Insight Focus

Despite a negative week for wheat due to healthy US harvesting progress and an import ban in Turkey, corn managed to remain relatively stable. However, there is unlikely to be further upside for corn due to good planting pace, favourable weather and reports of positive crop conditions.

Corn in Chicago managed to close the week unchanged, but wheat was down on lack of updates about the Russian frost and Turkey’s ban on wheat imports.

The market has now eliminated some of the risk premium in wheat due to the frost in Russia, but the reality is that there is no final assessment of the impact on production. This should keep the market supported yet volatile.

On the corn side, all regions are looking good, especially US corn which should limit further upside in Chicago.

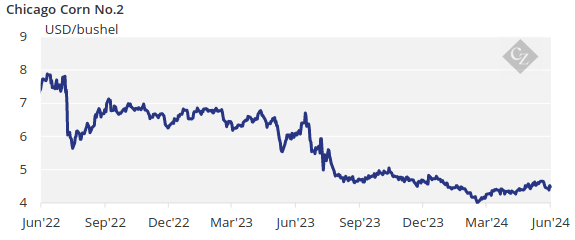

There is no change to our Chicago corn forecast for the 2023/24 (September/August) crop to average USD 4.60/bushel. The average price since September 1 is running at USD 4.55/bushel.

Corn Holds Strong Despite Wheat Pressure

Corn in Chicago saw small gains despite good planting progress, favourable weather and the first information on crop condition, which showed a healthy amount of 75% in good or excellent condition. It mostly held against the pressure from wheat, which fell across geographies.

US corn is 91% planted, up from 83% the previous week and versus 95% last year. The five-year average stands at 89%. Corn areas experiencing drought were unchanged at 8%, and the condition was 75% good or excellent – a substantial improvement on 64% last year. Argentinian corn is 35.1% harvested and 12% good or excellent.

Russian corn planting is 93.6% complete versus 92.1% last year. French corn is 90% planted, slightly behind the 98% recorded last year and the five-year average of 100%. The condition of French corn was 80% good or excellent versus 88% last year.

Wheat Under Pressure on Harvesting Progress

Wheat saw big pressure both in the US and Europe following a good start to the harvesting pace in the US and improving conditions. Prices have mostly corrected following the rally of the previous two weeks on the back of the Russian and Ukrainian frost.

On the Russian side, it is unclear whether wheat production will fall below the 80 million tonnes that the market has already priced in. There was a lack of fresh information around the final damage.

On top the negative price action since the beginning of last week, Turkey banned imports of wheat between June 21 and October 21, aiming to support local prices. Russian farmers rapidly asked the Turkish government to postpone the ban until June 30 as the bulk of Turkish imports come from Russia. Wheat sold off in Chicago but more so on Euronext.

US winter wheat is now 6% harvested, ahead of 3% last year and the five-year average of 3%. The condition was 49% good or excellent, up 1 point week on week and versus 36% last year. Areas under drought conditions improved by 4 points to 21%. French wheat condition was 62% good or excellent, or 1-point higher week on week but significantly below 88% last year.

On the weather front, the US is forecast to have dry weather in most agricultural areas. Brazil is also expected to experience dry conditions, which will help to clear flooded areas in the south of the country. Rains are forecast mainly in northern Europe, with some scattered showers in the south.