Insight Focus

Despite production losses in Russia, the wheat market is looking bearish due to favourable conditions in the US and Europe. Corn remained stable as higher consumption offset higher production in the latest WASDE report from the USDA.

Wheat was down for a second consecutive week while corn had mild gains in Chicago but big losses on Euronext. The June WASDE report was neutral for corn and bearish for wheat and we think the market has already priced in most of the uncertainties. We expect further sideways trading for corn in Chicago while volatility should remain in wheat.

There should be no uncertainties in the South American corn market, and US corn is looking good. We may still see some volatility in wheat as rains in Russia are benefiting the crop, but the real size of the crop is still unknown. US wheat is also looking good.

There is no change to our Chicago corn forecast for the 2023/24 (September/August) crop, which is averaging USD 4.60/bushel. The average price since September 1 is running at USD 4.55/bushel.

Corn Production Rises

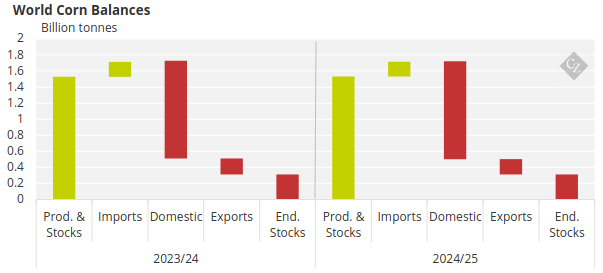

The June WASDE report left US corn production figures unchanged while world corn stocks were reduced by 1.5 million tonnes in a combination of slightly higher production but even higher consumption. The small changes to their production forecast were immaterial.

Source: USDA

It is worth highlighting the WASDE left Brazil’s corn production unchanged at 127 million tonnes while CONAB is forecasting 114.6 million tonnes.

US corn is 95% planted, up from 91% the previous week but slightly behind 98% last year and on par with the five-year average. Corn areas experiencing drought were one point lower at 6%, and condition was 74% good or excellent — 1 point lower week on week and an improvement on 61% last year. The Safrinha (second) corn crop in Brazil is 10.4% harvested, while Argentinian corn is 40.3% harvested.

Russian corn planting is 95.8% complete – about level with last year. French corn is 97% planted, only slightly behind last year and the five-year average. The crop condition was 80% good or excellent versus 86% last year.

Ukrainian corn was fully planted two weeks ago, and the government has now increased the production forecast to 28.5 million tonnes or 7% higher than the previous number but still lower than last year’s production of 31 million tonnes.

The French Agricultural Ministry forecast corn area up by 9.5% year on year but 5% below the five-year average.

Coceral forecast EU+UK corn production at 64.8 million tonnes, up from its previous forecast of 64.3 million tonnes and above the 63.8 million tonnes produced last year.

Wheat Data Feeds Bears

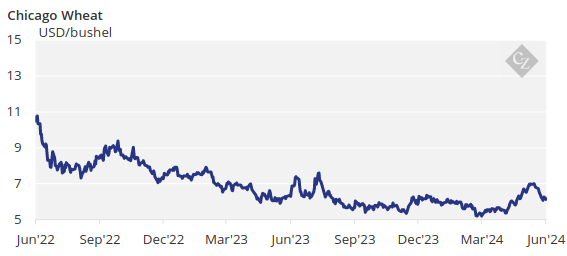

Wheat had a negative start of the week as it emerged US harvesting pace was very much ahead of last year and the five-year average. There are also much better conditions than last year. Rains forecast this week in Russia and Ukraine pressed the market lower by the end of last week.

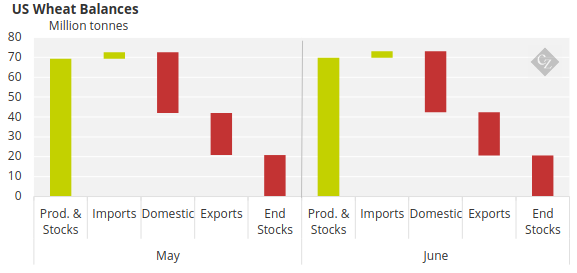

The June WASDE report reduced US carry out by 8 million bushels in a combination of 17 million bushels of higher production (higher yield) but an increase of 25 million bushels in exports.

Source: USDA

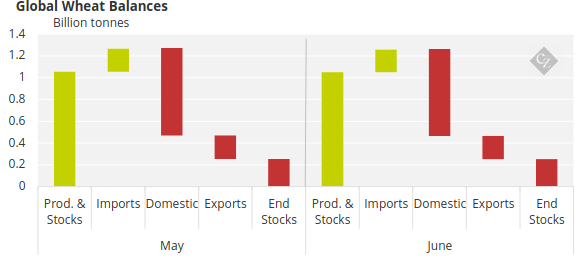

Global wheat stocks were reduced by 1.3 million tonnes due to a sharp reduction of 7.4 million tonnes of production in a combination of the mentioned higher production in the US, but 1.5 million tonnes lower in EU, 5 million tonnes lower in Russia, 1.5 million tonnes lower in Ukraine and some other smaller reductions. Overall, we continue to have a yearly stock destruction 7.3 million tonnes.

Source: USDA

US winter wheat is 12% harvested ahead of 7% last year and the five-year average of 6%. The condition was 47% good or excellent, down 2 points week-on-week but ahead of 38% last year. Areas under drought conditions improved by 5 points to 16%. The French wheat condition was 62% good or excellent, unchanged week on week, but a deterioration compared with 85% last year.

Coceral forecast EU+UK wheat production at 134.5 million tonnes, up from its previous forecast of 134.1 million tonnes but below the 139.9 million tonnes reported last year.

WASDE Numbers Priced In

The US is expected to experience average temperatures and above normal rainfall in the next week. Brazil is expected to remain dry, but some rains could arrive to the south again. Dry weather is forecasted for Europe, while rains are predicted in Ukraine and Russia.

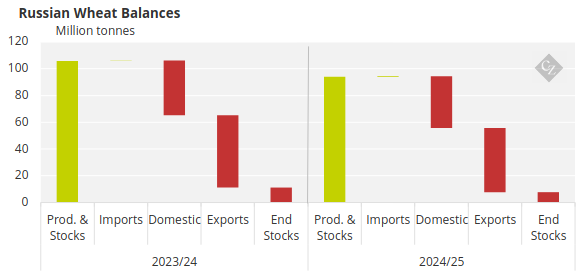

The WASDE report recognized the impact of the frost in Russia and Ukraine, with a 7.5-million-tonne production loss. Of these 7.5 million tonnes, 5 million were in Russia. The new forecast for production is 83 million tonnes, although this is still above estimates from local analysts, which are in the range of 79 million tonnes to 81 million tonnes. Russia produced 92.8 million tonnes last year.

Source: USDA

Most of the volatility of last four weeks have been on the back of the frost in Russia and Ukraine followed by hot and dry weather, so the WASDE numbers were already priced in. The market quickly rallied on wheat production losses and then corrected once rains returned.