Insight Focus

- Russia’s war in Ukraine continues to disrupt world wheat trade.

- High prices should drive Nothern Hemisphere wheat plantings higher

- Russia could lose out to other origins if it is seen as an unreliable supplier.

Introduction

War continues the desperate human suffering in Ukraine, while concerns mount about wheat prices being too high for the poorest nations.

Recent news reports are becoming ever more focused on the wave of worries from the UN and large importers in North Africa about wheat availability.

Finding solutions to the lack of Black Sea wheat exports is a huge task, especially as global stocks appear to be dwindling.

USDA Forecasts Fall in Stocks

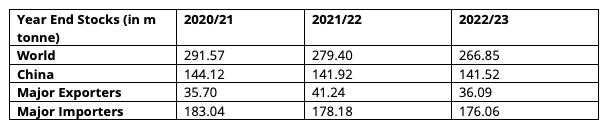

The US Department of Agriculture released its monthly World Agricultural Supply and Demand Estimates report at the end of last week. Numbers released projected a continuing trend of decreasing stocks for the coming marketing year.

The standout reserves are in China where, despite not being a big exporter, production is struggling to keep pace with domestic consumption, leading to marginal drawdowns from storage.

Optimism could be gained from the level of supplies within the major exporters, as 2022/23 will remain higher than in 2020/21. However, of the 2022/23 forecast, 17.15m tonnes are set to be in Russia and Ukraine.

The availability of wheat to the global market is therefore in some doubt.

Pressure on Russia

Russia has snatched the mantle of the world’s largest exporter away from the US and the EU in recent years.

The current turmoil throughout the market, aided by Russia’s invasion of Ukraine will likely escalate the pressure on President Vladimir Putin. A need to convince the world that Russia can be considered a reliable wheat supplier may well be needed to maintain its position at the top of the exporter’s table.

The Longer Term Outlook

Diminishing wheat stocks and the lack of imminent availability of those from the Black Sea may have created unprecedentedly high prices, but they should drive a surge in production for 2023/24.

With the Northern Hemisphere harvests beginning, we will start to see winter wheat plantings for the 2023 harvests begin in earnest in 2-3 months.

Profitable margins and the potential to plant greater numbers of acres provides a significant incentive to all arable farmers to sow more area to increase production in 2023. This should allow a rebalancing of stocks that have been declining over the last few years.

Conclusions

Pressure on Putin is coming in many forms. A need to supply wheat to poorer nations, including North Africa, is proving to be high among them.

The USDA’s stock reduction forecasts are adding to an already worrying situation for many.

Despite this abundance of negative news, which has driven prices to all-time highs, there is reason for optimism.

Plantings are highly likely to swell in the autumn throughout the Northern Hemisphere. This should lead to an increase in end stock projections for 2023/24.

Whatever the short-term result of Russia’s war in Ukraine, there seems every reason to be confident that by the end of 2022 wheat prices will have reason to begin to stabilise.

The consequence of which, could see nations reduce purchases from Russia in the longer-term as they gain more confidence in supply from elsewhere.

Other Insights That May Be of Interest…