- China’s wheat demand remains high as it attempts to rebuild its national pig herd, which was decimated by African Swine Fever.

- Meanwhile, Russia has upped its wheat export tax from 25 to 50 EUR/mt, which will be in place between the 15th March and 30th June.

- Both these factors have fuelled the rise we’ve seen in the wheat markets over recent months.

The Markets are on the Run

We have seen wheat markets rise over recent months.

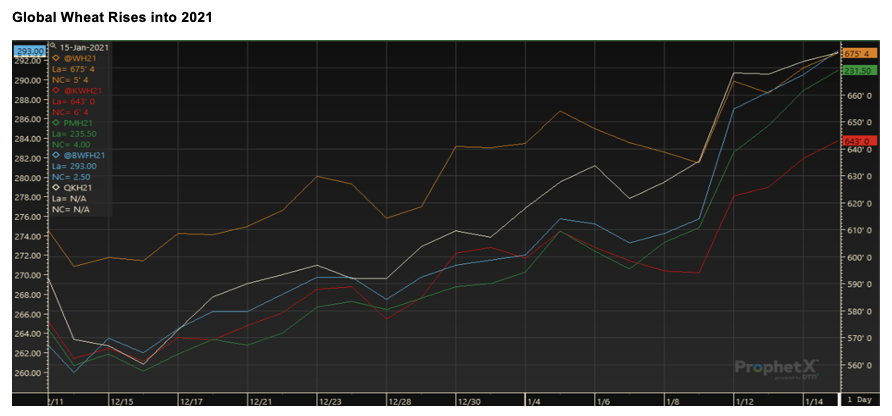

The chart below shows the trend since the beginning of December 2020, with little pause from the bullish run, which maintains its stronghold over the global markets.

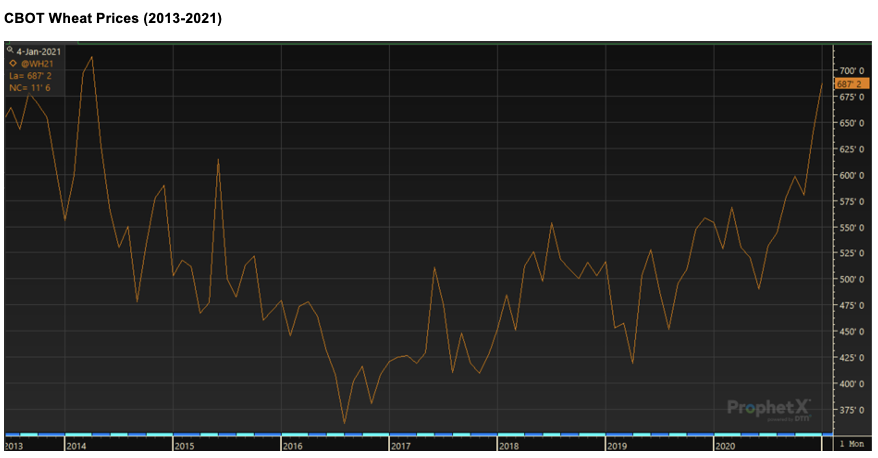

The largest volume traded wheat futures, the Chicago Soft Red Winter Wheat, have risen 40% in the last six months, from 490c/bu to a couple of cents shy of 690c/bu at the time of writing.

We have to look back to 2014 for the last time the market hit these dizzy heights, as is illustrated in the chart below.

China, Russia and a Nervous Market

China’s wheat demand has surged as it attempts to rebuild its national pig herd, which was decimated by African Swine Fever. It previously contained over 50% of the world’s pigs. To put this statistic into context…China’s herd contained around 406.5 million pigs at the end of December 2020, up 31% year-on-year.

China’s huge appetite for grains has fuelled bullish sentiment in corn, soybeans and wheat. Current estimates suggest that China will import 8.5-9m tonnes of wheat in 2020/21, up from 5.38m tonnes last season. If this materialises, it’ll be a new record.

At the other end of the spectrum is Russia. Russia has seen a brisk shipment pace with exports set to total 39m tonnes in 2020/21, up 4.5m tonnes year-on-year. Despite its larger harvest in 2020, domestic wheat and flour prices have seen a worrying rise in recent months with growing concerns over food price inflation.

This uneasiness resulted in export restrictions, followed by a 25 EUR/mt export tax on wheat exports being announced in mid-December, which will apply between 15th Feb 2021 and 30th June 2021. Last week, they confirmed that the tax will increase to 50 EUR/mt on the 15th March 2021. Corn and barley will also be taxed at 25 EUR/mt and 10 EUR/mt respectively.

These levies have reduced the competitiveness of Russian wheat, so much so that Egypt, the world’s largest importer, cancelled its last tender a week ago due to a lack of offers. Is this a one off, or is there more of this on the horizon?

A nervous market trading higher into 2021 found additional support from last week’s WASDE Release, which cut the record global wheat stock estimate for 2020/21 from 316.50m tonnes to 313.19m tonnes. Interestingly, the major exporters saw their overall ending stocks cut to 59.2m tonnes, down 4% in the space of two months.

What Next?

The wheat market is currently being fuelled by strong demand and the key exporters’ dwindling stocks.

As we approach spring in the Northern Hemisphere, attention will swing onto the 2021 harvests and crop projections. Yield potential as the winter crops exit the cold months will be of critical importance. The spring sowing of the high quality ‘sprinter’ wheats will help steer the premiums and discounts amongst the various quality markets.

Whether 2021 will be a year of high, medium or low yields is the big question ahead. As always, the weather will have the final word!

Other Opinions You Might Be Interested In…

- Czapp Explains: Winter Wheat vs. Spring Wheat

- Czapp Explains: Global Wheat Futures

- Wheat Farming: Finding the Right Destination at the Best Price

- The World’s Largest Wheat Producers and Exporters

- The World’s Largest Wheat Users and Importers