Insight Focus

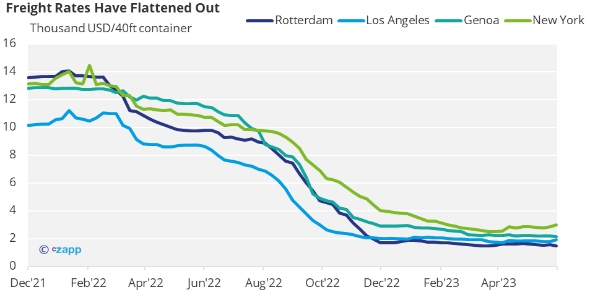

- Container freight rates have been in freefall for a year and a half.

- The usual period of higher demand in late summer could boost rates.

- But this year, a looming recession could mean there is no summer peak.

Container Trade Flattens Out

In 2021, the conversation in the freight market centred around supply chain blockages. Retailers could not import products quickly enough to satisfy consumer demand.

But as these issues began to smooth out in 2022, freight rates began to plummet. Between May 2022 and May 2023, rates have dropped by about 80% from around USD 10,000 per 40 foot container to about USD 2,000 per container.

Source: Drewry

The glimmer of hope on the horizon remains in the form of a higher demand period in late summer. During this period, retailers tend to restock dwindling inventories. But this year is a little different.

Inventory Woes Hang Over Market

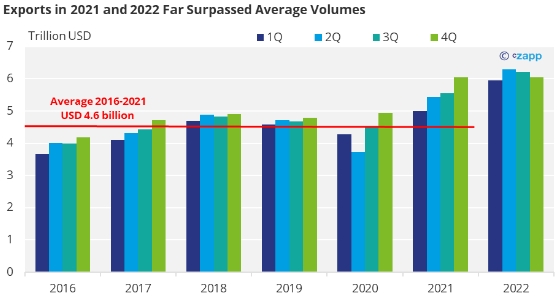

In the past year or so, having learned hard lessons from 2020 and 2021, retailers have been on a restocking mission. In fact, global exports in 2021 and 2022 significantly exceeded the average volumes of the previous five years.

Source: WTO

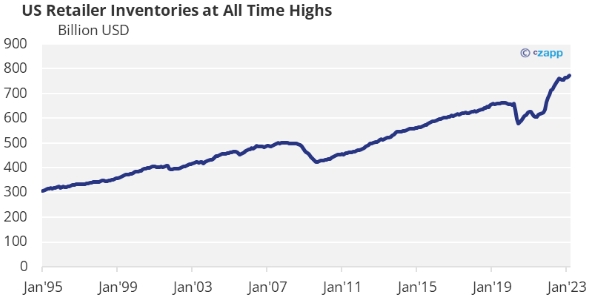

And now, retailers have full warehouses. According to the St. Louis Fed, inventories in US warehouses are at over USD 770 billion – a far higher level than has been seen in previous years.

Source: St Louis Fed

In fact, inventories have been growing since early 2022 and don’t look set to drop.

Source: St Louis Fed

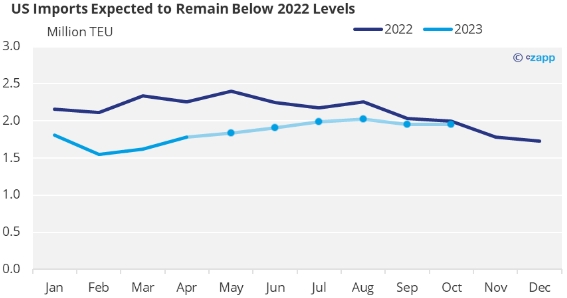

As a result, US imports are expected to remain below 2022 levels for the third quarter of 2023.

Source: NRF/Hackett Associates Global Port Tracker

Recession Threatens Demand Dip

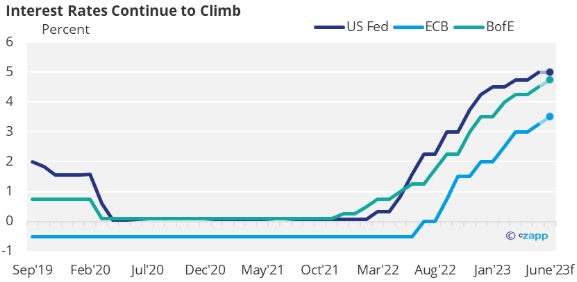

If warehouses are already brimming, this poses a threat to the hopes of a container freight rebound in late summer. Of course, if retailers can offload a lot of inventory, there will be no problem. But that doesn’t look like it will happen as consumers tighten their belts.

Source: US Fed, ECB, BofE

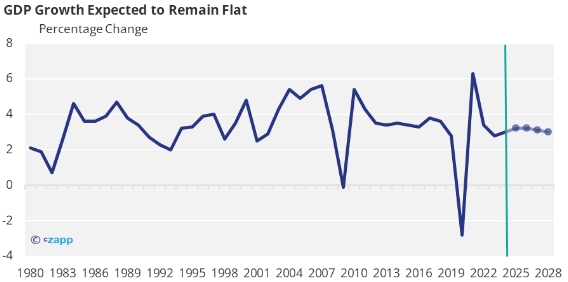

A series of harsh interest rate hikes to cool inflation have led to the IMF predicting a plateau in global GDP growth until 2028.

Source: IMF

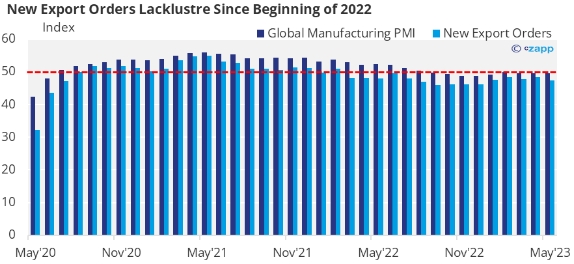

And according to PMI data, new export orders have been slipping since as early as February 2022 but inventories remain high.

Source: S&P Global

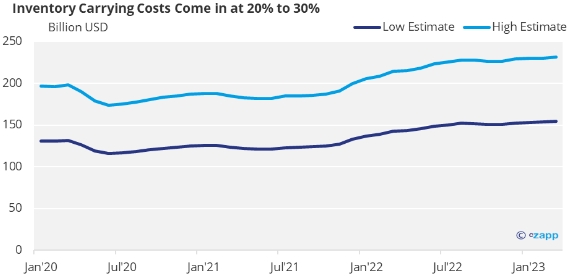

That’s not to mention the interest rate rises, which will lead to a rise in costs for those carrying stock. Investopedia estimates that the cost of inventory carrying is about 20% to 30% of the value of that inventory.

Source: St Louis Fed, Investopedia

Concluding Thoughts

- Inventories remain high in key importing markets like the US.

- This, combined with a lack of consumer demand due to higher living costs will have a negative impact on freight demand.

- Until inventories come to a level where there is more of a need to import on a regular basis, rates will remain low.

- There is still a great deal of volatility in the market and it is still difficult to agree rates more than a few months in advance.

- You can take the risk out of container freight by taking advantage of specialist hedging tools.

Cz is active in container hedging. If you’d like to know more about this and the other risk management services we offer, please get in touch.