- Harvests are underway in the Northern Hemisphere.

- Global prices are relatively high with reasonable stock levels on the horizon.

- However, weather disruption is playing its part…great fuel for any bull.

The Current Situation

The Northern Hemisphere wheat harvest is underway, but there’s a long way to go before we get a true picture of production and total supply numbers.

The heat is on! Baking temperatures across northern US States and Canada have farmers concerned, especially for the growing high quality spring wheats.

Heavy rain and flooding in parts of the EU and Black Sea region are creating similarly destructive concerns on the other side of the Northern Hemisphere.

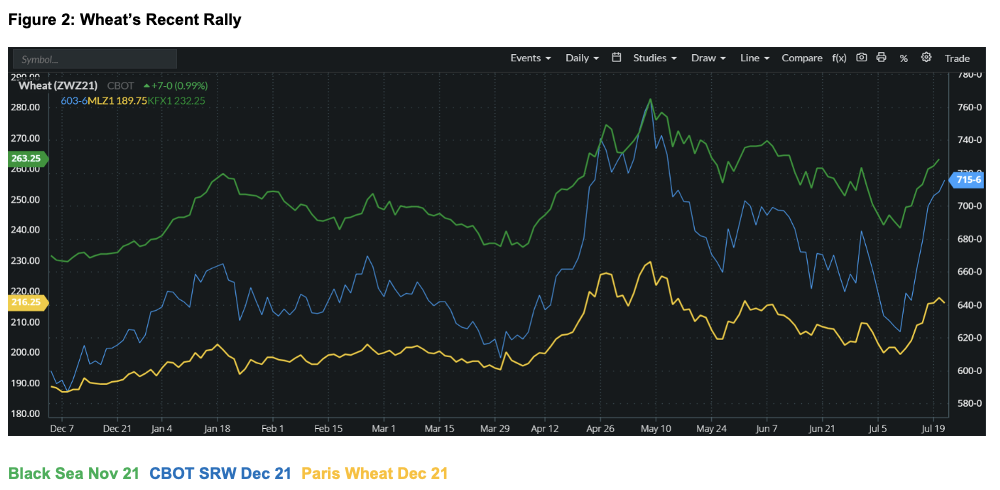

These weather issues, together with a month-on-month reduction in projected global wheat closing stocks have been the drivers of the recent price rally, as seen in Figure 2.

The July WASDE: Which Numbers Stand Out?

1. Wheat Production

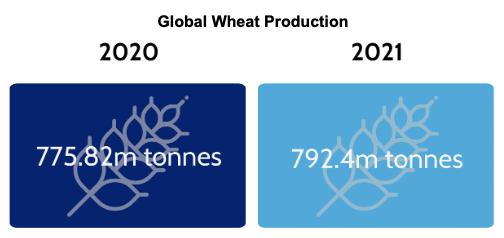

Despite the current weather issues, the USDA forecasts the world will produce 792.4m tonnes of wheat in 2021, up 16.58m tonnes year-on-year.

2. Closing Stocks

The USDA forecasts the world will have 291.68m tonnes of wheat left at the end of 2022. This is down month-on-month, but up 1.5m tonnes year-on-year.

More specifically, the world’s major wheat exporters should have 39.27m tonnes of wheat left at the end of 2022, up 5.85m tonnes year-on-year. This should be plenty to curb any medium-term supply concerns from the largest importers.

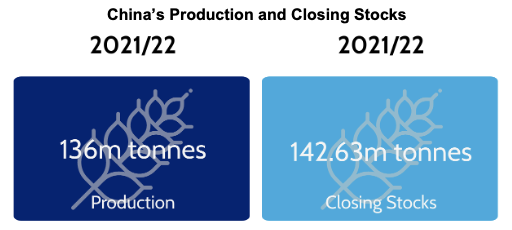

China’s production and closing stock estimates seem solid enough.

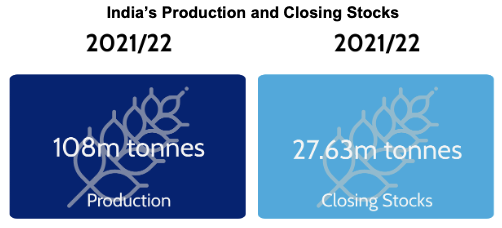

India also appears to have a well-balanced supply.

China and India’s stocks are now approaching 60% of the world’s total. This is indicative of nations with large populations as they’re often concerned about long-term food security.

The Four Cs Moving Forward

1. Climate

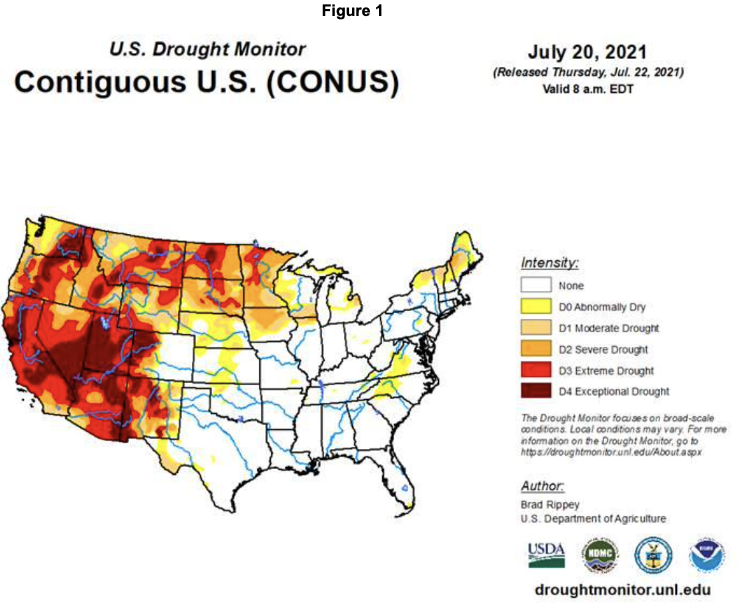

Extreme weather in North America suggests that 93% of the spring wheat area is suffering from drought. This is just one example that continues to cloud production estimates. It’s a long way before the end of 2021 and Southern Hemisphere harvests are done.

2. Corn

Corn’s impact on the wheat market should not be underestimated.

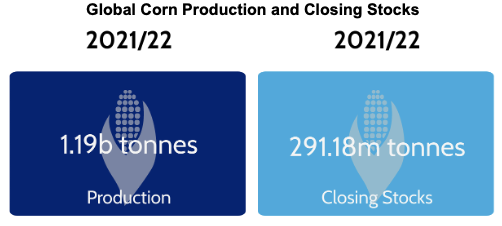

The world should produce 1.19b tonnes of corn in 2021, with closing stocks of 291.18m tonnes.

This is interesting when compared to the wheat numbers above. Corn is a much bigger (higher yielding) crop, yet stocks are similar.

3. China (and Corn)

China’s corn stocks at 198.16m tonnes represents nearly 70% of the global total that will not be exported. This leaves a mere 93.03m tonnes of elsewhere. Any further reduction to production could mean things turn very interesting indeed.

The futures markets are showing a good discount for corn under wheat so, for now at least, there’s nothing to fear.

However, demand for corn looks robust, particularly from China, as it attempts to rebuild its pig herd following the devastating African Swine Fever culls.

Any great reduction to corn stocks may see wheat replacing corn in some feed rations. At this point, wheat demand can increase substantially, with stocks reducing. This could be fuel for a bull run.

4. COVID

An ongoing news story, with continually unknown consequences…

It’s very likely, as we’ve seen over the last 18 months, that general demand for wheat will not be significantly affected. However, lockdowns, logistical disruption on an international scale, as well as speculation and rumours have proven to have a real impact.

In particular, the major importers, concerned for food security, will adjust their buying habits and terms accordingly. These factors could have short-term influence on market rallies and dips.

Conclusions

Global prices for wheat are relatively high (see Figure 2) with reasonable stock levels on the horizon. A bear might suggest the markets should stabilise or weaken as 2021 draws on.

Weather disruption is playing its part in maintaining the guessing game for what lies ahead…great fuel for any bull.

Changes to export taxes, such as those in Russia or Argentina, Chinese demand, trade disputes, food security and a COVID resurgence all have the ability to turn the best laid thoughts on their heads.

For now, there’s enough wheat to trade, so wild dramas should be averted, but never say never. The future, as always, is a venture into the unknown.

Other Opinions You Might Be Interested In…