Insight Focus

Recent futures market move is restrictive for physical raw sugar demand. Shorter vessel queues in CS Brazil may be first sign that demand is starting to fade. Market undersupplied during CS Brazil offcrop.

Demand Fading Towards End Of Year

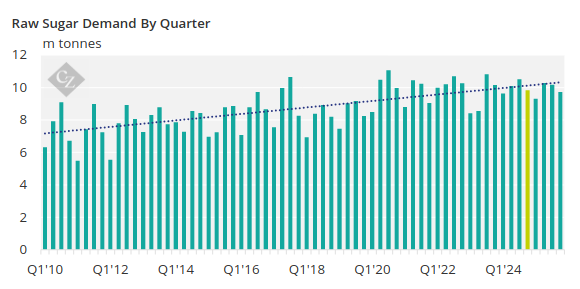

So far this year raw sugar demand has been strong. As we head towards the end of the year and into 2025 we think demand may start to fall. In fact, the market needs raw sugar demand to fall even further than we are forecasting to get through the CS Brazil’s offcrop.

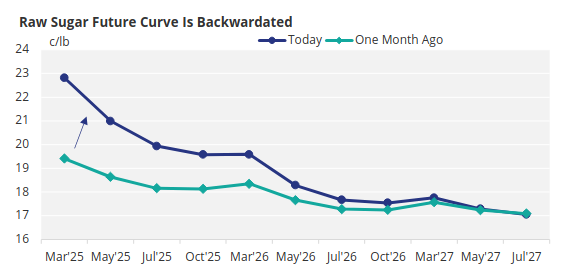

The recent move higher in flat price and forward curve may now be starting to impact physical offtake.

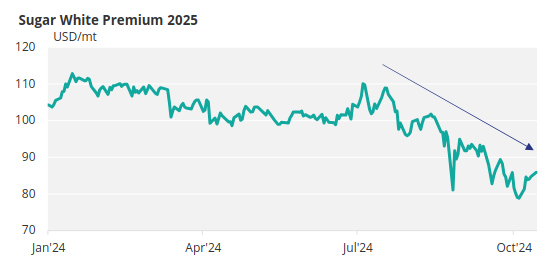

The backwardated (downward sloping) curve makes it challenging for buyers of raw sugar. Similarly the 2025 H/H white premium has fallen to around 85USD/mt, which isn’t enough for the typical re-export refiner to operate profitably.

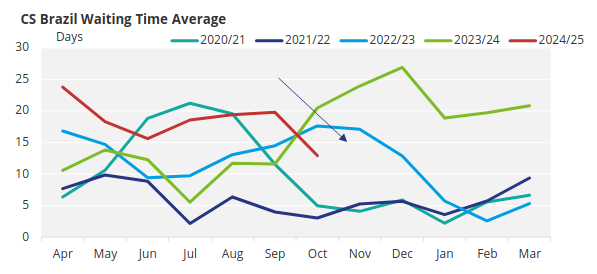

It’s possible we’re starting to see the impact of these market moves on demand. Waiting times at ports in CS Brazil are finally starting to reduce following several months of lengthy queues for vessels to berth.

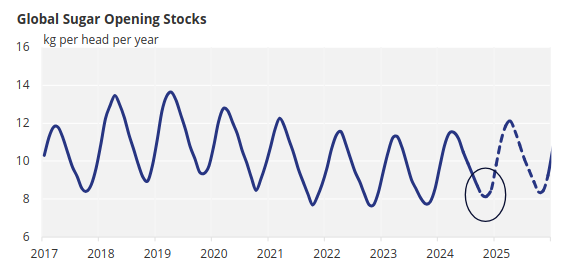

Looking forward, one challenge for demand reduction is that this is now a period of the year where global sugar stocks are at their lowest. This doesn’t leave a massive amount of flexibility for many buyers to change their demand intentions.

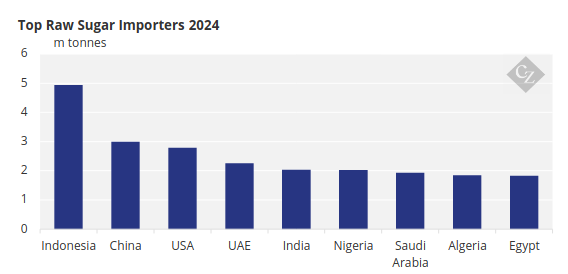

Let’s take a quick look at some of the major raw sugar buyers to understand more where there’s flexibility for reduced demand:

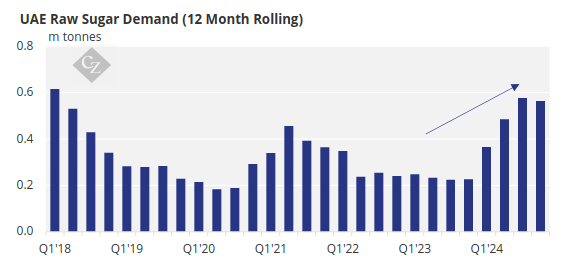

United Arab Emirates is likely to have the most flexibility to reduce or defer demand as their offtake so far in 2024 has been higher than normal.

We’ve already mentioned the weaker white premiums but refiners in the region are also struggling with subdued demand and increased competition from European producers who having a much-improved crop.

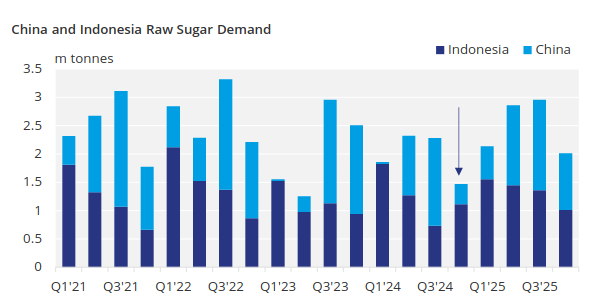

Indonesia and China are likely to have much less flexibility: the timing of imports into these regions is controlled to some extent by when licenses or import permits are valid. In both cases, we already expect a drop in demand in Q4 leaving limited opportunity to reduce or delay demand further.