Insight Focus

Wheat markets remain volatile amid global uncertainties. Since the beginning of 2025, US markets have shown more bullish trends than European markets, driven by export competitiveness, fund activity, and rising Black Sea export prices.

Wheat markets have continued their volatility, driven by a plethora of continually emerging mixed bullish and bearish news reports.

Whether it is Trump with his trade tariffs or the US meeting with Russian officials to attempt to end Russia’s war of aggression in Ukraine, uncertainties persist. In addition, there are weather concerns for the 2025 wheat harvest in Russia, the US, Europe, India, and more.

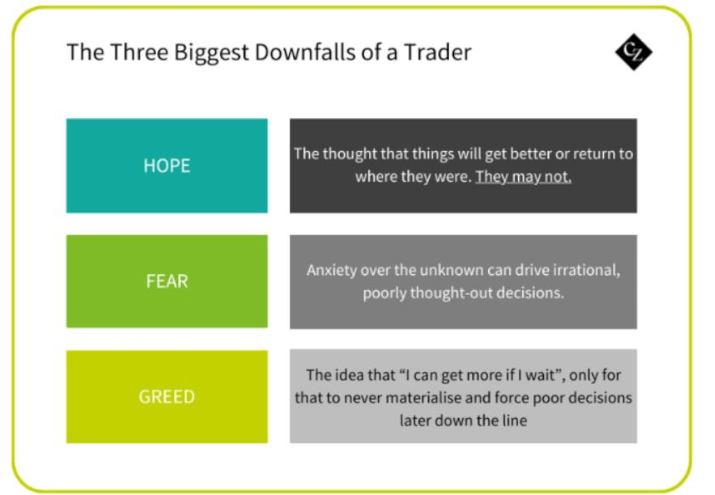

Managing business risk in these volatile times may often seem daunting, but a calm head with clear objectives can be the key to overcoming the emotional pitfalls of hope, fear, and greed in such a market.

Wheat Markets Diverge Since Beginning of 2025

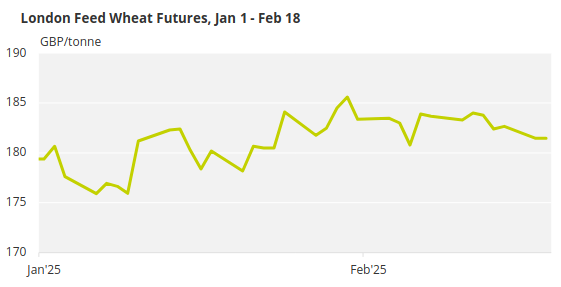

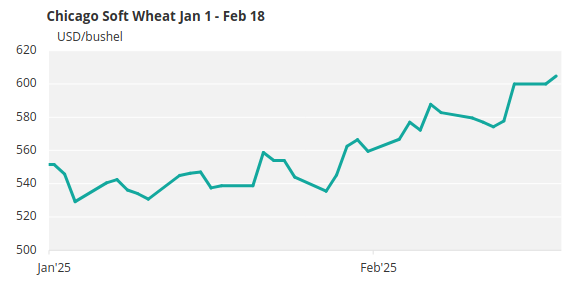

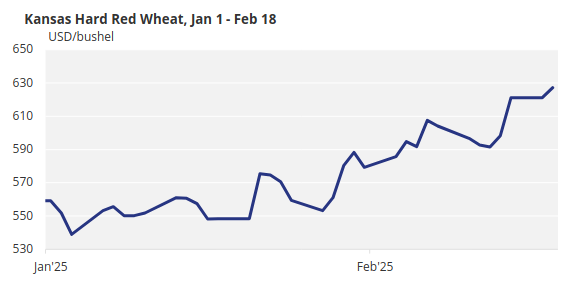

As the charts below show, since the New Year, values have been erratic on an hour-by-hour basis as the market swings from one story to another.

Perhaps the most interesting point in the charts above is to see that markets have not all moved in unison. The US markets have most definitely been more bullish than the European markets.

What Factors Have Been Driving Markets Since the New Year?

Funds

At the turn of the year, funds were significantly short of wheat futures on both sides of the Atlantic. While Paris funds have been buying to reduce their shorts, this has had less impact on prices than US funds buying in a smaller percentage of their short positions over the same period.

This is likely due to the export competitiveness of each market. Smaller European supplies have kept them out of much of the global trade this season, as they have maintained premium prices to avoid excessive exports. In contrast, the US has continued to pursue exports, resulting in cheaper prices when funds began buying. Coupled with the increase in Black Sea export prices, US values have risen proportionately higher.

Weather

Meteorological woes continue to plague wheat markets. Dryness and now cold temperatures are a threat to Black Sea and North American wheat crops, while other parts of Europe face another year of excessive rainfall. India has suffered a less-than-ideal monsoon season, raising questions about its ability to maintain low domestic prices.

Global stocks have been dwindling for nearly a decade, and the continuation of this trend—now looking increasingly likely—will no doubt be music to the ears of any long-term bulls.

Politics

Trump 2.0 has brought moment-by-moment volatility to many markets, and wheat has not been spared. The prospect of trade wars is generally not bullish for commodities, as potential damage to major global economies—especially China—could apply the brakes to demand if populations see food inflation while having less money in their pockets.

Russia’s continued aggression in Ukraine appears to have the potential for an end, although the nature and timing of any peace remain uncertain. Nonetheless, the US is striving for some form of settlement, and peace in the region would likely encourage a calmer outlook for wheat prices.

Key Considerations for Wheat Buyers and Sellers

We have previously discussed considerations for buyers and sellers in the following articles:

Fundamentally, with the above factors in mind:

- When prices are too low for farmers to make a profit, they will inevitably rise at some point. Even if this occurs over the longer term, reduced wheat planting will lead to lower supply, driving prices up.

- Conversely, when prices rise to levels where populations—particularly in North Africa and parts of Asia—struggle to afford food due to inflation, demand will ultimately dwindle. Although people must continue to eat, they will buy less, causing demand and prices to drop over time.

Never lose sight of the three biggest downfalls of a trader.

Never panic when prices suggest doom, gloom and all is lost; there will be better days ahead. Remember that ‘the trend is your friend’, so don’t be afraid of it.

Wide open eyes to the bigger picture, a calm head and margin/profit focus is a consistent recipe for making money. The fundamentals and basic economics of supply vs demand will always bear true in driving prices. It just may take time to get there!