Insight Focus

Another record month of imports of liquid sugar and premix powders in August. Will the new import policy affect white sugar imports?

On 12th September 2024, the Government of China (GoC) announced that from 1st December 2024, it will implement a zero percent preferential tariff on all products from Least Developed Countries (LDCs) that have established diplomatic relations with China. This includes 33 African countries and 8 Asian countries. This policy only affects in-quota sugar imports.

Could New Policy Boost Up Imports of White Sugar?

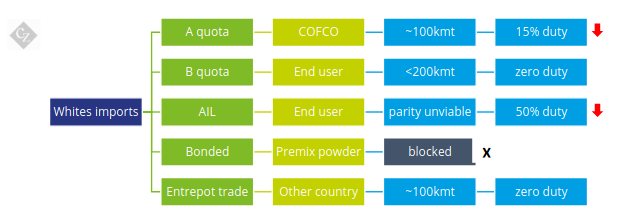

We think the impact on white sugar could be minimal. Chinese white sugar demand is categorized as below routes. The new policy has only a material impact on A quota imports. And those quotas are in the hands of one importer.

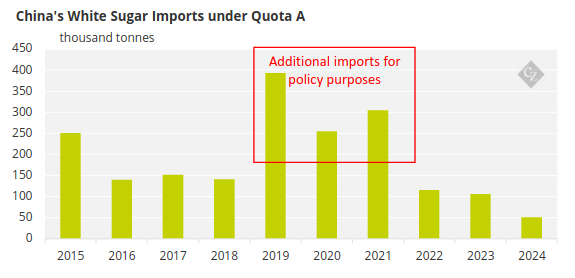

For A quota white sugar imports, the volume has decreased sharply since 2022. As we have explained before, COFCO has been adding sugar refining capacity in recent years, and is promoting its own refined sugar to end customers, so more quota allocation from white sugar to raw sugar can be expected.

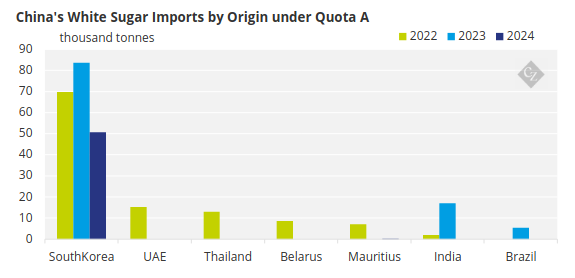

In terms of country of origin, most of this sugar is sourced from South Korea. This is more likely to be supplied to some customers who have special requirements for quality, and less switchable.

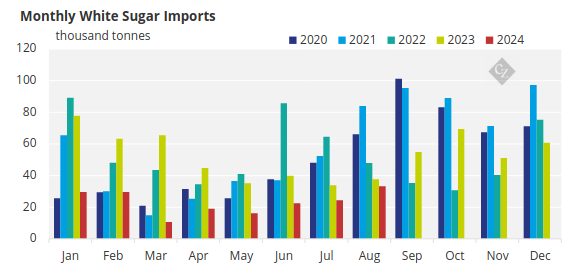

China’s sugar imports rose to 33.3kmt in August, still a historically low level for the same month. Imports in 2024 are still on our expected trajectory, estimated at around 350k tonnes for the whole year, half of the volume in 2023.

Elephant in the Room – Liquids and Premix

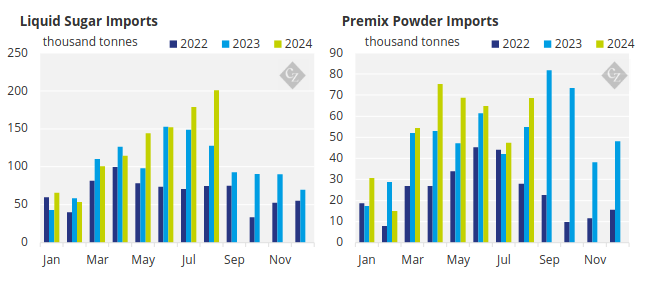

Almost every week I hear rumours that liquid sugar and premix are going to be regulated, new or old. But the data tell a different story. August imports hit a record for the same period. I put together a timeline of events related to both products.

- 2021 HS codes adjustment – new codes for liquid sugar and premix powder.

- Decision on Commodity Classification of premixed powder on Aug.24, 2022.

- QB/T 4093-2023 Liquid Sugar Industrial Standard come into effect on Jul.1, 2024.

- Regulations of sugar in CBZ come into effect on Jul.1, 2024.

The last one closes the trade flow of white sugar imports into the CBZ (and processed into premix powder for re-exporting to China). But the rest appeared to have no effect on direct imports of liquids and premix. Until there is a real change, we think this flow will continue.

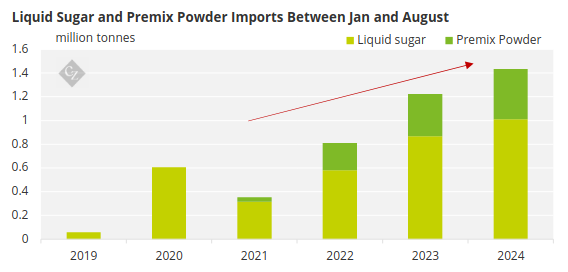

This brings cumulative imports of both products to 1.435 million tonnes in January-August 2024, gradually approaching our estimate of 2 million tonnes for the full year, compared with 1.8 million tonnes in 2023.

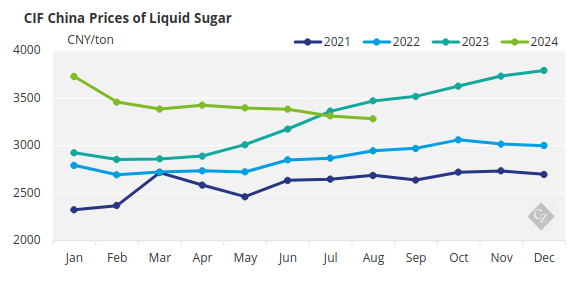

In August, the CIF price of liquid sugar dropped again, to 3284 yuan/ton. After tax, the dry weight price is about 5540 yuan/ton, compared with the white sugar price of 6300 yuan/ton in coastal areas in August, and the price difference of 760 yuan/ton ensures the profits of importers.

If anything is going to affect this import, the price is probably more likely. The surge in world market prices in September has caused import costs to soar sharply, which may cause difficulties for importers unless they have covered their demand in advance. But I learn that their purchasing paces are usually based on orders from domestic end users, who have typically been buying hand-to-mouth in the last 3 years.