Insight Focus

The 2024 apple crop in Poland will fall far short of market expectations due to adverse weather. There will be low apple availability for the fresh and processing market, meaning F&B manufacturers may have to turn to wine.

Wine Market Oversupplied

European wine demand has been impacted by inflation and accumulation of stock. At the end of last year, the French government greenlit the mass destruction of millions of litres of wine in an effort to ensure the price didn’t collapse.

This doesn’t just affect distilleries but also farmers, who despite the support programs for wine, need to sell grapes to generate income.

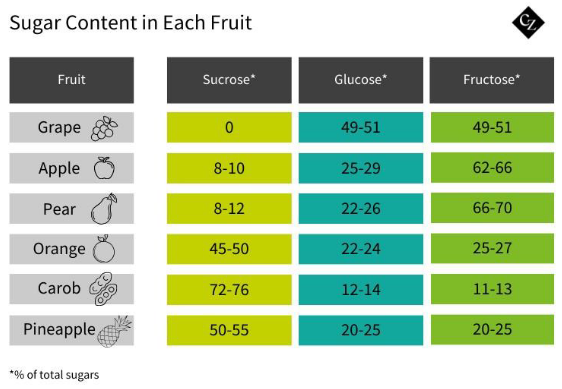

So, what does this have to do with apples? Well, when processed, apples – and other fruits such as grapes — are turned into deionised products. The deionisation process removes the colour, flavour, acid and aroma from the fruit, essentially leaving a clear colourless liquid that has sweetening properties.

This means that, although there are different sugar contents in each product, they can be used interchangeably by food manufacturers.

Deionised apple juice is most commonly used in food and beverage manufacturing because it is normally the most cost competitive. However, if supply is constrained, this may no longer be the case. In fact, deionised grape juice could become more competitive.

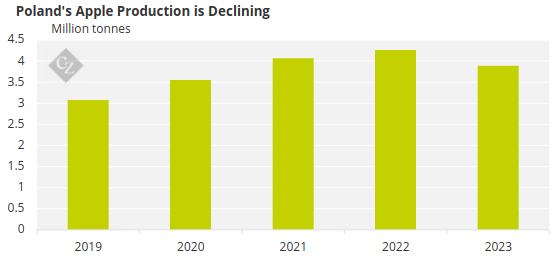

Polish Apple Production Booms

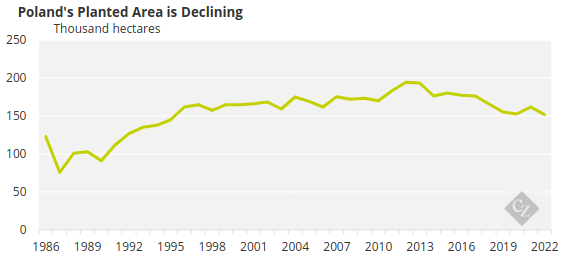

In the last few years, Poland’s apple production volumes have been growing. After a small dip in 2023, favourable growing conditions at the beginning of the year led to speculation that there may be record production of 5 million tonnes for the 2024 season.

Source: FAOSTAT, Statistics Poland

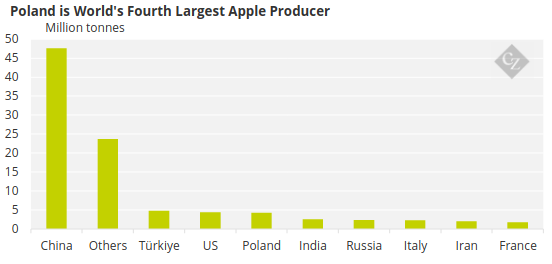

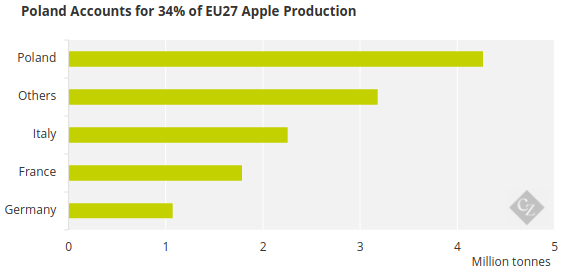

Poland is a major apple producer and the largest in Europe. As a result of previous strong harvests and projections of growth in 2024, buyers reduced their stocks as good supply and competitive prices were foreseen.

Source: FAOSTAT

However, April and May were difficult times for Polish apple orchards due to cold snaps hitting during crucial blooming and pollination periods. In a few months, farmers will be able to assess the damage, but so far it looks like initial production projections may be reduced by as much as 2 million tonnes. This leaves Poland with a total production volume of a maximum of 3.5 million tonnes – its lowest level since 2019.

Polish Production Dips as Orchards Decline

Almost 30% of EU apple production comes from Poland.

Source: FAOSTAT

Despite Polish government support, there has been a global trend of reduction in the number of orchards.

Source: FAOSTAT

The EU is now expecting lower availability and higher prices, which combined with inflation, will negatively impact fresh apple consumption. The share of apples that are allocated to the processing industry is expected to remain stable on last year.

This translates to a reduction of apples for processing on the continent. This is worsened by the fact that the industry had high expectations for the crops this year, and as the supply of cold-stored apples from last season is exhausted, the effect on the processing industry will be significant. Polish concentrate production is now estimated to be around 75 000 tonnes lower than last year.

Concluding Thoughts

- Given the issues with apple supply, some of the surplus from the grape market could be allocated to the non-alcoholic grape juice industry.

- If food and beverage manufacturers switch to deionised grape juice rather than deionised apple juice, this could benefit both markets.

- This may reduce pressure on the apple market, which would lead to higher availability of apples and hence more stable prices.

- It would also go a long way to stabilising grape prices and reducing oversupply in the wine market.

- This will not just help the European market, but also the global apple market considering that this year processed apple exports are forecasted to be notably lower than last year