Insight Focus

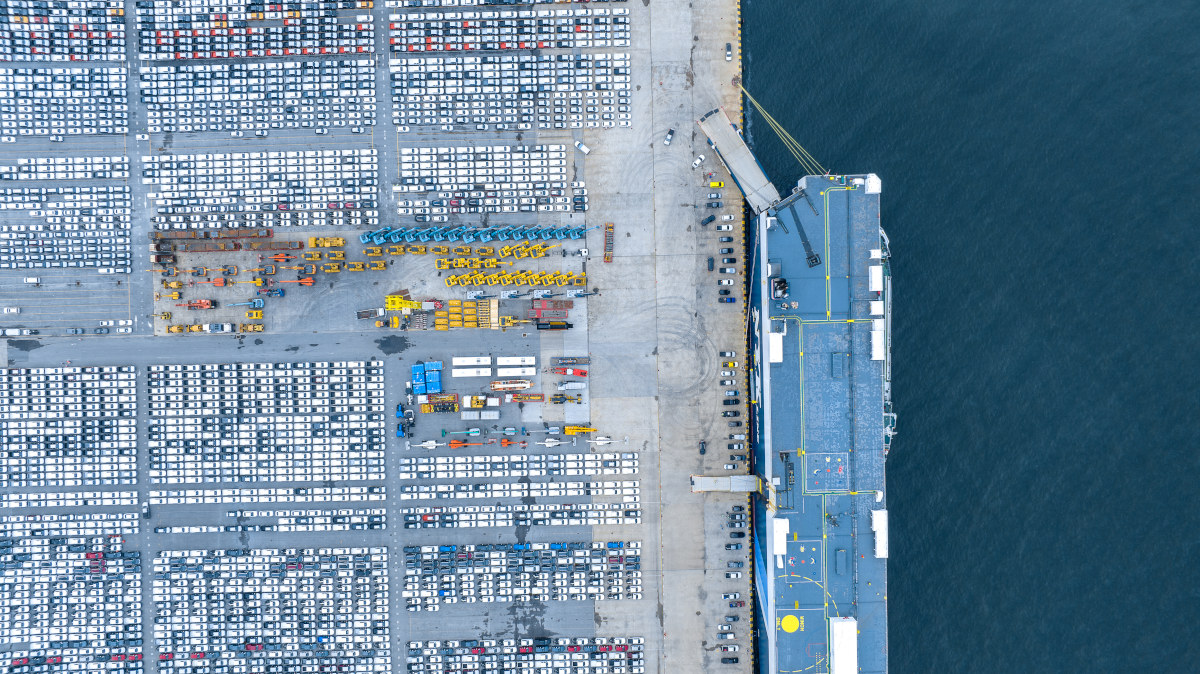

- The freight market has gone through a bumpy few years.

- After a historic spike from 2020 to 2022, the market is now under pressure.

- But there are a few reasons why this recession will be very different than the last.

Volatility Defines Freight Market

Because freight is dependent on supply and demand, it is hugely susceptible to the ups and downs of the global economy. It can often be seen as a barometer for consumer appetite. In fact, recessions often coincide with a drop in freight rates.

Note: Shaded period indicates recession

Source: St Louis Fed

As a recession looms, the market looks like it is under pressure and could potentially weaken even further. This came after a few years of higher demand than supply, which pushed up freight rates.

Note: Shaded period indicates recession

This demand was caused largely by higher consumer spending. When the Covid-19 pandemic began, a wave of global stimulus measures injected huge amounts of money into the global economy. The IMF estimates the amount to be around USD 9 trillion.

Because people had more money (and were largely unable to spend it on services due to lockdowns), demand for goods skyrocketed. The good times continued, with an almost 5% increase in seaborne trade during 2021 and 2022 compared with 2020 levels.

This demand for goods directly pushed up container demand but also indirectly affected bulk freight. With sky-high container rates, those exporters who were able to switch between the two were now requesting more bulk services. This higher drybulk freight demand in turn fed into higher prices.

More supply constraints were caused by Covid lockdown measures, such as port closures, lower staffing capacity, quarantine requirements and supply chain inefficiencies. Loading and unloading took longer with fewer staff so vessels were tied up for longer. There were also quarantine issues related to staff crossing international borders.

Now, there has been an increase in vessel availability as supply chain issues became more workable. Port congestion has declined significantly. We also know that congestion in ports has continued to ease, increasing vessel availability. Container rates have dropped, moving volume away from breakbulk, one of the key drivers of strength in 2020-2022.

A deeper global recession than anticipated will weigh heavily on sentiment and more interest rate hikes will also further hamper consumer appetite for goods.

This poses the question of whether we are now looking at a period of stagnation similar to the post-2008 period.

Supply Side Outweighs Demand Side

After a Black Swan event such as Covid, it is difficult to make predictions for the future. However, there are some factors that are bullish for the future market direction.

The primary difference between the recessionary period from 2008 to the one we are entering now is that we are in a fundamentally tighter supply environment with just 1.5% fleet growth in 2023, the lowest in 30 years.

During the period between 2005 and 2008 when freight rates were climbing, there was a flurry of new orders to try and meet demand. Finance was readily available during this period, and new shipyards were springing up every day.

But vessels take time to build and, as we can see from the chart above, this new capacity only began to come online in 2008 – right as the recession began to hit and demand declined.

This glut of new vessels meant the market was extremely oversupplied relative to demand and led to a 10-year period of stagnation for rates.

Now though, the situation is very different. Despite the new wave of demand from 2020 to 2022, new vessel orders have been at very low levels.

The main reason for this is new environmental regulations that are designed to reduce carbon emissions. The next few years will be a period of transition for the industry.

Because they knew these regulations were looming, shipowners in the past few years could not react to higher demand in the same way they did in 2005 – by buying more ships. This is mainly because they didn’t know what to buy. Even now, with so much uncertainty surrounding the legislation, there has been a lack of new purchases.

And as well as a lack of new orders, fewer vessels gave been scrapped, meaning the fleet is growing older. If there is a flurry of scrappage in the near future, the lack of new orders in the pipeline will restrict supply, pushing prices up.

Weak Chinese Demand Raises Concerns

Consumer spending is beginning to drop off as the global economy enters a downturn. One key demand driver – China – has been one major cause for concern for the shipping industry. Demand from China is one of the biggest factors in freight rate growth due to its huge population and astronomical growth.

In fact, China was almost single-handedly responsible for a huge commodities boom in the early 2000s as its economy expanded and demand rose. Demand was sustained by infrastructure megaprojects and the 2008 Beijing Olympics.

Source: World Bank

The Zero-Covid policy China pursued from 2020 to 2022 served to mute consumer spending, which was a problem for freight. After the policy was abandoned at the beginning of 2023, there were expectations of a huge demand surge, but so far performance has remained muted.

However, Chinese purchasing power is set to continue to increase over the next five years at leaast.

Source: IMF

Once China ‘re-enters the market’ we expect a significant uptick in demand. China is expected to push for growth with infrastructure spending though 2023.

Russia-Ukraine Poses Freight Wildcard

Another wildcard for freight rates is the Russia-Ukraine war, which has already greatly influenced rates. In fact, when the invasion began in early 2022, rates saw a bump due to a change in grain flows.

Ukraine and Russia are two of the biggest global grains suppliers Disruptions to these trade flows have decreased vessel efficiency, pushing up tonne-miles. This means more miles are travelled for the same amount of cargo, reducing availability and supporting rates.

And despite adverse impacts from the war in Ukraine, a large grain crop is anticipated, which is bullish for Panamax vessels but will in turn pull up Supramax and Handysize vessel rates.

There are however questions over Ukraine’s ability to export its wheat going forward. Tensions are starting to be seen in the Black Sea grain deal brokered between Russia and Ukraine. And Ukraine’s neighbours, such as Romania and Poland, have begun to push back against Ukraine grain exports, arguing that they are depressing local prices.

If the war does end, relations between Russia and the west are likely to remain frosty. This means we cannot expect trade flows to return to “normal” and adds to uncertainty going forward.

Concluding Thoughts

- There are many factors to consider when predicting how freight rates will progress.

- The impact of some situations, such as the war in Ukraine, are far more difficult to assess.

- The general sentiment in the freight market is optimism for market recovery, particularly in the second half of the year.

- While a demand dip is a concern, this recession looks very different to the last one for freight.

- In 2008, the price drop was caused by oversupply and low demand.

- A lack of new orders and uncertainty over emissions regulations compliance pose supply-side restrictions.

- With new orders requiring several years’ lead time, any higher demand from China or the Black Sea is likely to create more supply-side restrictions.

- Although demand is likely set to drop, tighter supply will limit freight price drops.

Key Questions for 2023 and Beyond

- Is it the right time to cover all freight for 2023/4 at current levels? No – the outlook remains uncertain

- Will we see volatility and spikes in demand through 2023? Likely Yes – the market remains sensitive to change

- Is the market likely to give more opportunity on the downside? Potentially yes – current sentiment is weak

- Do we think some coverage at current levels is prudent to manage upside risk? Yes – the upside risks could strengthen the market quickly and the market is at a relatively attractive level

How Can Czarnikow Help?

Czarnikow has developed a number of tools and structures to help manage forward freight exposure effectively. The key is to engage now so we can closely advise on an ever-changing environment and ensure the structures are in place so freight can priced or hedged when the time is right.