Insight Focus

Adverse weather and disease threaten Thai cassava supply. Farmers are adapting with pest management and crop diversification to stabilize yields. Chinese demand will continue to play a critical role in shaping future cassava price trends.

Thai Cassava Farmers Face Challenges

Thai farmers are struggling with the weather. The recent El Nino which is coming to an end could still mean some areas of Thailand receive less rainfall than usual, especially in the north of the country. A possible transition to La Nina could then mean heavier rainfall towards the end of the year.

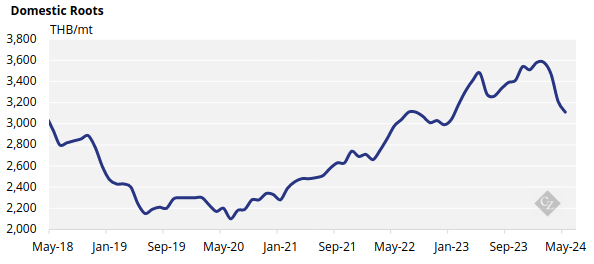

Cassava farmers have also had to contend with an outbreak of Cassava Mosaic Disease (CMD), which leads to lower yields. Consequently, the Thai Tapioca Trade Association (TTTA) has reported that the crop yield might be smaller than expected this year, potentially driving prices up.

Additionally, given the record high cane prices, some farmers have switched to planting cane instead of cassava, adding another layer of complexity to the supply dynamics.

Farmers Intensive Efforts

Farmers are adopting integrated pest management practices to combat cassava mosaic disease. This involves using disease-resistant cassava varieties, applying biological controls, and maintaining field hygiene to prevent the spread of the disease.

To reduce the effects of drought, they are prioritizing effective water management through irrigation and conservation practices. Organic fertilizers, crop rotation, and intercropping help to maintain fertility and decrease pests.

Some farmers are diversifying their crops, planting both cassava and cane, to hedge against market fluctuations. This strategy not only ensures a steady income but also helps in maintaining soil health through crop rotation.

Demand Dynamics

Cassava remains a staple in many Thai dishes. Changes in consumption habits can influence demand, as can the demand from businesses such as starch and bioethanol production.

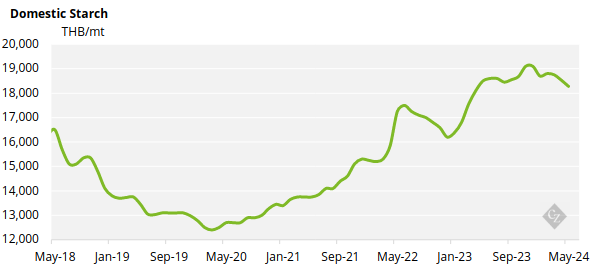

Key importers of Thai cassava, especially China, play a crucial role. Rising demand from China may cause prices to rise. Favourable trade policies between Thailand and importing countries can increase export volumes. Despite these influences, recent trends indicate a downward trajectory in cassava prices since early this year, expected to continue into Q3.

The Influence of Chinese Demand

China’s demand for cassava starch, used in food products, textiles, paper, and adhesives, is a major driver of Thai cassava prices. Increased demand for these products can lead to higher cassava imports. Additionally, cassava is essential for bioethanol production in China, with policies promoting renewable energy and biofuels driving up demand.

If China faces domestic challenges, it will likely increase imports from Thailand to meet its needs. Fluctuations in the exchange rate between the Chinese Yuan and the Thai Baht can also affect the cost competitiveness of Thai cassava, making it more attractive to Chinese buyers when the Baht is weaker.

Conclusion

The intricate dance between supply-side challenges and farmers’ efforts, coupled with demand dynamics from key markets like China, paints a complex picture for Thai cassava prices. Continuous monitoring of these factors, especially China’s industrial and trade policies, is essential for accurate predictions. If Chinese demand remains strong due to industrial needs and favourable trade conditions, it is likely to support higher cassava prices in the Thai market in Q4. Conversely, any reduction in demand or increase in domestic supply within China could temper price rises.

Farmers’ relentless efforts to sustain and boost cassava yields amidst these challenges are crucial. Their innovative practices and adaptability not only secure their livelihoods but also stabilize the market, ensuring that cassava remains a viable and profitable crop in Thailand.