Insight Focus

- A collapse of the Black Sea Grain Corridor Agreement.

- Now all shipping considered a legitimate military target by both sides.

- Uncertainty prevails on wheat’s volatile global markets.

Introduction

The Black Sea Grain Corridor Agreement was brokered by the United Nations and Turkey in July 2022 following the Russian invasion of Ukraine.

Negotiated to facilitate shipments of grains from specified Ukrainian ports to the World’s poorest importers, reliant on Black Sea grains to feed their populations.

According to the UN, over two thirds of grain shipped through the deal has been destined for the poorest and developing nations.

On Monday 17th July 2023, the latest renewal date for the agreement to be extended, Russia announced its withdrawal from the accord with immediate effect.

Russia’s withdrawal did not come as a huge surprise, given their consistent protestations about certain Western sanctions, which they demand be retracted, in order to ease their own agricultural exports.

Global concern for food price rises is causing much diplomatic discussion, with no solutions apparent more than a week after the agreement’s collapse.

Wheat Market Reactions

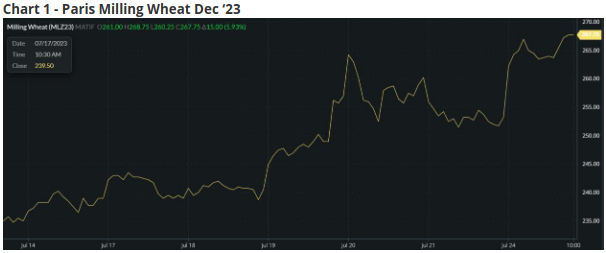

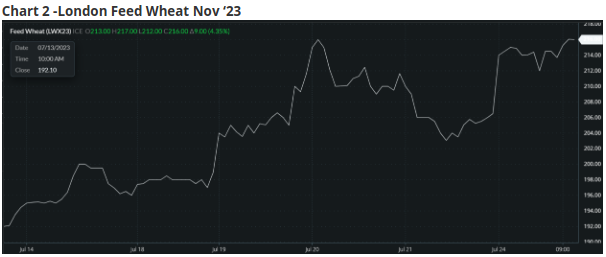

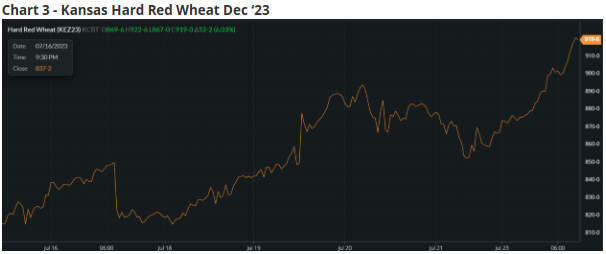

Reaction to the news on Monday last week has seen a volatile time on the World’s wheat markets, as shown in the charts below.

Source Barchart Commodityview

The lead up to the news of Russia’s withdrawal from the agreement and the initial reaction was slightly bullish, with a quick reversal downwards as the market was wary of an overreaction to what was considered an unsurprising outcome to the renewal process.

Nonetheless, various events since have been adding uncertainty to drive volatility, which looks like remaining in the short term.

Adding Uncertainty

As wheat market participants last week absorbed the initial news of the Black Sea Grain Corridor Agreement collapse, more news surfaced to compound the anxiety and drive prices higher.

Within days, firstly Russian and subsequently Ukrainian authorities, stated their intention to consider all shipping heading to each other’s ports as military targets; assuming that they would be carrying military cargoes for the war effort.

The consequences of this could significantly reduce grain shipments from both countries if these threats are acted upon.

We can assume that for the time being, loading at and shipping from Ukrainian Black Sea ports will stop. The question is whether these threats to shipping will have any material impact on Russian shipping from the Sea of Azov and Black Sea ports.

Over the last week, Russia has begun a strategic and calculated operation to halt Ukrainian grain exports in any direction that they can.

This started with missile attacks on the important Ukrainian grain ports of Odesa and Chornomorsk. The aim of these, appear to be the destruction of portside grain silos and vessel loading infrastructure.

Not content with closing off Ukraine’s Black Sea ports, Russia has further escalated by commencing drone attacks on the Danube River export terminals close to the Romanian border. These are seen as critical export routes, including the Romanian port of Constanta, from where 7.5 million metric tonnes of Ukrainian grain have been shipped from January to June 2023.

The turmoil caused is most certainly not leaving much optimism for the world’s major importers of Black Sea grains, all of whom need a quick resolution.

The Winners and Losers

Ukraine

As the devastation of Russia’s invasion continues, Ukraine is again the biggest loser.

Resilience is key to avoid defeat and the grain export problems will persist until Russia is backed into a corner from which they have to negotiate and compromise. In the meantime, wheat exports through neighbouring countries will have to struggle on as best they can.

Russia

There are those suggesting that the Russian’s are the immediate and short-term winners out of the current situation.

- Prices have risen, thus Russian sellers obtain more for their produce being exported.

- Russia’s president Putin, has a desire to blackmail the western democracies into relaxing sanctions on Russia’s economy, in particular use of the ‘Swift’ payment system.

- Russia’s Foreign Ministry spokeswoman, Maria Zakharova, stated last week that ‘the UN still has three months to achieve concrete results’ in respect of Russia’s demands. Providing that these are satisfied ‘we will return to the discussion of this issue’ (the Black Sea Grain Corridor Agreement).

- Putin is attempting to appear to be the ‘good guy’ by suggesting that Russia will continue to provide cheap and possibly even free wheat to friendly African countries in need of Russian exports.

Longer term it is hard to see how any prolonging of the Black Sea issues can help Russia.

- It’s unlikely that there is political will to back down to Putin’s demands in the West.

- Providing cheap or even free wheat to the countries considered ‘friendly’ to Russia, ie those not condemning their invasion of Ukraine, will become increasingly difficult as time goes on; both logistically and economically.

- It is likely that the big political players, such as China and India, are going to find it harder to stand by and support Putin as he creates yet more global disruption.

- If Ukraine can instil uncertainty for ship owners to reduce Russian exports through the Black Sea, there could be a significant backlash for Putin, both at home and abroad as Russian businesses struggle with the fallout.

China, India and Russia’s Friendly Countries

For these countries, Putin’s actions seem likely to:

- Add political pressure from the majority of the world’s countries who are condemning the war

- Disrupt the economies of Russia’s ‘friends’ at a time when there is a need for global economic stability.

- Leaders of poorer nations reliant upon Russian food imports may fear internal political instability if food availability or prices return to the top of concerns.

The Rest of the World

There are only losers in the rest of the world as:

- Populations continue to finance support for Ukraine in its war effort.

- Experience the increasing potential for global conflict and security worries.

- The wider impacts for food and economic stability.

The Solutions

Considering how the demise of the Black Sea Grain Corridor Agreement is overcome depends upon political will and diplomacy.

China could play a pivotal role, together with appropriate words from the likes of India and African nations. These are the only players who have real influence over Russia’s president Putin in the short-term.

The simple facts are that:

- The World’s poorest populations need feeding.

- Tensions surrounding food, as we saw in the Arab Spring uprisings in 2010/11, show that a major disruption to the global wheat supply chain by Russia is not an option.

- China is now the World’s largest wheat importer and will actively seek a stable market.

- Russia is the largest wheat exporter and needs to maintain this trade for Putin’s own internal ambitions.

There will no doubt be much political sparring over coming weeks, but Russia has given the UN three months to resolve their demands.

The West will likely work with the UN and Turkey to give assurances for Russia’s agricultural exports and possibly intermediary financing banks to ease these concerns.

Russia needs the Black Sea for exports more than Ukraine, thus they have a definitive need to keep shipping active in the region.

Conclusions

Russia has a definitive requirement for its own wheat and agricultural exports to continue.

China, India and African leaders will no doubt apply their own private pressures to President Putin to seek solutions.

Wheat is grown on more acres than any other crop in the World. A smooth-running supply chain is critical to feeding the masses.

The global political will to resolve movement of wheat through the Black Sea will ultimately overcome the hurdles.

Pressure will be brought to bear where needed and the probability is that Ukrainian wheat will move once again in the coming weeks, with or without President Putin’s agreement!