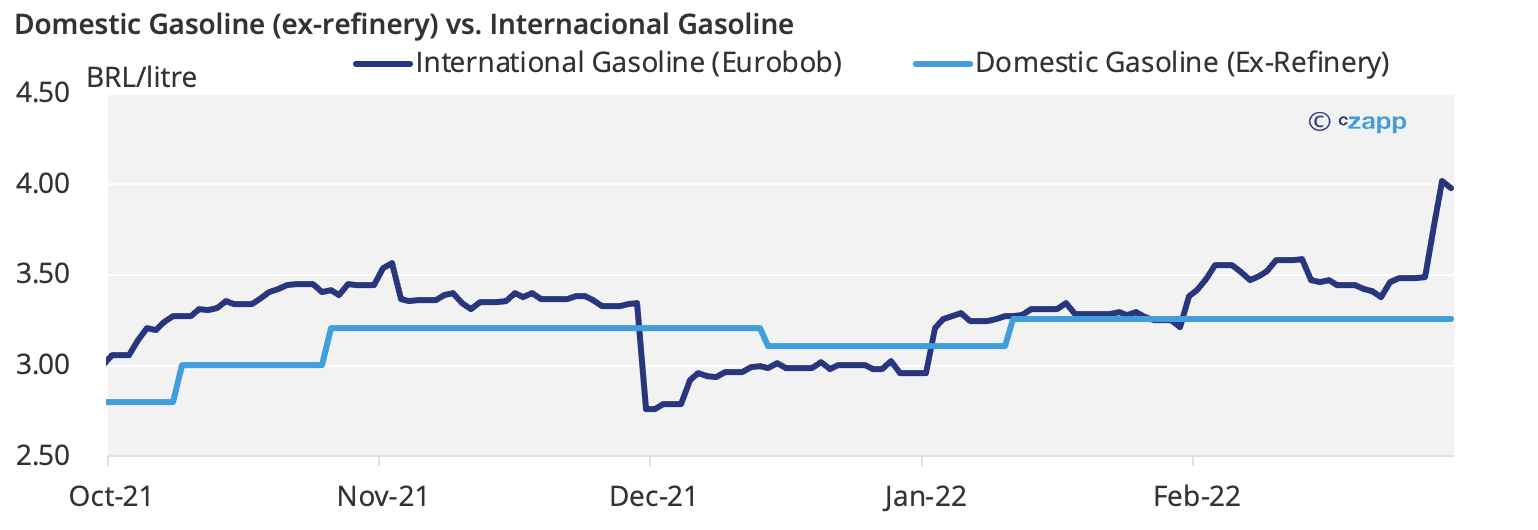

- However, Brazilian domestic gasoline prices are set by Petrobras and haven’t increased since January 12th, when crude oil was USD 85/bbl.

- Domestic gasoline prices are therefore more than 20% below where they should be.

Following International Parity

- If Petrobras increases prices in line with the move in crude oil, ex-refinery gasoline prices could reach BRL 4/liter; at the moment, it is around BRL 3.26/liter.

- A price increase at the refinery would be passed on to the final consumer at the gas stations, allowing ethanol to gain its competitiveness.

- In other words, there would be room for ethanol prices to rise too.

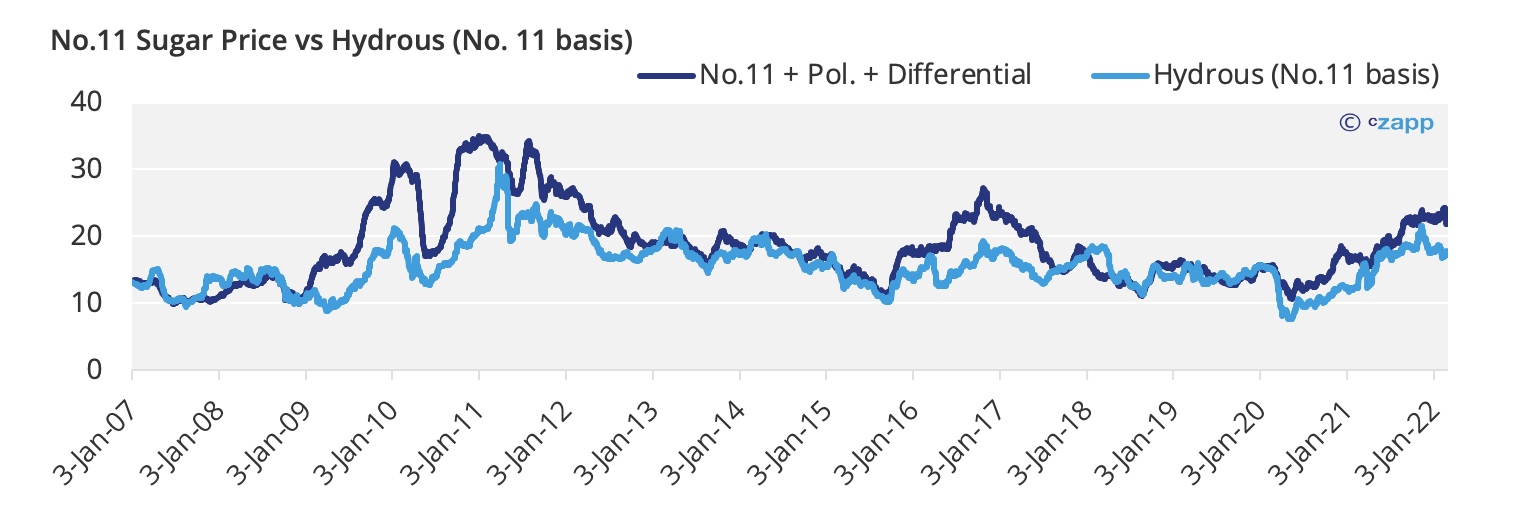

- In theory, ethanol could trade as high as 21c/lb on a sugar equivalent basis, from 17c/lb today.

- However, it’s still not clear if Petrobras will increase gasoline prices to BRL 4/litre; the government is trying to keep domestic inflation under control and the Presidential Election is in October.

- Today the parity is 17c/lb, making sugar the preferred product for producers.

Simulating a less sugary mix

- A Petrobras price increase would therefore be bullish for sugar, as it would need to strengthen to ensure strong sugar production when mills start crushing cane from April onwards.

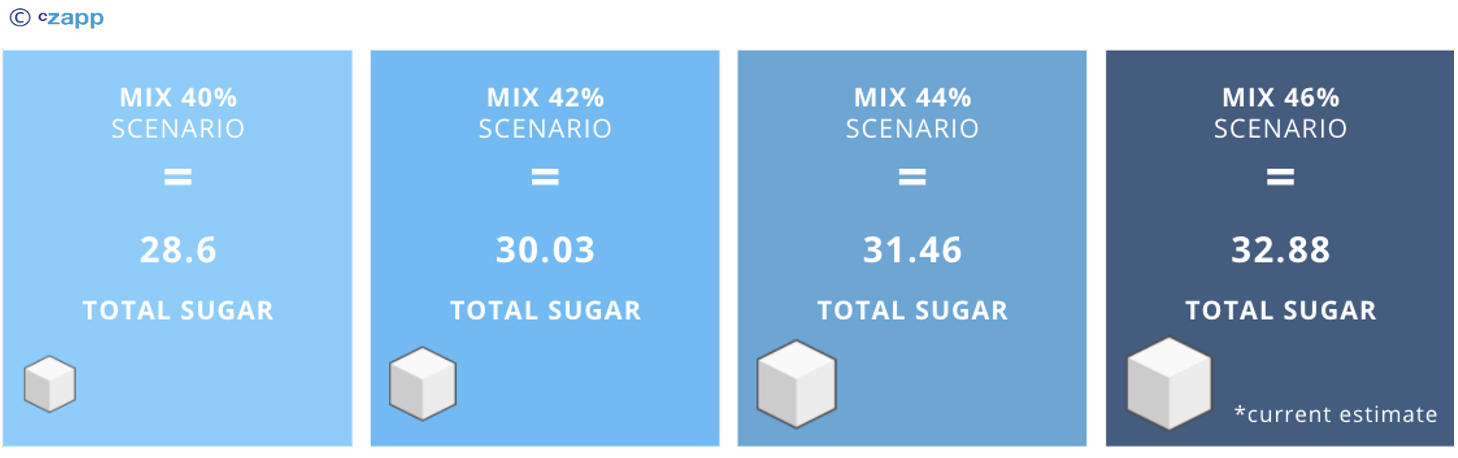

- Today we are considering mills allocate 46% of their sucrose to sugar, which is the most they can achieve.

- If they decide to make more ethanol you can see the effect of each 2% swing on the total production number below.

- It is also important to remember that currently more than 60% of the sugar that would be produced under the “max sugar” scenario has already been committed to trade houses and hedged in the futures market.

- Therefore, it’s unlikely we see a drastic reduction in sugar output towards ethanol in 2022 – as we saw back in 2018 and 2019

Political Risk Alert

- It is important to remember that we do not know when or how much the readjustment will take place.

- Increasing fuel prices is a key issue in the 2022 election race.

- As a result, there is a risk of international prices not being passed on to refineries for the moment

- Or perhaps be passed on partially.

- Basically, the decision on the mix of mills does not depend on the international market, but on how Petrobras will conduct its pricing policy.

Explainers that you might like