Insight Focus

- We think China will buy 4.5m tonnes of raw sugar in 2023.

- This would make it one of the world’s largest raw sugar buyers.

- Most of this demand is likely to appear in H2’23.

China Moves the Sugar Market

China is one of the largest buyers of raw sugar in the world.

When and at what price Chinese refiners choose to buy sugar is therefore hugely important for the market. In 2022 they defined the bottom of raw sugar’s price range, repeatedly buying raw sugar below 17.50c/lb.

Source: Refinitiv Eikon

In this article we look at what they might do in 2023.

How Much Raw Sugar Will China Import in 2023?

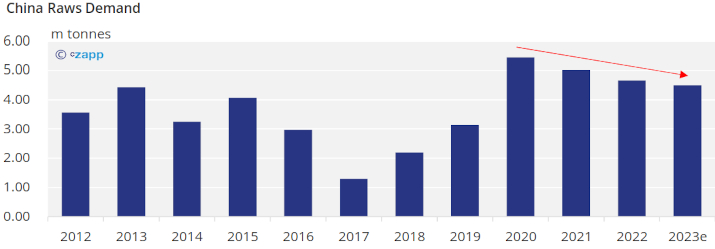

We think China will import around 4.5m tonnes of raw sugar in 2023.

This would be the third successive year of decline in raws demand, thanks to high in-country sugar stocks. However, 4.5m tonnes is slightly above average annual imports for the last decade.

As always, Chinese raw sugar buying will be price dependent: if raw sugar futures are too expensive refiners may not import the full 4.5m tonnes.

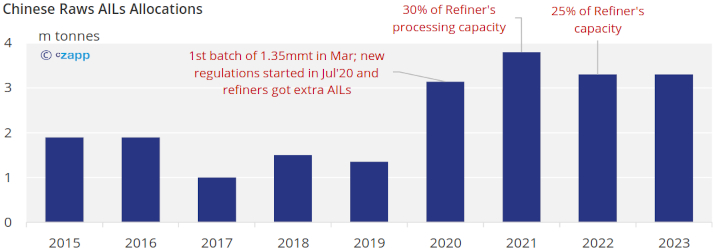

Crystallized sugar imports into China require government approval. The government issues a sugar import quota each year of 1.945m tonnes. Sugar entering under quota pays 15% import duty.

Sugar can also be imported out of quota at 50% duty, but the government controls how much of this sugar can be imported by issuing refiners with licences, referred to as “AILs”.

When Will China Buy Raw Sugar?

Refiners submitted their applications for quota in October/November 2022. The government usually approves applications in March/April, once the local cane harvest has finished.

AIL applications are usually also approved at some point in Q2 each year and last year were set at 25% of the refining sector’s nameplate capacity. We think this will continue in 2023, meaning around 3m tonnes AILs will be issued.

Bulk shipments of raw sugar towards China are likely to begin at roughly the same time as the new Centre-South Brazilian cane harvest, from May’23 onwards, once government approvals have been given.

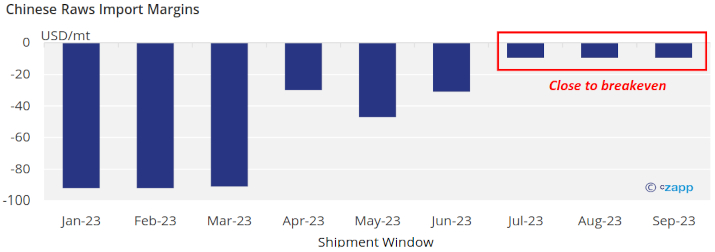

The backwardation in the raw sugar futures is another reason why Chinese raw sugar demand may be higher in H2’23.

Import margins in H2 are currently much better than H1 – they are close the breakeven. Current prices for the later 2023 futures contracts might already be approaching levels which stimulate buying from Chinese refiners.