Opinions Focus

- US renewable diesel demand is supporting soybean oil.

- Indonesian palm oil stocks high following export ban.

- Asian palm oil doesn’t have a strong road fuel outlet.

What is going on with palm oil (price collapse) and more specifically palm’s relationship to soybean oil?

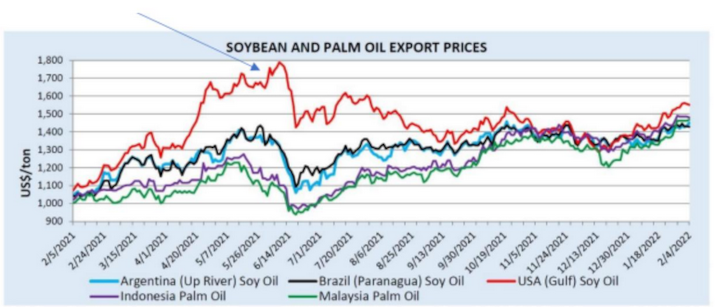

Remember back in the second quarter of 2021 when the soybean oil “price spike” occurred in what I will refer to as “the global vegetable oil markets welcome the US renewable diesel (RD) industry to the marketplace”:

This price spike led to a breakdown in the relationship of US soybean oil prices to global palm oil prices with US soybean oil eventually trading to nearly two times the price of Malaysian and Indonesian palm as a 6-month panic erupted over the US soybean processing industry’s capacity to meet new demands for soybean oil from the US RD industry.

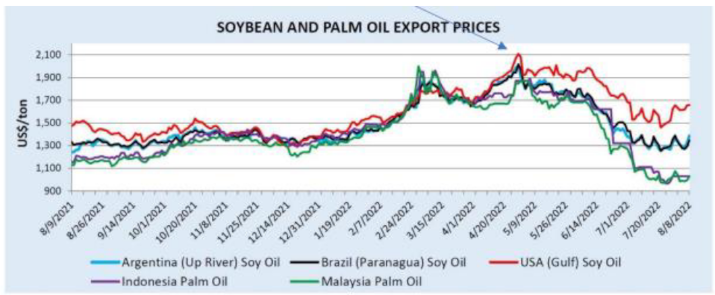

A second panic occurred again in the second quarter of this year but this time with US soybean oil and palm oil prices both rallying to new highs (other vegetable oils also achieved all-time record highs) led for the most part by soybean oil but with a few months of leadership by palm, i.e., no breakdown in the price relationship oils but instead a high correlation in prices.

But now, the right end of the below chart, the prices have again developed sharp differences with soybean oil priced again at two times the price of palm. What is going on?

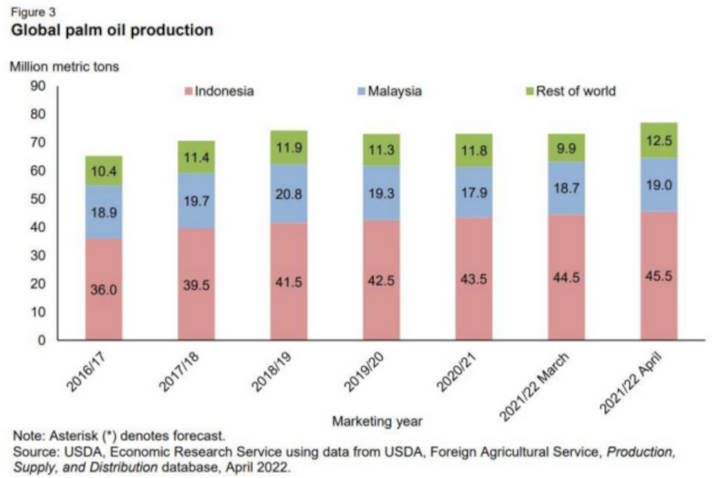

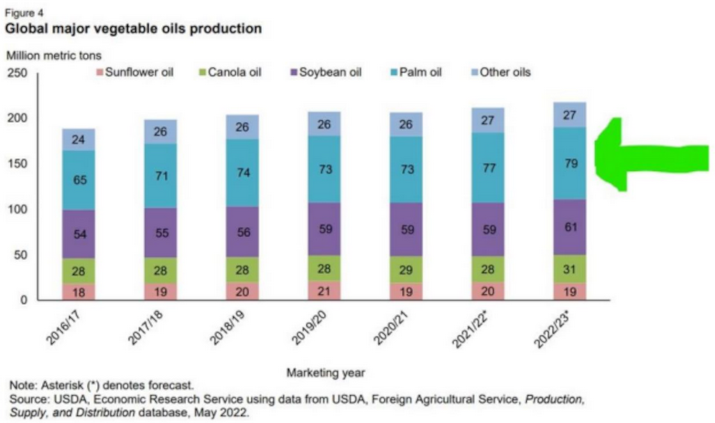

It is not unusual for palm oil prices, the number one produced vegetable oil in the world, to decouple from soybean oil prices, the second most produced vegetable oil in the world. The decouplings often occur due to policy changes by the Indonesian government which is contributing to the current palm price weakness. A failed government imposed export embargo earlier this year (at the frenzied peak) by the Indonesian government has resulted in a palm oil glut that needs to clear, i.e., the physical and financial capacity to carry palm oil inventories, mostly in Indonesia, has its limits so export embargoes cannot last very long (and are probably not a very good idea as global consumers just wait until the storage or the financing runs out). It could be, however, that there is something more “permanent” to the current decoupling that may be a new price trend that emerges in global vegetable oil prices due to US RD policy.

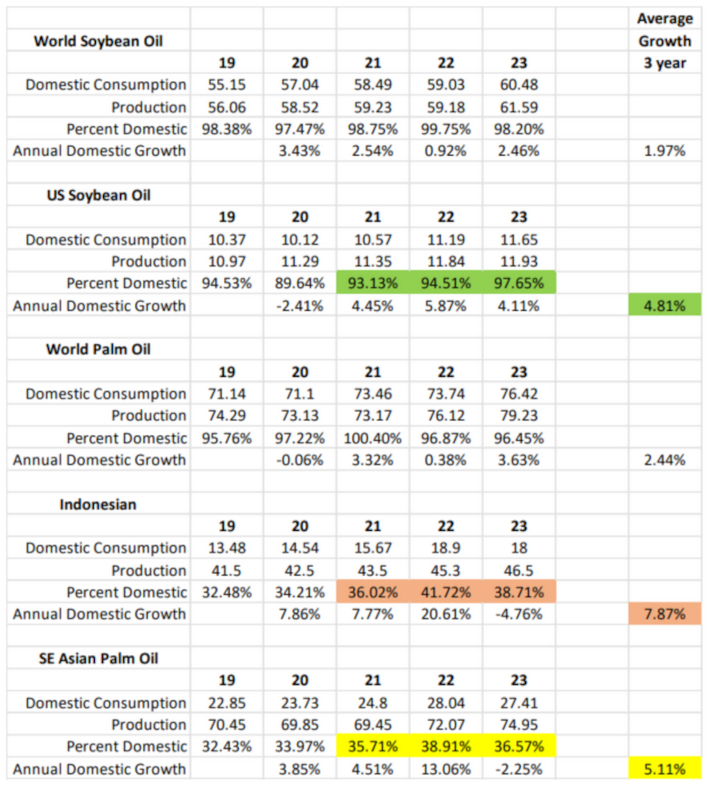

US RD policy is keeping a price floor under US soybean oil prices. The USDA forecasts that soybean oil demand for biofuel production, biodiesel plus RD, will approach a record 46.50% of total US soybean oil production in the coming year. This soybean oil “fuel” demand versus palm’s fuel demand (primarily Indonesian domestic biodiesel production) yields the following informative metrics:

- World soybean oil food plus industrial demand is growing at 1.97% on average for the last 3 years

- US domestic soybean oil demand growth, recently fueled by the RD industry, is growing way above world growth at a 4.81% average

- The US, with RD policy now in place, will now consume NEARLY all its soybean oil produced domestically at 97.65% of production with a trend toward 99% in coming years (no exports!)

- World palm oil domestic consumption is growing at a faster rate than world soy at 2.44%, BUT…

- The South East Asian total percent usage of palm, including the rapid expansion of Indonesian palm oil blends into diesel at 30% and moving toward 40%, consumes only 36.57% of total palm production with the rest going to FOOD consumption (domestic and but mostly exports)

- The following table is all expressed in million metric tons and comes from USDA forecasts

The Punch Line(s):

Palm oil, when supply exceeds demand, still needs to drop dramatically in price to find consumer food demand mostly in poorer countries because there is not enough global fuel demand for the supply

Soybean oil in the US, when supply exceeds demand, ….you get the point… just hard to paint that scenario today with insatiable demand from the RD industry for US soybean oil.

With the above, a new world order of soybean oil premiums to palm emerges and likely remains until RD policy changes.

A yawning, permanent price spread will separate the price of US soybean oil and global palm and the driver is US policy on biofuels, primarily from RD. Check your food labels and the ingredients your local baker is using and expect to see “made with palm oil” where you used to see vegetable oil (which is mostly soybean oil).

I leave the health implications and debates to the doctors and nurses.