Insight Focus

- Record high wheat prices encourage farmers to improve husbandry and maximise planting.

- China’s push for food security with today’s high prices could mean we see expansion there.

- China should still import wheat, with Russia the favoured origin.

Russia is the world’s largest wheat supplier, but its exports have been hit by sanctions and logistical disruption around the Black Sea. Global wheat prices have surged to record highs in response. China produces around 137m tonnes of wheat each season, but with domestic prices hovering around 3,200 RMB/tonne (502 USD/mt), farmers may plant more. Wheat imports have been more expensive than domestic wheat since last July, further incentivising expansion.

How Feasible is Chinese Wheat Expansion?

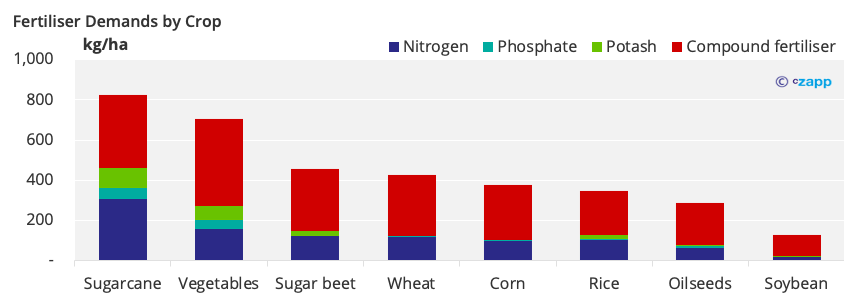

Whilst China’s farmers may be tempted to plant more wheat, it is a nitrogen-intensive crop, so today’s high fertiliser prices could limit the feasibility of expansion. This is especially relevant as flooding across Northern China last autumn means the winter wheat will need more fertiliser this spring.

Sugarcane and vegetable plantings could also be hit as they demand even more fertiliser than wheat. That said, vegetables pay 10 times that of grains so we don’t think China’s farmers will switch from vegetables to grain crops. Soybean could be favoured, however, as it requires less fertiliser.

On the other hand, fertiliser may not be an issue for China as it’s self-sufficient in nitrogen and phosphate fertilisers, sourcing only potash from Canada.

In addition, the Central Government has recently allocated USD 3.2 billion in subsidies to ensure a high level of grains production. On top of this, it’s allocated an additional USD 254 million to help winter wheat yields as heavy rains delayed planting last Autumn.

How High Will Wheat Returns Be?

China’s farmers should receive 14,000 RMB/ha (2,222 USD/ha) for their wheat this season, up 4,718 RMB/ha (743 USD/ha) from 2020.

Whilst returns are up, they’re still low compared to other crops, such as vegetables, which offer 100,000 RMB/ha (15,873 USD/ha).

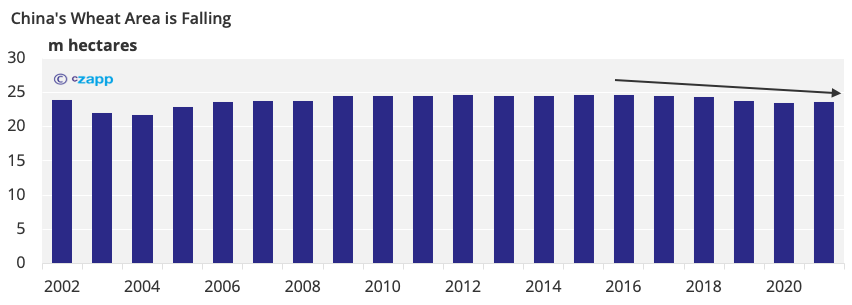

China’s wheat area has been falling for the past four years on the back of these poor returns. Disease, flooding, and labour shortages have also hindered expansion.

It’s Not All About the Money, Though

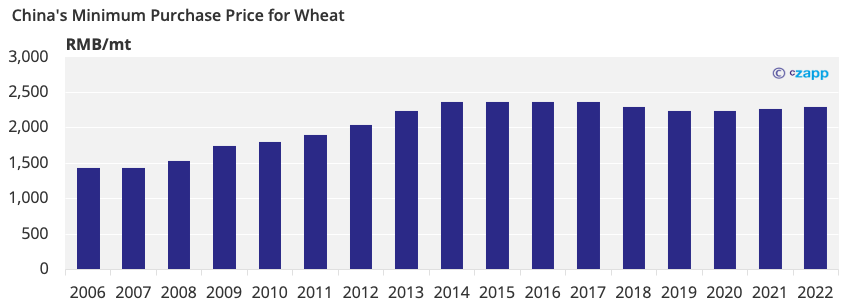

Although wheat returns are comparatively poor in China, production is largely driven by government policies.

COVID-19 highlighted the importance of food security in China. To ensure grain supply and improve quality, the government designated specialised farmland for grains production as wheat is one of its most important food staples.

The government also guarantees a minimum wheat purchase price, full cost insurance and income insurance and subsidies for agricultural supplies including fertiliser, seeds, mechanisation, etc.

All of the above will be increased this year, with more than 60% of the insurance fee being covered by Central and Provincial Government subsidies.

Will Wheat Take Area from Sugar Crops?

Unlikely. China’s winter wheat is often multi-cropped with summer corn, summer soybean or rice in the south, not competing with sugarcane as the crops demand different conditions.

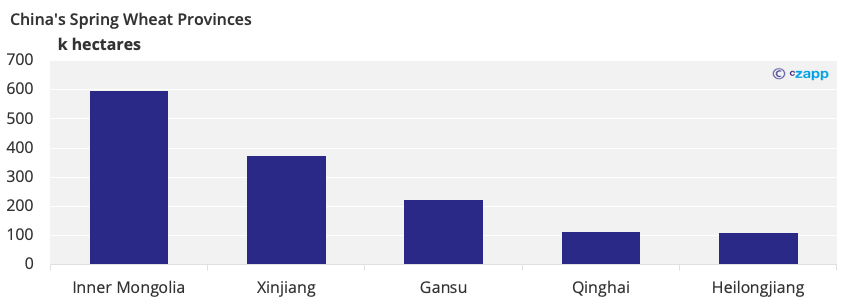

Its spring wheat is rotated with corn, soybean, or sugar beet in the north. Spring wheat acreage could perhaps increase with high prices and government support policies encouraging farmers to plant more. Sugar beet should still form part of the rotation, though.

Concluding Thoughts

- With wheat prices and government policies pushing for food security, China’s wheat acreage could climb.

- High prices should only impact spring wheat, which accounts 5% of China’s total wheat production.

- Any changes should therefore be pretty insignificant in the grand scheme of things.

- China will still need to import wheat and is now open to Russian grain, which may be difficult to sell elsewhere.

- This is because of China’s neutral stance on Ukraine and its land border with Russia.

Other Insights That May Be of Interest…

Russia Invasion Could Boost China-Russia Trade Flows

Black Sea Sugar Freight Suffers Little War Disruption

Is ‘Fortress Russia’ Self-Sufficient in Sugar?

Explainers That May Be of Interest…