Opinion Focus

Tensions in the Gulf have significantly risen these past days. Meanwhile, oil prices have calmed down. However, we know that it can change at any moment. With this report you can understand what it means if crude oil reaches USD 100, and how it could affect CS Brazil sugar production.

Tensions between Iran and Israel skyrocketed this week. Oil prices, not so much – at least not like when the war between Russia and Ukraine started.

Source: Bloomberg

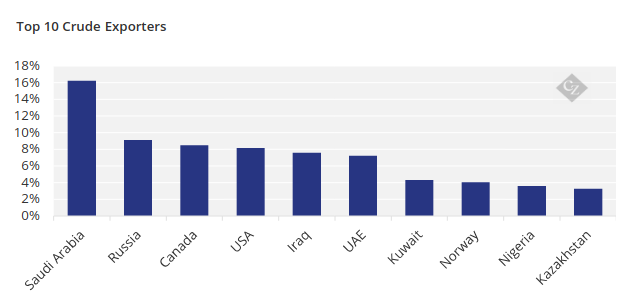

Iran is currently the 9th oil producer, is only the 52nd world exporter – 2022 data. Meanwhile, Russia is the 2nd world exporter, explaining why the Russian war had a larger impact on Brent prices.

Source: OEC

Still, any tensions in the region can quickly escalate and in consequence, oil prices can surge once again. The market has come down a bit and analysts are sceptical that the conflict could push oil prices above USD100/barrel.

That said, in an environment where we have seconds to make a decision it is good to understand the dynamics behind market variables. Still, at the present, we find it hard that war in the Gulf should be reflected in Brazilian ethanol prices.

First, Petrobras

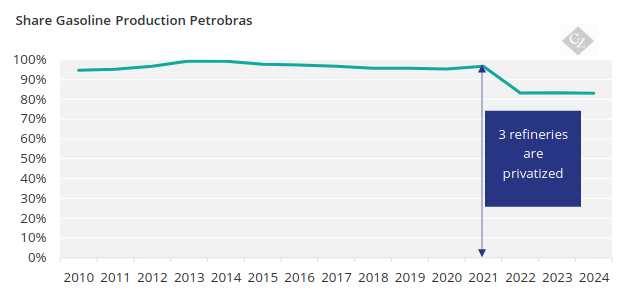

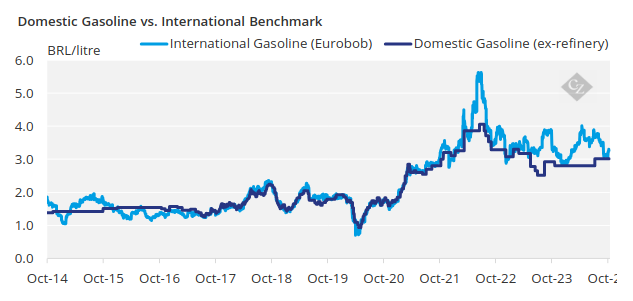

Petrobras produces over 80% of Brazilian gasoline. This means the company is a price maker, and therefore it is a benchmark for domestic gasoline prices – the remainder 20% of the market must follow the flow or lose sales.

Source: ANP

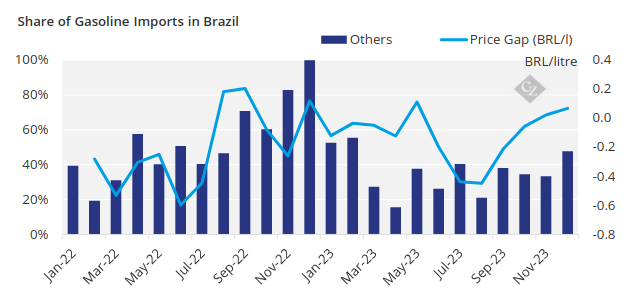

That was not a problem when the company started to follow the international prices as benchmark back in 2017, this meant that competition was a bit fairer – we can see other players becoming more active in importing gasoline.

With the change in Brazilian government, the company direction also shifted. The goal is not international prices anymore, but a more “local price reference”.

Still, even with the new price policy announced, the pressure remains to readjust prices whenever the parity becomes too wide.

What we see is a return to pre-2017, when readjustments were made once or twice a year. The summary is, do not expect external volatility to be reflected domestically.

In the next section we connect the dots, stay with me …

The Ethanol, Gasoline and Sugar Connection

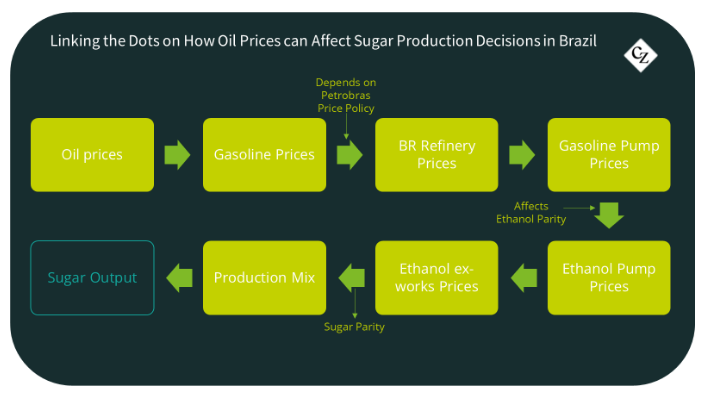

Why, you might ask, would a conflict in the Middle East be important for sugar mix decisions in Brazil. The summary of the link is:

A rise in gasoline prices means that ethanol can also rise without losing its competitiveness. Therefore, any readjustments cause by higher oil prices would benefit ethanol and push it closer to sugar prices – the so-called sugar parity.

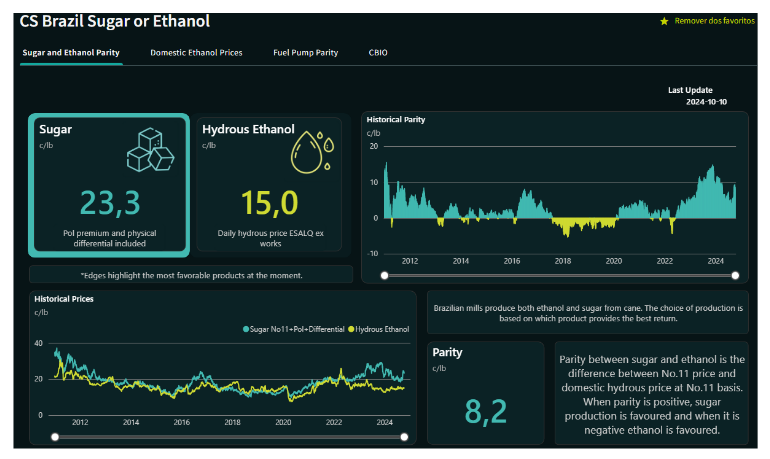

This dynamic is daily updated in our Business Intelligence section.

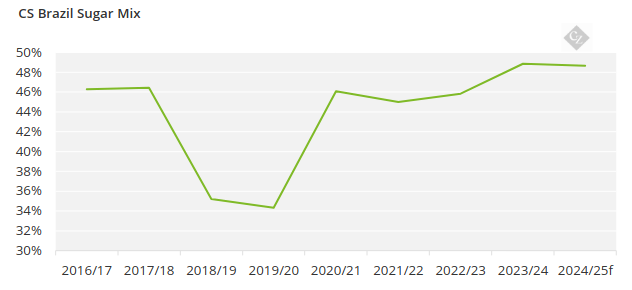

If ethanol prices have a better return, then producers will adjust production mix towards ethanol – reducing the sugar mix. This was seen both in 2018/19 and 2019/20 – coinciding with the change in Petrobras price policy, strong oil market and low sugar prices.

However, the parity for sugar is currently 800 points. This equals an ethanol over BRL 4.2/litre, which is a 70% increase from current values – highly unlikely.

Looking from another angle, so you can have a figure in mind, if oil prices reach USD100/barrel (and if and only if Petrobras makes a price adjustment), at this level ethanol would be 18c/lb on a sugar basis.

So, unless we see this happen to ethanol prices, combined with a fall in sugar as well, the sector will continue to maximize sugar production.