Insight Focus

- PET resin export orders slow as prices fall and buyers reset global inventories.

- Plummeting ocean freight rates generate increased interest in Asian resin.

- Demand outlook remains clouded in uncertainty amid a volatile political and economic backdrop.

What Does Q4 Hold in Store for Asian PET Exports?

The demand outlook for Chinese PET resin exports is currently clouded in uncertainty.

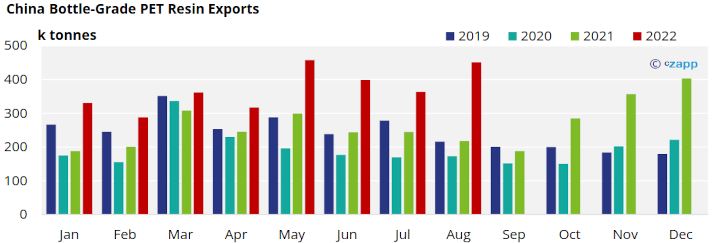

Having received record export orders through Q4’21 and Q1’22, Chinese PET resin producers spent much of the first half of the year trying to ship orders they had in hand.

China was able to record high exports in H1’22, with more than 2.15mmt shipped (up 45% YOY). This was achieved despite navigating COVID-related disruptions and port closures (see latest trade report).

New bottle-grade PET export orders have fallen sharply since August, with resin availability lengthening, despite August’s export shipments continuing to far exceed previous years.

Major Chinese PET resin producers are still offering volume for October and November shipment, in stark contrast to earlier in the year when producers were oversold,

A repeat of last year’s surge in Q4 exports is looking increasingly unlikely.

Buyers Reluctant to Purchase in a Falling Market

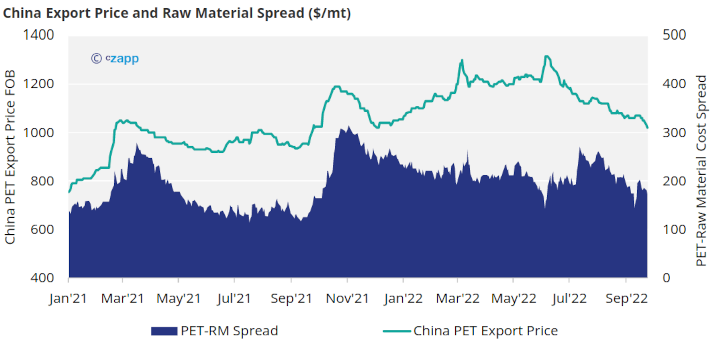

Since the beginning of August, China FOB prices have fallen by an average of USD 130/tonne and continue to steadily decline on a weekly basis.

With future raw materials prices backwardated into Q1’23, further PET resin price reductions are expected (see latest PET Raw Materials Futures report).

Chinese producers are already offering December forward prices at a USD 20-30/tonne discount to current values and export margins look set to narrow further.

The projected drop in PET resin export prices, combined with an uncertain global demand outlook, is resulting in a reset in global inventories, with buyers drawing down on stock ahead of any potential recession.

Rising interest rates also mean that FMCG companies will be seeing a real cost increase associated with holding and funding higher stocks.

However, short-term stock adjustments may not in themselves lead to reduced overall demand, but may simply delay pre-buying.

Container Rates in Free-Fall, Buyers Still Risk High Demurrage Costs

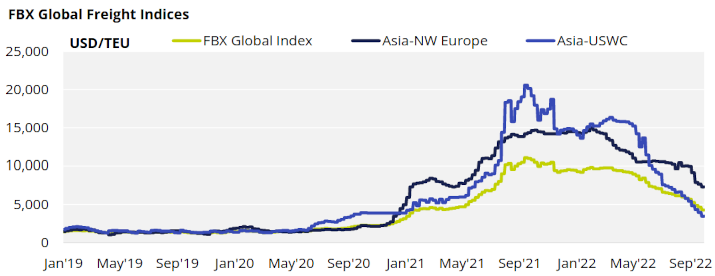

Whilst demand uncertainty may be changing inventory patterns, the ocean freight market has been in near-free fall over the past month.

Container demand has slumped on rising inflation and recession fears, with boxes more readily available than they have been for a long time.

Even in the run up to China’s National Golden Week holiday, which would traditionally see container demand increase, rates have continued to drop, with Asia – Northern Europe rates have fallen 5% on the week.

In response, carriers are starting to cancel sailings with the highest levels of blanked capacity, and according to some shipping analysts, may prompt a new floor for spot rates in the coming weeks.

The about-turn in freight rates will undoubtedly generate increased interest in cheaper Asian resin.

However, whilst lower ocean rates are being cheered by importers, logistics into many key markets is still challenged by congestion and labour disputes.

As a result, delays and high demurrage fees may take the shine off some of these bargain rates.

USD Strength is Counteracting Gains from Lower Freight

Whilst the collapse in ocean freight favours PET resin imports, the relentless surge in the US Dollar has eroded some of the competitiveness of US denominated imports, particularly in Europe.

Source: Refinitiv Eikon

Since the double bottom in H1’21, the USD Index has leapt by nearly 30%, hitting a new 20-year high in late September.

The supercharged US Dollar not only reduces import competitiveness but is also impacting production costs for PET resin producers importing Asian PTA and MEG feedstock.

At least in the near-term, a strong US Dollar will provide resistance to increased Asian PET export demand.

Conclusions

- Implosion of freight rates on their own may not be enough to kick-start the somewhat sluggish export demand out of China.

- However, whilst current market sentiment is overtly gloomy, economic prospects within many of China’s key export markets continue to steadily recovery from the pandemic, supporting future PET demand prospects.

- The removal of EU Generalised Scheme of Preferences (GSP) on Indian PET resin in Jan’23 is also expected to enable Chinese producers to expand market share into the region.

- Therefore, export demand may simply find itself delayed into Q1’23 when prices are expected to stabilise and the outlook for 2023 becomes a little clearer.

- However, potential demand losses are expected to result from a further deterioration of the Russian economy, China’s largest Pet resin export market, and the restart of JBF RAK’s PET resin facility in the UAE, due to begin early Q1’23.

Other Insights That May Be of Interest…

Plastics and Sustainability Trends in July 2022

European PET Market Stumbles as Producers Left Blind on Costs

PET Resin Trade Flows: China’s PET Exports Surge as Logistics Ease Post-COVID

Asia PET Market View: Chinese Consumption Rebound Drives New PET Orders