Insight Focus

Raw sugar rallying again on enormous volume. Prices now above all key technical indicators. Speculators have plenty of room to push the market higher.

Big Move Higher On Huge Volume

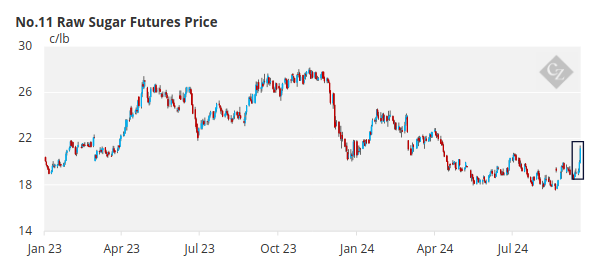

Raw sugar futures soared by 118 points (V’24 contract) on Wednesday.

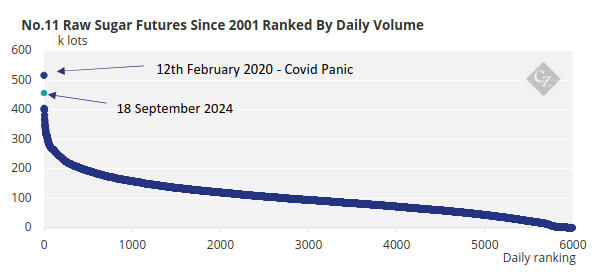

What’s more extraordinary is the volume that was traded: out of over 6000 trading days since 2001, this was the second largest daily volume (across all active contracts), second only to mid-February 2020 when the threat of Covid was causing panic across all markets.

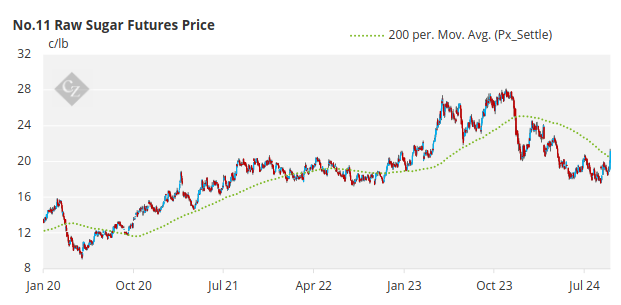

On the technical side, we’ve broken the 200dma after hanging on to the 100dma in spot raw sugar contract (V’24). TheeRSI (Relative Strength Indicator) and the MACD (Moving average convergence/divergence) are both overbought.

We’ve flagged the risk of the market moving higher repeatedly in our Market View reports in recent weeks. Hopefully the strength isn’t a major surprise given the cane crop problems in CS Brazil, even if the severity of the move is! For example, here’s how the Market View published yesterday morning began:

And here’s the opening commentary from the week before:

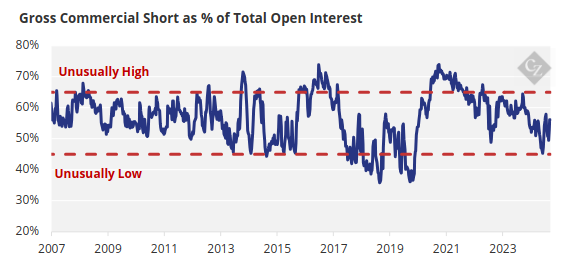

Given the high volume, we think some the buying was involuntary: perhaps mill buybacks triggering speculative short covering, for example.

We know that many raw sugar end-users are extremely well-hedged and so don’t need to chase the market higher in the short term. The commercial long position in raw sugar is 41% of open interest, a level only previously exceeded in Q2’2020 when the raw sugar market was below 10c/lb.

Consumers bought plenty of this cover below 20c/lb, which gives them a bit of flexibility.

We believe that most of the major sugar trade houses are also now bullish, with Wilmar reversing their bearish view in the middle of this year.

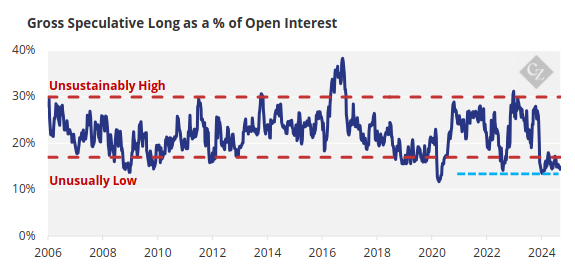

This means that the speculators will have quite a lot of influence over what happens next. At the moment they have the lowest long position as a % of open interest that we’ve seen since the COVID panic of Q1’2020. It’s as low as it was during the financial crisis panic of 2008.

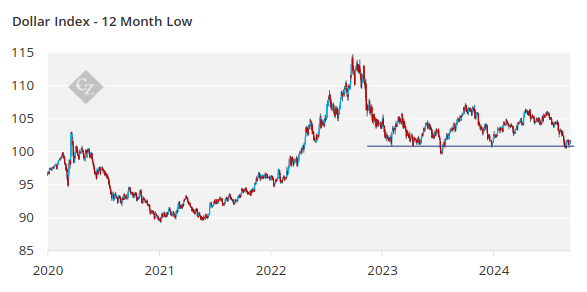

This gives speculators a lot of room to buy sugar in the short term, and the severity of this week’s move could well tempt momentum traders and trend followers into the market. This might be helped by the recent Federal reserve 50bps rate cut, the USD being close to 12-month lows and recent ongoing strength in the coffee and cocoa.

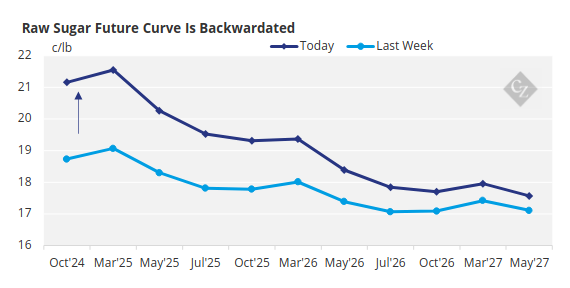

From a sugar market point of view, most analysts think the market will be undersupplied in Q1’25. It’s possible that the 2025 backwardation will be enough to reduce a bit of demand in in the coming months.

This week’s price action could open the door for a year-end rally towards 24c, especially if speculators come back to the market.

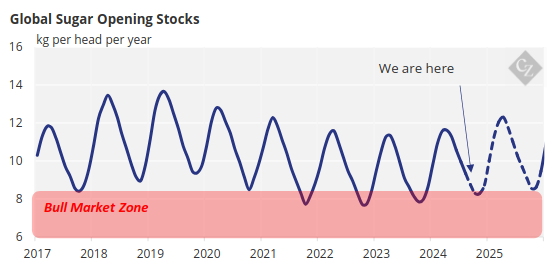

But for the time being we’re not getting too carried away. October is the global low point for sugar stocks each year, and stocks are slowly rebuilding following the drawdown of the early 2020s.