- A further interest rate rise in the US becomes the latest in a trend of rate increases globally.

- In this week’s Ask the Analyst, we discuss how this could affect commodity supply chains.

- If you’d like us to answer one of your questions in an upcoming edition, please email will@czapp.com.

Federal Funds Rate Set to Rise

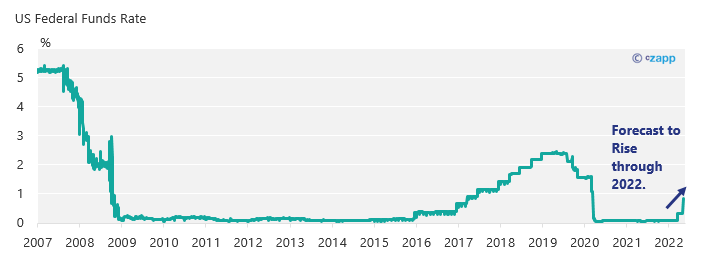

Federal Reserve Chair Jerome Powell has raised the US Federal Funds Rate by 0.5% in response to higher inflation increasing the cost of living.

This is second increase this year since the COVID-19 pandemic brought rates back down to near-zero two years ago.

Several other central banks are currently undertaking similar moves, with the Bank of England announcing this week that interest rates would rise to 1% (the highest in over a decade), and the European Central Bank also expected to increase rates during 2022.

These will help limit the risk of the US dollar becoming out of sync with sterling and the euro.

What This Could Mean for Supply Chains

A rise in a country’s primary interest rate makes the cost of borrowing from their central bank more expensive for banks and other financial institutions.

These costs are then passed on to other companies who borrow to help finance their business.

For those along the commodities supply chain, higher interest rates generally increase the cost of renting storage space and holding stock. This deters demand by making buyers less keen to hold stock and thus can be bearish for price in the longer term.

Likewise, financing hedges and trades becomes more expensive in a higher interest rate environment, potentially reducing the appetite of traders and risk managers – also bearish for price.

Existing Disruptions

As we have covered in detail by now, managing global supply chains is a different challenge to what it was just a few years ago.

Disruptions from regional COVID lockdowns coupled with Ukraine’s limited ability to export key crops, and sanctions on Russian goods and services means we are beginning to see a shift away from the Just-in-time model preferred throughout much of the last half century.

Consolidating supply lines, reshoring, and increased stock holding is becoming more prevalent now there is less certainty over goods being able to navigate the globe smoothly.

This is at odds with traditional logic that rising interest rates encourage reduced stock holding.

Whilst the effects of changing interest rates take time to materialise, participants in commodity supply chains may have to balance maintaining a reliable flow of goods in a disrupted world, alongside increases in the cost of the credit enabling them to do so.

How Can We Help?

If interest rates are forecast to rise through 2022, this will increase the cost of finance, potentially leaving market participants exposed to increased credit costs later in the year. Czarnikow has the ability to lock in this cost now to protect against future rises in interest rates.