- Global wheat prices are higher than we’ve seen for around 10 years.

- Import and export dynamics have changed during this period.

- Here, we discuss how this might influence the market going forward.

Global Wheat Price Changes

Wheat prices are currently at their highest level in some years (Fig 1).

The last month has seen predicted global wheat stocks further reduced to 277m tonnes at the end of 2021/22, equating to approximately 35% of estimated total production (775m tonnes). These figures have been providing yet more food for the market Bulls.

Interesting times lie ahead as the Southern Hemisphere’s 2021 harvest looms and the 2022 harvest is being drilled throughout the Northern Hemisphere.

The Significant Changes for Wheat Over Recent Years

Looking at published numbers (USDA), we often just consider the overall picture. Digging a little deeper can sometimes provide an alternative perspective for our thoughts. Pondering the current year (2021/22) versus the previous two years (2019/20 and 2020/21) shows some intriguing developments.

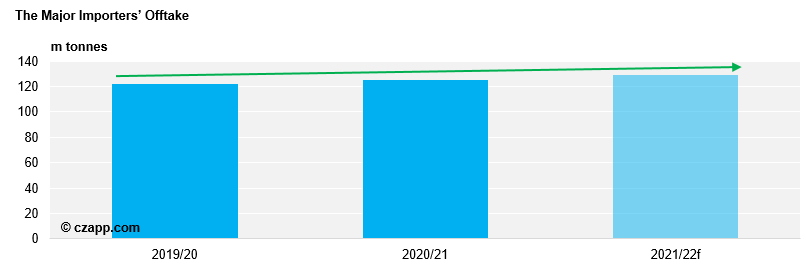

The Major Importers

Here, we’re treating Bangladesh, Brazil, China, Japan, North Africa, the Middle East, and South-East Asia as the major importers. A first glance at the

total volume of imports by these importers may appear unremarkable.

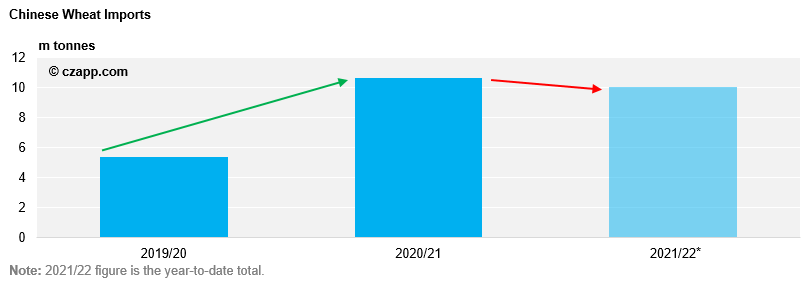

Population growth would support a continued slight increase year-on-year, so why probe further? Dig a little deeper, though, and something does look different: China’s imports.

It’s worth noting that the import figure for China in 2018/19 was 3.15m tonnes, thus a 300% increase in as many years. Although an increase from 3m tonnes to 10m tonnes doesn’t appear significant on a global scale, it’s not necessarily just the number, it’s the market sentiment that moves the market prices.

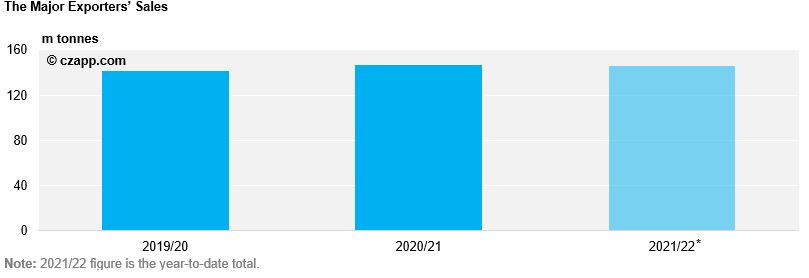

The Major Exporters

It clearly requires an importer to buy for an exporter to sell. As such, the numbers are similarly unsurprising for the major exporters’ total sales.

Peer more closely and intriguing variations materialise.

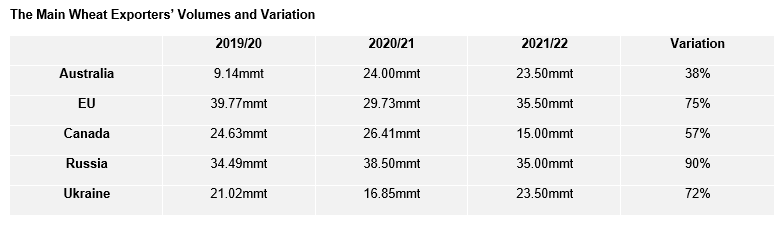

The individual figures begin to paint a very different picture to the collective volume. The ‘variation’ shows the percentage of sales during the smallest export year, relative to the largest; quite drastic amounts, considering these represent merely a three-year period!

In each of the above cases, the smallest export volume years are reflective of the radically smaller wheat harvests in comparison to the largest export years.

What Can We Grasp from These Variations?

Total imports and exports seem to gently increase as populations grow.

China has been an important driver in the recent commodity market rises. As well as increasing wheat imports, the world’s most populous country has been busy buying corn, driving all grains markets higher.

The major exporters’ crop sizes and hence available volumes for sale to importers have proved to be concerningly unstable with the variations shown above.

With climate concerns at the forefront of world news, this looks to be an ongoing issue on a global scale.

Conclusions

Large increases in China’s desire for wheat, and grains generally, could indicate a longer-term uplift in wheat demand on the world stage if other nations follow.

Recent harvests have demonstrated that the major exporters can see available export volumes swing by far greater than the 35% stocks-to-production ratio seen globally.

A collective drop in harvest availability of greater than this level would signal severe disruption to the hitherto robust supply chain.

A productive end to the 2021 harvests, coupled with an encouraging start to the 2022 crop, will allow cool heads to prevail and a backing off for prices.

Strong demand from China and other major importers, combined with any unsettled progress for 2022 wheat production, could see prices remain strong or conceivably rise higher still.

We most certainly have thought-provoking months ahead on the world stage.

Other Opinions You Might Be Interested In…

- Czapp Explains: Winter Wheat vs. Spring Wheat

- Czapp Explains: Hard Wheat vs. Soft Wheat

- The World’s Largest Wheat Producers and Exporters

- The World’s Largest Wheat Users and Importers