Insight Focus

The new USDA report forecasts global wheat stocks at near decade low. US tariffs, along with other geopolitical tensions and weather risks add further uncertainty. Price volatility is expected as supply struggles to meet demand.

The world of wheat is always a rollercoaster, and 2025 is proving to be no exception.

Trade Tensions Rise Under Trump

President Trump has most certainly begun to make his mark on the world since his re-election, whether through attempts:

- To broker a peace deal to end the war in Ukraine

- To reassess the US’ security alliances—with NATO, Canada, Greenland, and others

- To initiate a trade war aimed at bringing manufacturing back to the US, while disrupting any momentum toward free trade agreements

President Trump is fully committed to what he sees as putting the US first, regardless of the consequences.

The impact on the wheat market is term likely to be limited in the long term. In the meantime, trade tariffs may be viewed as bearish, while a calming of current tensions could be supportive.

A longer-termed trade war with China, however, could disrupt global economic progress and potentially dampen overall demand, putting downward pressure on prices.

USDA Flags Lowest Wheat Stocks in Nearly a Decade

Last week, the monthly USDA WASDE Report reminded us that 2024/25 world wheat ending stocks are forecast to be the lowest in nearly a decade—since 2015/16!

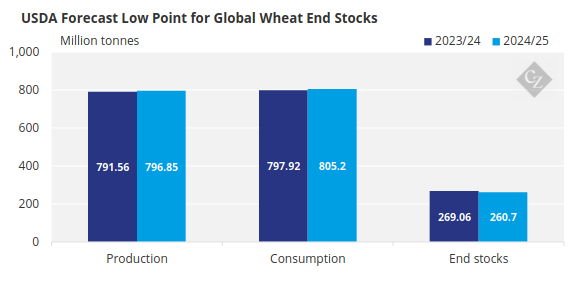

This year, global stocks are projected at 260.7 million tonnes, down from 269.06 million tonnes at the end of the last marketing season—an alarming decline. What makes this even more concerning is that the 2024 harvest delivered a record crop of 796.85 million tonnes, yet it’s still down on the consumption estimate of 805.2 million tonnes.

At some point, if stocks continue to fall, a day of reckoning seems inevitable—when prices must rise to encourage more plantings to increase supply.

Source: USDA

Uncertainty Looms Over 2025 Wheat Harvest

With a downward trend in stocks, it would at least be reassuring to have a bumper 2025 harvest on the horizon. Unfortunately, that’s far from guaranteed.

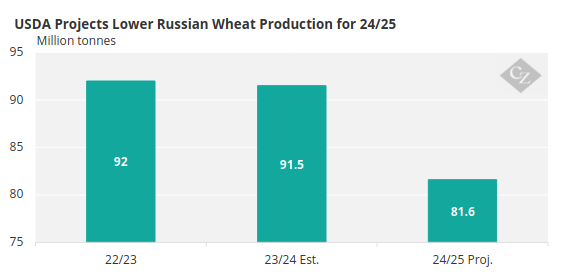

The world’s largest wheat exporter, Russia, is facing the prospect of another poor crop, following a disappointing 81.5 million tonnes in 2024. Dry conditions going into winter had early forecasts for 2025 as low as 78 million tonnes, though recent estimates have crept back above 80 million tonnes—similar to last year.

Source: USDA

The US reports to have the second lowest number of planted acres in the ground since records began in 1919! Stocks are currently more plentiful in the US than elsewhere, so at least it should be able to play its part in exports during the 2025/26 campaign.

Both Russia and the US have suffered from dryness, although much will depend upon the coming weeks as the wheat matures towards harvest in the summer months.

India has also faced challenges, with production forecasts varying widely. Imports have been mentioned in the past, which if needed, would be a bull story for the market.

North Africa, the world’s biggest importing region, has experienced struggles with a lack of rainfall in some areas, which again could spark a need for greater imports in the coming year.

Australia is predicting a smaller crop for 2025 at between 28 million tonnes and 30 million tonnes, down from the 34.1 million tonnes in 2024.

Meanwhile, the EU—despite some weather-related difficulties—appears on track for a more typical harvest in 2025 compared to the disappointing crop of 2024. This should see France and Germany return to the export market with renewed energy, though a record crop still seems unlikely at this point.

All in all, wheat crops for 2025 are unlikely to significantly outshine the record global harvest of 2024. Considering the planet’s ever-increasing population, it is hard to see any meaningful fall in demand.

Complexities

- Stocks are falling, and production is struggling to make meaningful inroads to rebuild them.

- Wars are raging, and trade wars are looming.

- Global economic turmoil could suppress demand. However, weather risks could stifle supplies.

- There is never a dull moment in the world of wheat—and price volatility is surely inevitable!