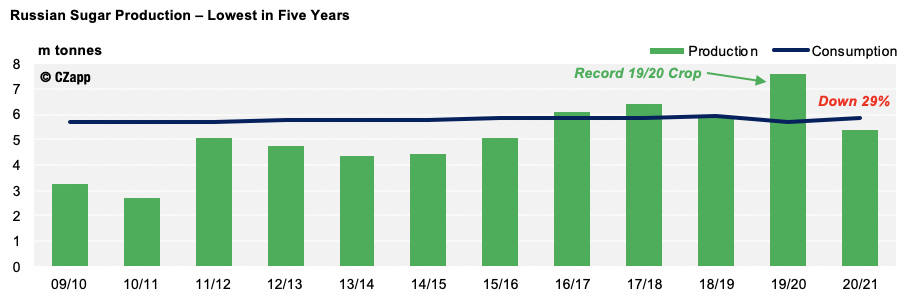

- Russia will produce 5.5m tonnes of sugar this season, down by over 25% year-on-year.

- Less beet has been planted and its growth has been hindered by extremely dry weather.

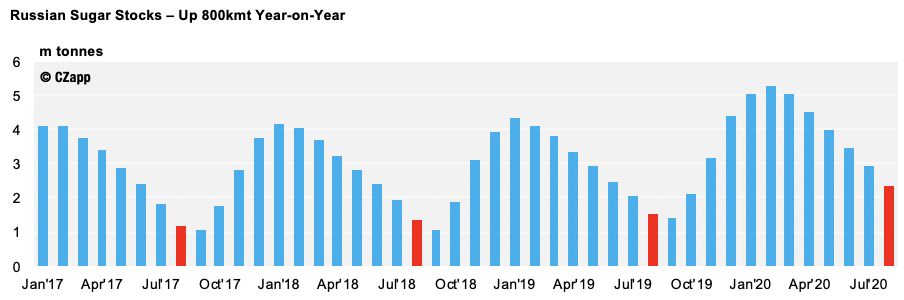

- However, sugar stocks are high so the strong export pace should continue.

Production Dips After Heatwave

- We think Russia will produce 5.5m tonnes of sugar in 2020/21; this is a 500k tonne reduction from our previous estimate.

- If this materialises, it will be Russia’s poorest sugar production for five years and 2.1m tonnes below last year’s record crop.

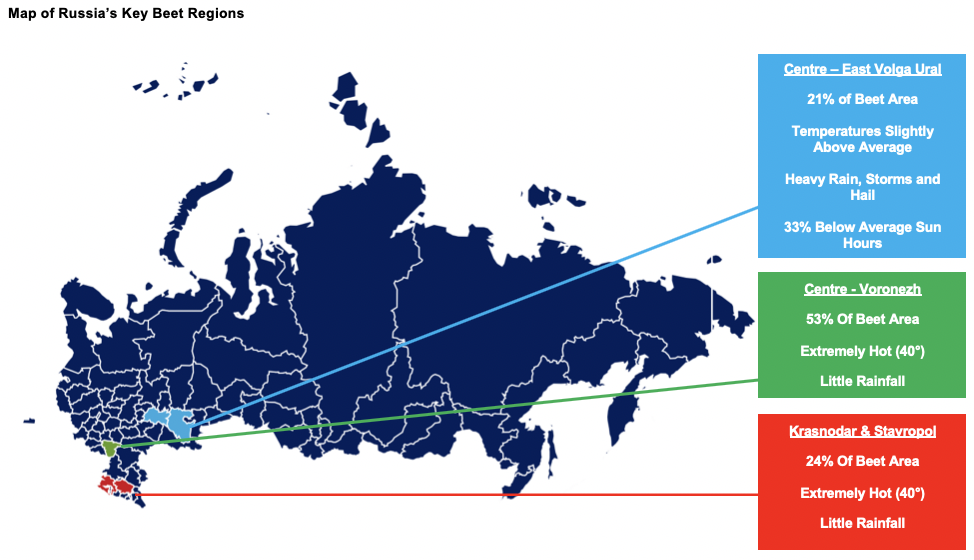

- The reduction stems from the recent heatwave, which has not been good for beet growth.

- Temperatures have been as high as 42° in the South with very little rain, especially towards the East of this region.

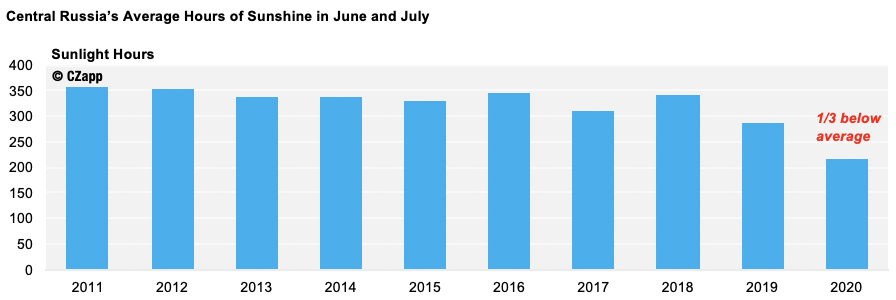

- Rainfall has been plentiful in the Central and Eastern regions, but it has been very stormy with limited sunlight, the latter of which is essential for beet growth.

- Some reports suggest that grain crops here could face losses of up to 40% due to the dry weather.

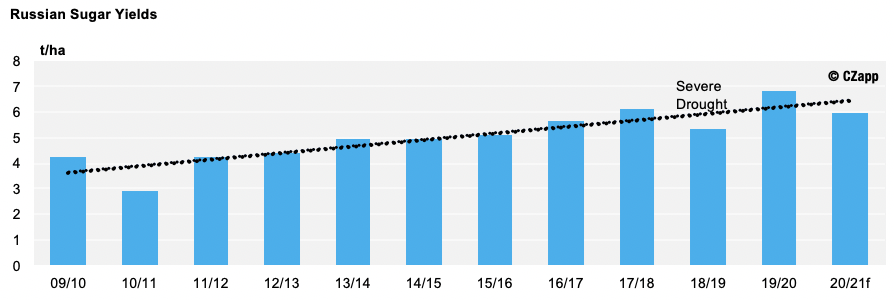

- We have therefore reduced our yield estimate for the 2020/21 season.

- We think yields will be higher than they were in 2018/19 when there was a severe drought in Russia.

- This is because the beet planting density has increased by 5% since then.

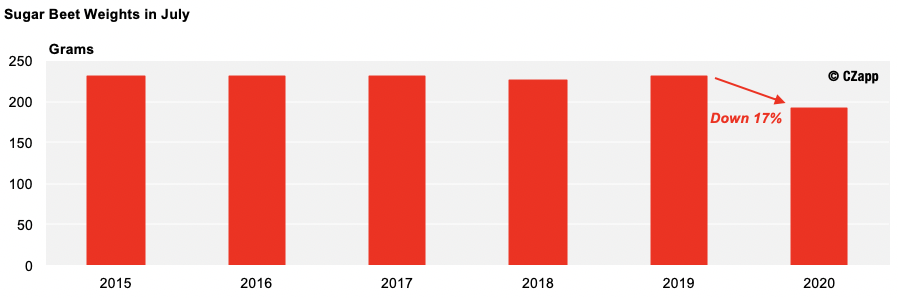

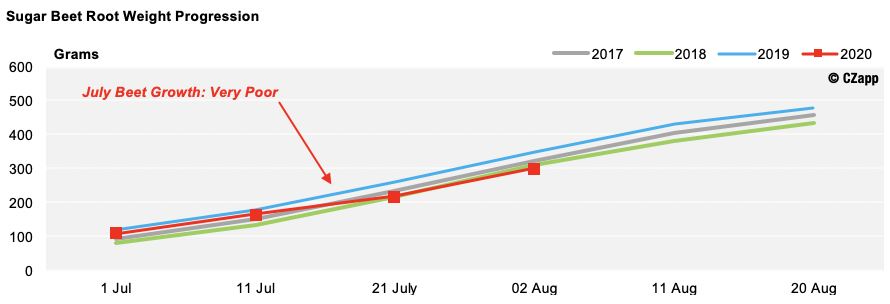

Beet Growth Was Very Slow in July

- In July, the average sugar beet root weight increased by 192 grams; 17% lower than the previous years’ average.

- The sugar beet weight progression aligns with that of the poor 2018/19 season.

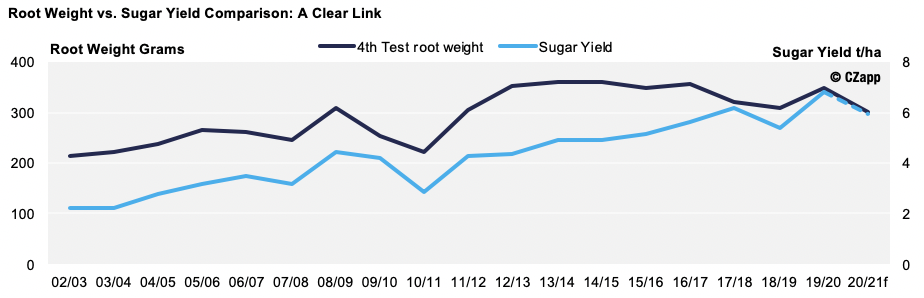

- These beet tests are important because there is a very strong link between the weight of the beet roots at the start of August (the fourth test) and the eventual sugar yield.

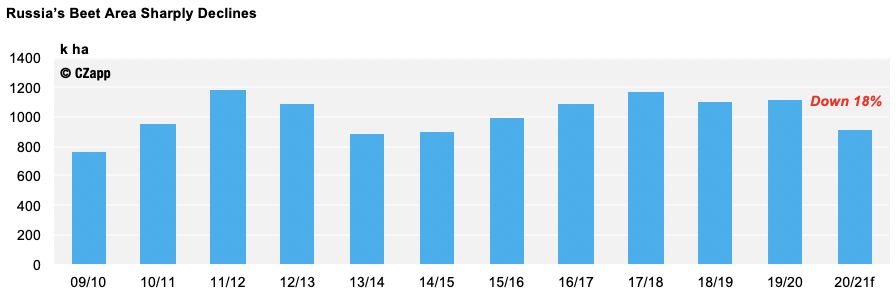

Sugar Beet Area: A Sharp Decline

- Russia’s beet area has dropped significantly this season meaning its harvested area will fall by over 200k ha (18%).

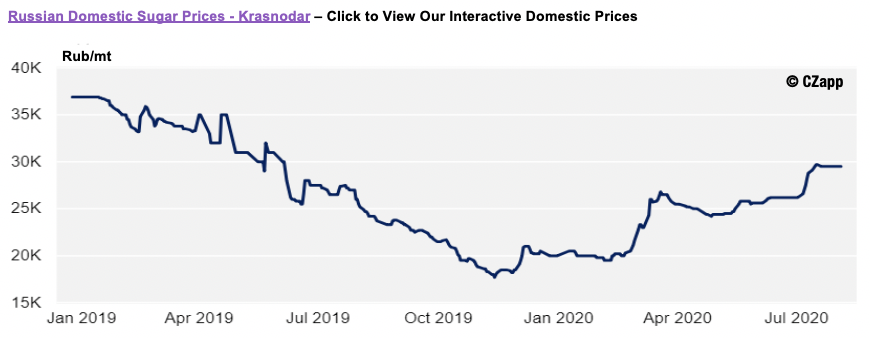

- After last season’s overproduction, Russia’s domestic sugar prices halved over the course of 2019, leaving farmers less incentivised to plant sugar beet due to its low profitability.

- At its lowest point, the domestic price was equivalent to $280/t.

A Large Surplus Means Exports Will Stay Strong

- This production decrease puts Russia back into deficit, as they are set to consume about 500k tonnes more sugar than they produce next season.

- Fortunately, sugar stocks are high following last season’s record crop and a COVID-induced drop in consumption.

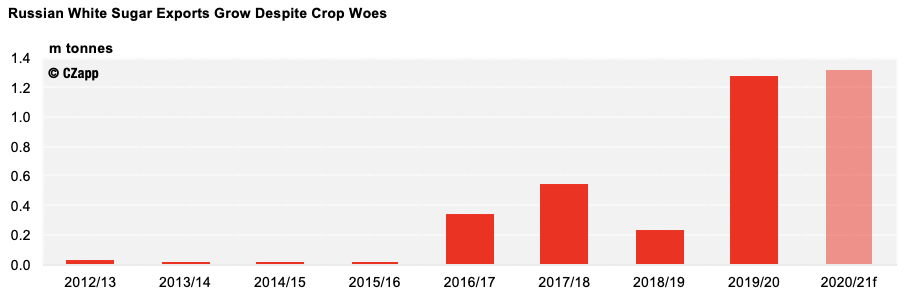

- With such high stocks, Russia will have 1.3m tonnes of white sugar available for export.

- If the price incentivises it, there will be 1.3m tonnes of exports, similar to the last season.

- Most of this sugar will go by rail to neighbouring countries such as Kazakhstan, Uzbekistan, and Azerbaijan.

Other Opinions You May Be Interested In…

- July 2020 Sugar Statshot: Worries Grow for 2020/21 Crops

- The World’s Largest Wheat Producers and Exporters

- Thailand to Suffer Worst Cane Crop in Over 10 Years