Insight Focus

- World stocks are at an eight-year low.

- Market prices are low and under pressure.

- Diplomats negotiate wheat trade flows.

Introduction

Values have had a bearish trend over recent weeks, despite weather extremes and world end stocks forecast at their lowest in eight years. Diplomatic discussions could soon add interest to market commentaries.

Wheat Prices

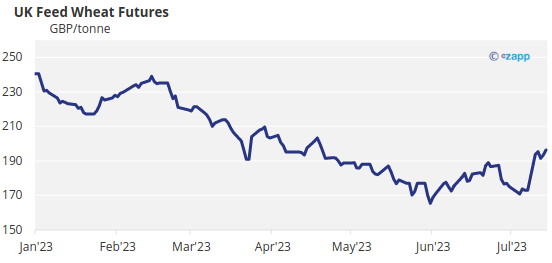

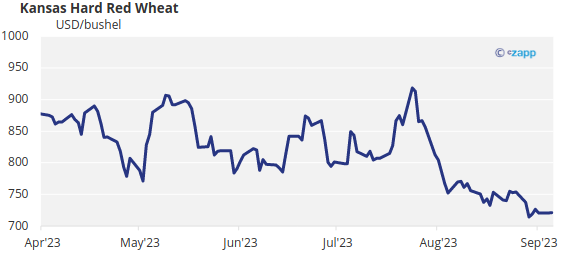

Since Russia pulled out of the Black Sea Grain Corridor Agreement in July, values have endured a decreasing trend over the last month.

As the charts below demonstrate, prices have fallen since the beginning of August.

Production, Consumption And Stocks

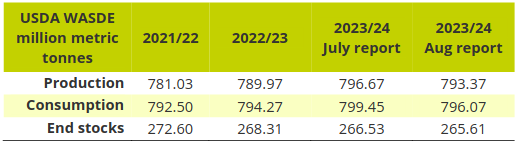

The latest edition of United States Department of Agriculture World Agricultural Supply and Demand Estimates (USDA WASDE) report on 11 August did little to set markets alight.

Weather extremes continue to reduce production estimates, down from a huge 800.19mmt as recently as June.

The financial woes of the global economy appear to be taking their toll on wheat consumption. As populations grow demand usually increases year on year. But not this year: year-end stocks of 265.61mmt are the lowest since 2015-2016.

These economic issues overriding politics, war and weather are driving values for now.

Diplomats And Negotiations

Turkey And Russia

President Recep Tayyip Erdoğan of Türkiye was the driving force, together with the United Nations, in delivering the Black Sea Grain Corridor Agreement from July 2022 until its collapse in July 2023.

President Erdoğan’s visits to Moscow for discussions with Russia’s president Putin, hope to bring an easing of tensions for Black Sea grain shipments.

Putin is reported to be asking Turkey to act as facilitator to supplying 1mmt of Russian wheat to African ‘friendly nations’ in need of the imports.

President Erdoğan is likely looking to reignite a grain deal involving Ukrainian exports. Success would potentially enhance his international standing, useful given his recent election.

Egypt And India

The two countries are to discuss a wheat for fertiliser deal, whereby Egypt provides Fertilisers to India, who in turn supplies Egypt with wheat.

Such a deal makes sense with Egypt one of the world’s largest fertiliser exporters and wheat importers. India on the other hand, is the world’s second largest wheat producer, with a significant need for fertilisers.

Nonetheless the discussions come at an interesting time, given recent reports of India’s suggestion that it may look to import up to 10mmt of Russian wheat.

Ukraine And Its EU Neighbours

The Ukraine is in ongoing negotiations with its European neighbours over the expiry this month, of an agreement whereby Ukraine wheat transits through its neighbours for onward export.

This agreement maintains a ban on the use of this wheat within the relevant transit countries in order to avoid flooding their local domestic markets.

Thoughts And Conclusions

Diplomatic discussions are in the spotlight and time will show whether they bear fruit in changing the global trade flows either short or long term.

Ultimately, deals to help the free movement of wheat, although possibly more bearish for prices, will generate greater stability, following the turmoil of the last 18 months.

The low wheat values could reduce the total acreage of winter wheat planted this autumn across the northern hemisphere, despite the reducing stocks forecasts.

A smaller 2024 wheat crop, while a hopefully more optimistic economic outlook in 2024, has the potential to kickstart a bull run if demand grows while stocks drop further.

The world of wheat is an ever-changing place. The current, lacklustre market should be treated with caution: there is usually a calm before the storm.